31 Win Loss Analysis Survey Questions to Boost Sales Success

Discover 25 expert win loss analysis survey questions to unlock buyer feedback, boost win rates, and sharpen competitive intelligence strategies.

Every revenue leader wants to know what’s really driving—or derailing—their sales opportunities. That’s where win-loss analysis comes in, pulling back the curtain on the true causes of closed-won and closed-lost deals. A great win loss survey doesn’t just serve up numbers—it digs into stories, hearing directly from buyers weeks after a decision. The insights aren’t just “nice to know”—they inform your product roadmap, sharpen your messaging, fuel competitive intelligence, and arm your sales team with what actually works. If you’re serious about understanding buyer feedback, win-loss surveys deserve a spot in every modern revenue playbook.

Won Deal Debrief Survey

Why & When to Use

Deploying a won deal debrief survey is your golden ticket to understanding what fueled your most successful wins. You don't need to wait long—send it shortly after a prospect officially becomes a customer, while the experience is still fresh. That’s when honest feedback is most likely, and you can capture the precise moments that made “yes” happen.

The value goes far beyond a pat on the back. When you hear directly from buyers about what worked, you can:

- Identify sales behaviors you’ll want to replicate everywhere.

- Uncover messaging angles or themes that truly resonated.

- Pinpoint product features that acted as your competitive ace.

- Gather competitive intelligence—what made you stand out from the rest?

- Fuel internal celebration by connecting the dots between strategy and results.

Want to create a best-practice library for your reps and give marketing content that’s rooted in reality? These surveys pave the way. Follow up internally by sharing the highlights in your sales huddles and looping in product teams on praised features. You’ll keep everyone’s focus on what truly moves the needle.

5 Sample Questions to Include

What was the single biggest factor that convinced you to choose us over other options?

Which product feature or capability sealed the deal for you?

How did our sales experience compare with other vendors you evaluated?

On a scale of 1–10, how confident were you in our ability to deliver value before signing? Why?

What nearly prevented you from moving forward with us?

A great debrief is your playbook for repeatable, scalable success. Harvest these stories, and you won’t just win deals—you’ll win better and more often.

A study by the Win Loss Analysis Association found that 68% of companies using structured win-loss surveys improved their sales strategies. Source

Creating your win-loss analysis survey with HeySurvey is a breeze—even if you’ve never done it before! Follow these 3 easy steps to get your survey up and running fast, plus a couple bonus ideas to make your survey truly shine.

Step 1: Create a New Survey

- Head to HeySurvey and start by clicking Create New Survey.

- You can pick a blank survey or jump right into a template tailored for win-loss analysis if you want a shortcut.

- Give your survey a clear name so your team can find it easily later (e.g., “Q2 Win-Loss Analysis”).

Step 2: Add Your Questions

- Click Add Question to start building your survey.

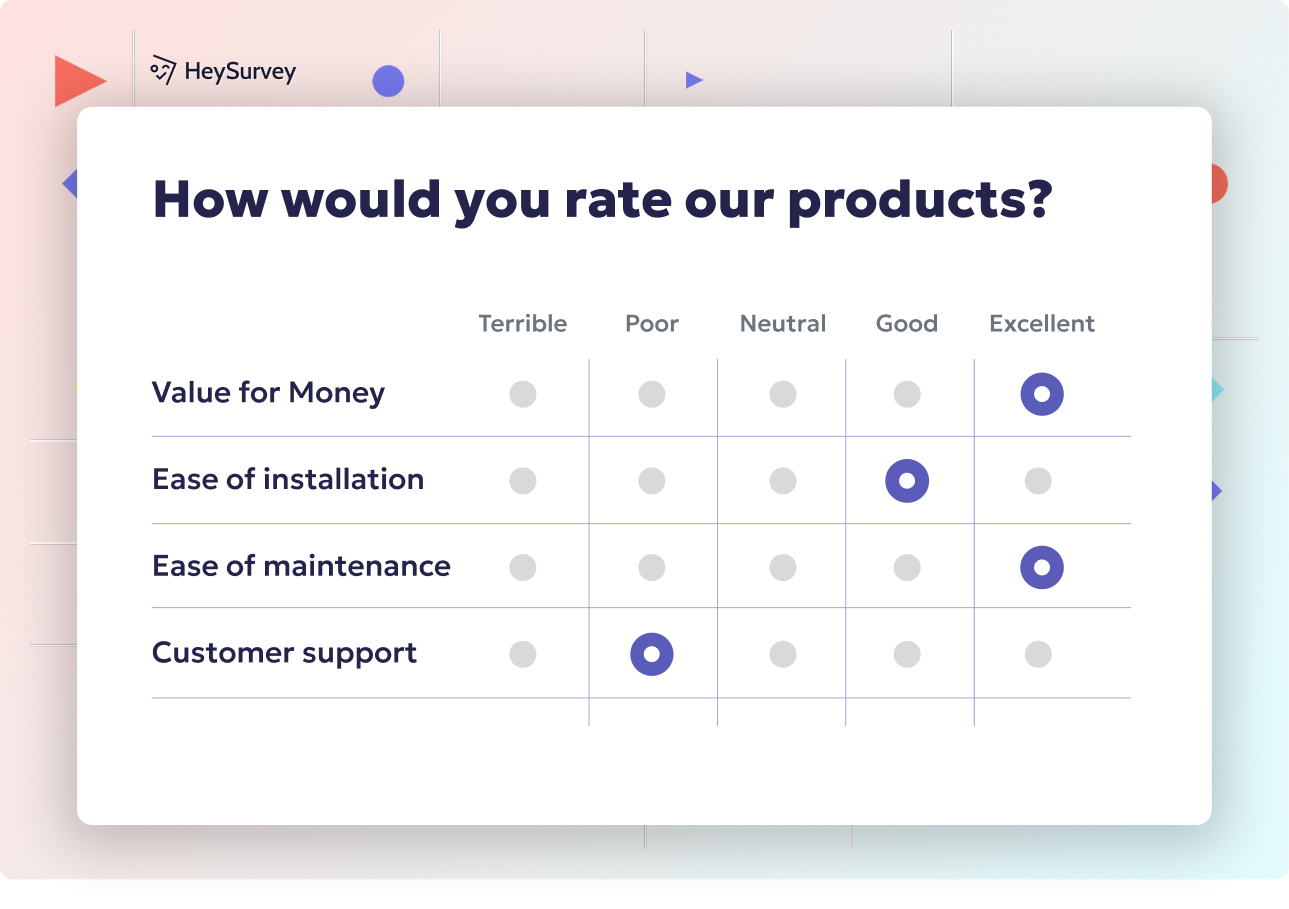

- Choose question types that fit your needs—single or multiple choice, scales for ratings, or text boxes for open feedback.

- Enter your win-loss survey questions exactly how you want respondents to see them (feel free to copy those sample questions from the article!).

- Mark questions as required if they’re must-haves, or keep it optional to reduce survey fatigue.

- Use branching if you want to send respondents to different questions based on their answers (perfect for drilling down on wins vs. losses).

Step 3: Publish Your Survey

- Hit the Preview button to see how your survey looks on desktop and mobile devices.

- When you’re happy, click Publish.

- You’ll get a shareable link to send via email or embed on your website.

- Remember: to publish and collect responses, you’ll need to have a free HeySurvey account set up.

Bonus Step 1: Apply Your Branding

- Open the Branding Panel to upload your logo and add brand colors.

- Customized branding helps build trust and increases survey completion rates.

- Tweak fonts and backgrounds to create a consistent look and feel aligned with your company.

Bonus Step 2: Define Settings or Skip Into Branches

- Use the Settings Panel to set response limits, start/end dates, or redirect respondents to a custom URL after submission.

- Enable anonymity if you want candid feedback without any reservations.

- Fine-tune question branching to skip irrelevant sections and give each participant a tailored, smooth survey path.

Ready to get started? Click the button below to open a sample win-loss survey template in HeySurvey and customize it your way!

Lost Deal Post-Mortem Survey

Why & When to Use

A lost deal survey isn’t about licking wounds or assigning blame—it’s your reality check to learn, adapt, and eventually steal back the win. Within days of a lost deal, send your survey to get buyers’ raw impressions before memories fade into polite afterthoughts. These insights are invaluable if you want to address pitfalls and improve.

Your survey will uncover:

- Real reasons behind lost opportunities: Was it price, a missing feature, or something else?

- Bottlenecks in your sales process and when things started to go sideways.

- The criteria and “tipping point” that led to a competitor winning.

- Buyer feedback that goes beyond anecdotes by collecting quantitative and qualitative data.

- Solid competitive loss reasons to guide your future strategy.

Taking action on lost deal insights can be transformative—revisit your proposal templates, tweak pricing, or prioritize that one missing feature that’s losing you deals.

5 Sample Questions to Include

What was the primary reason you ultimately chose another solution?

Which feature, service, or price point did the winning vendor offer that we did not?

How would you rate the relevance of our proposal to your business challenge?

At what stage did we fall behind competitors in your evaluation?

What could we have done differently to earn your business?

Don’t just file the feedback away—share highlights in retrospectives and sales enablement sessions. That’s how you turn lost deals into future wins.

A study by the Win Loss Agency found that 60% of lost deals are due to misalignment between the vendor's offering and the buyer's needs. Source

Competitor Displacement Survey (Deals Won Back from a Competitor)

Why & When to Use

Winning an account back from a competitor is like taking back your lunch money—and you’ll want to understand exactly how you did it. The competitor displacement survey is sent to customers who have recently switched to your solution after using a rival. Timing is crucial: reach out while the switch is new, when emotions and reasoning are still vivid.

The goals here are juicy:

- Validate which of your differentiators most compelled the buyer to make the jump.

- Diagnose your competitors’ weaknesses straight from the customer’s mouth.

- Learn which elements of your messaging and onboarding helped seal the deal.

- Build a playbook for competitive “take-out” campaigns using fresh data.

- Empathize with switching pains, so you can make the transition delightfully smooth.

Feed this feedback to your product and marketing teams ASAP—you’ll want to capitalize on “switchers’” motivations in your outreach and future campaigns.

5 Sample Questions to Include

What shortcomings did you experience with the previous vendor that prompted the change?

Which of our differentiators was most compelling in your decision to switch?

How did implementation or onboarding influence your confidence in moving away from the competitor?

Which stakeholders championed the switch internally and why?

What could the previous vendor have done to retain your business?

This survey turns your competitive intelligence into a practical toolkit for unseating rivals—and makes for a few satisfying internal high-fives, too.

Renewal & Churn-Prevention Survey (Post-Purchase Loss Insight)

Why & When to Use

Whether customers are renewing, expanding, or walking away, the renewal and churn-prevention survey sheds light on what keeps them loyal—or pushes them out the door. Surveying your customers at contract renewal or cancellation is more than a retention formality. It gives you actionable signals for customer success and future expansion.

This survey only works if it’s well-timed and honest:

- Right after the renewal or churn decision is when drivers and triggers are clear in buyers’ minds.

- Ask about accomplishments and outcomes, not just satisfaction scores.

- Tap into expansion readiness or surface threats before they metastasize.

- Gather buyer feedback that reveals product strengths and gaps.

- Benchmark your own team’s responsiveness and reliability—with unfiltered honesty.

Armed with these insights, your product and customer success teams can build meaningful strategies for boosting loyalty and preventing churn before it starts.

5 Sample Questions to Include

What key outcomes did you achieve—or fail to achieve—since adopting our solution?

Which features deliver the greatest ongoing value to your team?

How satisfied are you with support responsiveness and expertise?

If you considered canceling, what factors influenced that consideration?

What additional capabilities would strengthen your loyalty going forward?

Survey results should feed into your customer success playbooks and inform product enhancements. Don’t hide tough feedback—address it directly and move the needle.

A study found that the propensity to churn increases when friends do, especially when many strong friends churn, suggesting that churn managers should consider strategies aimed at preventing group churn. (arxiv.org)

Sales Process Feedback Survey (Buyer Journey Friction Points)

Why & When to Use

Every buyer’s journey, whether ending in a win or loss, offers a treasure trove of lessons about your sales process. A sales process feedback survey is deployed to both won and lost prospects to uncover friction points unrelated to product. Think of this as the backstage pass to the show that is your buyer’s experience.

Why send it?

- Pinpoint issues like confusing demos, disconnected proposals, or slow follow-ups.

- Isolate where your process shines and where it falters, regardless of win/loss.

- Gather buyer feedback on communication, decision-maker engagement, and resourcefulness.

- Use anonymous input to foster continuous improvement, not blame games.

- Tailor your enablement and training to address the highest-leverage gaps.

Continuous improvement is impossible without a candid view into your buyer journey. This survey hands you a roadmap, so you’re not just guessing where to get better.

5 Sample Questions to Include

How clear was our articulation of your business problem and ROI?

Rate the relevance of each interaction (discovery, demo, proposal) on a 1–5 scale.

Were decision-makers appropriately engaged by our team?

Did any stage of the process feel rushed or stalled? Please specify.

What resources (case studies, calculators, references) would have improved your confidence?

Pore over these responses with your sales and enablement teams. Improvement isn’t accidental—it’s intentional, and this is your playbook.

Choosing the Right Recipients & Timing for Win-Loss Surveys

Timing is everything. Send your win-loss surveys too soon, and buyers may ignore them; wait too long, and the details blur. The sweet spot for most is:

- Email surveys: 24 to 72 hours after decision for high open rates.

- Phone interviews: 7 to 14 days post-decision for deeper feedback.

Selecting recipients is just as vital. Aim to target:

- Decision makers (aka economic buyers) for overarching business drivers.

- Technical evaluators for precision on product fit and functional requirements.

- User champions for unique perspectives on experience and team dynamics.

A multi-touch approach often works best:

- Start with a brief email survey for quick, candid input.

- Follow up with a targeted phone interview for richer storytelling and context.

Cadence and flexibility are key. Rotate outreach among personas and types of opportunities to keep your analysis balanced and your response rates healthy. Strike while the iron’s hot, and feedback will always be more honest.

Best Practices: Dos and Don’ts for Designing & Delivering Win-Loss Surveys

Let’s keep it real—survey design can make or break your efforts. Here are the essential best practices for win loss surveys everyone should follow.

Dos: - Keep surveys brief and focused—no one loves a never-ending form. - Personalize your introduction for each recipient. - Offer anonymity to encourage frank, honest answers. - Align every question with the recipient’s actual role in the deal. - Always close the loop internally by sharing top findings with go-to-market teams.

Don’ts: - Avoid asking leading or loaded questions that bias the answer. - Don’t send surveys immediately after delivering bad news—they’ll be ignored. - Never bribe for positive responses; authenticity is key. - Don’t ignore lengthy qualitative comments—these nuggets hold the richest insights.

Simple, direct, and respectful surveys get the highest response rates and the most actionable feedback. By sticking to these survey design tips, you ensure your survey isn’t just filling a spreadsheet—it's fueling next quarter’s wins.

Turning Win-Loss Survey Data into Actionable Insights

So, you’ve collected a pile of feedback—don’t let it gather dust. Turning win-loss survey data into action is where you’ll truly improve win rates.

Here’s how to do it right:

- Code qualitative responses to surface recurring themes quickly.

- Identify patterns in deal drivers and blockers, slicing by vertical, competitor, or deal size.

Quantify feedback and create easy-to-digest dashboards:

- Win rate improvement by team or vertical

- Shortening of average sales cycle time

- Rise in competitive displacement rates

Feed themes directly into product, pricing, and enablement strategies.

Schedule closed-loop meetings between sales, marketing, product, and leadership for deep-dive reviews.

Most importantly, ensure buyer feedback isn’t a one-and-done. Operationalize buyer feedback by continuously updating your revenue playbook and tying changes to business outcomes. The entire organization wins when you transform data into action—and watch those win rates climb.

Finally, remember: win-loss analysis isn’t just about deals, but about people, processes, and perpetual improvement. The more you listen—and act—the more you’ll win, again and again.

Related Business Survey Surveys

27 Tips to Tackle Nonresponse vs Voluntary Response Bias

Explore nonresponse vs voluntary response bias with 30 sample survey questions to improve survey ...

29 Essential SWOT Survey Questions for Strategic Insights

Discover 25+ expert SWOT survey questions designed to capture strengths, weaknesses, opportunitie...

25 Quality Assurance Survey Questions for Best Results

Elevate your approach with 25 sample "quality assurance survey questions" and best practices to s...