32 Ordinal Survey Questions: Complete Guide to Ranking Scales

Discover a complete guide to ordinal survey questions with 25 sample questions covering scales that rank responses for better insights.

Ordinal survey questions are the middle ground between simple categories and precise numbers—they let you go beyond yes/no, revealing how your respondents truly feel, rank, or rate your topics. When you need to know not just what people choose but how much they agree or how strongly they prefer something, ordinal scales are your best friends. Dive in for actionable tips, examples, and expert tricks that transform bland survey data into powerful, prioritized insights.

Understanding Ordinal Survey Questions

When you need to measure more than just categories, ordinal survey questions step in to provide order—but not precision. These questions invite respondents to organize their answers in a sequence, whether that’s by preference, satisfaction, or frequency. The order matters, but the gaps between each choice aren’t equal or even known.

Consider how this fits into the world of data: - Nominal data just labels things (like colors or cities). - Ordinal data ranks them (like favorite to least favorite color). - Interval data makes sure the steps between options are the same (like temperature in Celsius).

People often mix up ordinal vs. interval scale questions, but here’s the clincher: only interval scales can rightly claim that the jump from “2” to “3” is the same as from “3” to “4.” For ordinal scales, you know “4” is more than “3,” but not by how much.

When it’s time to visualize results, certain charts shine: - Simple bar charts work when you want to display a single ordinal question. - Stacked bar charts let you compare across groups, like departments or age ranges. - Diverging bar charts make positive vs. negative opinions pop.

Interpreting ordinal data can be tricky! Most analyses stick to medians, counts, or modes, since mathy stats like means can be misleading. Always match your analysis method to the way ordinal data works—keep things in order, but don’t force averages where they don’t belong.

When analyzing ordinal survey data, employing non-parametric tests like the Mann-Whitney U test is recommended due to the data's ordinal nature. (pmc.ncbi.nlm.nih.gov)

Creating your ordinal survey with HeySurvey is a breeze, even if you’re new to the platform. Follow these three simple steps to get your survey up and running quickly—and then try some bonus tips to make it truly yours!

Step 1: Create a New Survey

- Head to the HeySurvey homepage.

- Click on “Create Survey” to start fresh, or pick a relevant pre-built template designed for ordinal questions.

- Give your survey an internal name that helps you recognize it later—something like “Customer Satisfaction Survey.”

No account needed to start, but remember, you’ll need one to publish and view results.

Step 2: Add Questions

- Inside the Survey Editor, click “Add Question.”

- Choose the question type fitting your ordinal data needs:

- Likert Scale for attitudes or agreement.

- Scale (NPS or numeric) for ratings.

- Choice for rank order or frequency questions.

- Semantic Differential can be created using carefully paired bipolar choice options.

- Enter your question text and customize answer options with clear, balanced labels.

- Mark questions as required if you want to ensure answers before moving on.

- Repeat until you’ve added all the questions your survey needs.

Step 3: Publish Your Survey

- Click the “Preview” button to see how your survey looks to respondents.

- When happy, hit “Publish” to generate a shareable link.

- Share your survey anywhere: emails, social media, or your website.

- If you want to track responses or analyze data, make sure you’re logged into your HeySurvey account.

Bonus Step A: Apply Your Branding

- Open the Branding and Settings Panel.

- Upload your logo to place it at the survey’s top-left corner.

- Customize colors, fonts, and backgrounds via the Designer Sidebar for a polished, on-brand look that feels professional and inviting.

Bonus Step B: Define Settings

- Set your survey’s start and end dates, so it’s live exactly when you want.

- Limit the number of responses to control data collection.

- Define a redirect URL to send respondents to a thank-you page or special offer after submission.

- Enable or disable respondent viewing of results if you want them to see summary charts.

Bonus Step C: Use Branching for Smarter Surveys

- For a personalized respondent experience, use Branching in the Survey Editor.

- Define which question follows based on earlier answers.

- Create multiple endings customized to various response patterns.

- Branching keeps your survey relevant and engaging, avoiding unnecessary questions.

Ready to dive in? Click the button below to open a template and start creating your perfect ordinal survey today!

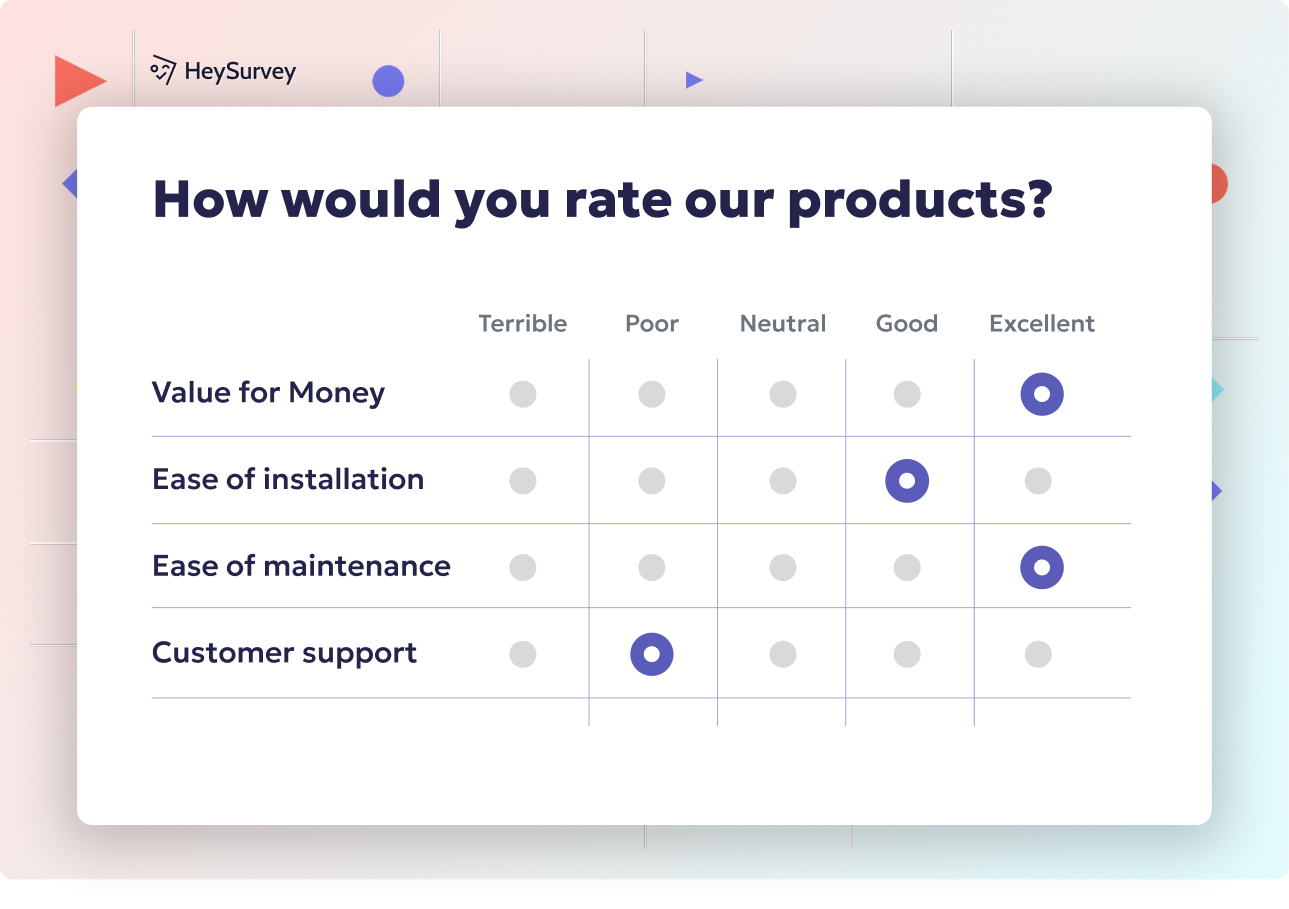

Likert Scale Questions

Why & When to Use

The Likert scale is the classic for attitude measurement—you’ve likely clicked “Strongly Agree” more times than you remember. It shines when you want to measure how much someone agrees or disagrees along a continuum.

Likert scales usually run from 5 or 7 points: from “Strongly Disagree” up to “Strongly Agree,” maybe with some “Neutral” in the middle. These are perfect for exploring opinions, emotions, and perceptions—ideal for employee engagement surveys, brand sentiment checks, or usability testing.

You want a scale that’s: - Balanced (equal positives and negatives) - Labeled clearly (so no one’s confused) - Intuitive (no mental gymnastics required)

When a question is about a feeling or an attitude, Likert is your go-to. People love these because they invite nuance—not just “yes” or “no,” but “how much?”

5 Sample Questions

- How strongly do you agree that our software is easy to learn?

- How satisfied are you with the speed of our customer support?

- The product’s price feels reasonable.

- I feel motivated to recommend this course to colleagues.

- The checkout process was straightforward.

Each of these questions can use answer options like “Strongly Disagree,” “Disagree,” “Neutral,” “Agree,” and “Strongly Agree.” This format keeps responses clear, ordered, and—dare we say—charmingly easy to analyze.

Research indicates that using ascending-ordered Likert scales (starting with negative options) reduces inflated positive responses compared to descending-ordered scales. (researchgate.net)

Semantic Differential Scale Questions

Why & When to Use

When you need a subtle touch, the semantic differential scale stands tall. These scales ask respondents to rate a topic between two opposite adjectives—for instance, “Unappealing” vs. “Appealing,” with a blank line or tick marks in between.

This format isn’t just for fun; it reveals the nuanced impressions people have about brands, products, or experiences. Use it whenever you want to go beyond satisfaction and dig into flavor—the felt sense of a thing.

Perfect for: - Brand research (how does your logo feel?) - First impressions of new products or services - Measuring shifts after a campaign or rebrand

The secret? Choosing contrasting word pairs that target exactly what you need to know: - Trustworthy vs. Untrustworthy - Simple vs. Complicated - Fast vs. Slow

Unlike typical agree/disagree scales, semantic differentials capture subtler shades of opinion. They’re a designer and marketer’s secret weapon.

5 Sample Questions

- Rate our new logo: Unappealing ___ ___ ___ ___ ___ Appealing

- Our website feels: Disorganized ___ ___ ___ ___ ___ Organized

- The onboarding flow is: Complicated ___ ___ ___ ___ ___ Simple

- Customer service response time: Slow ___ ___ ___ ___ ___ Fast

- The newsletter tone is: Formal ___ ___ ___ ___ ___ Casual

This method simplifies perception research—respondents can quickly indicate “how much” they lean to one side.

Rank Order Questions

Why & When to Use

If you want to force people to make tough choices and prioritize, rank order questions deliver. These questions are the workhorses of trade-off studies, feature roadmaps, and product or pricing decisions.

Unlike rating everything as “important,” ranking requires each option to claim a unique spot. If you’ve ever voted on dessert options and had to pick a winner, you know the drill.

Use rank order questions when: - The list isn’t too long (ideally 3 to 7 items) - The items are genuinely comparable - Prioritization or resource allocation is needed

Avoid them if you’re just asking about independent features (let people rate each separately). Don’t make your respondents haul through a huge list—ranking ten things is a recipe for survey fatigue and random, half-hearted answers.

5 Sample Questions

- Rank these features from most to least valuable: Analytics, Integrations, Mobile App, AI Suggestions.

- Order these delivery options by preference: Same-day, Two-day, Standard, In-store pickup.

- Rank marketing channels that influenced your purchase.

- Arrange these subscription perks by importance.

- Put these pain points in order of severity.

Rank order questions pull out clear winners and losers—they help you see not just what people like, but where they’ll fight for their favorites.

Rank order questions are effective in eliciting clear preferences by forcing respondents to prioritize options, though they can be cognitively demanding and are best limited to 5–7 items to maintain data quality. (verint.com)

Numeric Rating Scale (NRS) Questions

Why & When to Use

Everyone loves a good number scale—from five-star movies to ten-point pizza reviews. NRS questions are popular because they make surveys quick, universal, and dead simple to analyze.

If you need a dashboard metric or want to benchmark quickly, numeric scales cut right to the chase. On a scale from 0–10 or 1–5, respondents can tell you exactly how much they like, trust, or recommend something. You’ll see this in: - Net Promoter Score (NPS) for loyalty - App store ratings - Fast pulse surveys

Numeric scales are best when you need: - High-level benchmarking (e.g., “Are we a 6 or an 8?”) - Quick, one-click answers - Easy graphical reporting (bar charts, agency dashboards, heat maps)

Respondents instinctively understand these—just pick a number, done. But remember, don’t go too granular; most people couldn’t explain the difference between a “7” and an “8” if you pressed them.

5 Sample Questions

- On a scale of 0–10, how likely are you to recommend us to a friend?

- Rate your overall checkout experience (1–5).

- How would you grade our packaging quality (0–10)?

- Assess the course relevance to your job (1–5).

- How do you rate the mobile app’s load speed (0–10)?

Keep it simple, visual, and instantly understandable—that’s the beauty of numeric ratings.

Frequency Scale Questions

Why & When to Use

If discovering routines and habits is your goal, frequency scales shine. Instead of just learning if someone does something, you’ll know how often—that’s a game changer for product managers, marketers, and researchers.

Frequency scales typically use options like: - Never - Rarely - Sometimes - Often - Always

You’ll spot them in behavior tracking, studies about consumer routines, and measuring feature adoption over time.

These scales work best when: - You want to monitor use or engagement - Tracking change over time is essential - Habits, risks, or behavioral triggers matter

Be careful, though: make sure each frequency is clear and evenly spaced—respondents need to know exactly where their habits fit.

5 Sample Questions

- How often do you use our mobile app?

- In a typical week, how frequently do you purchase coffee out?

- How often do you read our email newsletter?

- How regularly do you update your software?

- How often do you encounter bugs in the platform?

The result? Concrete, actionable data about how and when people interact with your product or service.

Best Practices for Crafting Ordinal Survey Questions

A thoughtfully crafted ordinal question can be a data goldmine—but if you’re not careful, bad scales can sabotage your results. Follow these tactical tips to make every response count:

- Keep scale lengths consistent across your survey—don’t jump from 5-point to 7-point scales unless you have a brilliant reason.

- Avoid double-barreled statements (asking two things at once). “This service is fast and reliable” splits opinions and confuses your data.

- Balance your scale options—give equal weight to positive and negative responses, and make sure every choice is clearly labeled for easy understanding.

- Pre-test your questions on a small audience first. This helps you catch confusing wordings or order effects (where people naturally lean toward the first or last option).

- Use radio buttons in a single column for clarity and accessibility. Visual cues and consistent formatting nudge respondents to answer comfortably.

- When it comes to analysis, lean heavily on mode, median, or non-parametric statistical tests—ordinal data doesn’t play nicely with means or complex calculations.

Craft every scale with care, and you’ll collect feedback that’s not just ordered, but insightfully actionable.

Common Mistakes & Don’ts

Even seasoned survey pros can fall into traps. To get reliably shiny data, dodge these common blunders:

- Don’t treat ordinal means like real averages. You can’t claim the jump from “2” to “3” is the same as “3” to “4”—stick with counts, modes, or medians.

- Avoid overlapping or unevenly spaced scale labels. If “Sometimes” and “Occasionally” both appear, you’ll have confused (and possibly angry) respondents.

- Don’t overload your survey with too many ordinal items. People lose steam—and you get messier, less accurate data. Three to five well-chosen scales per topic is plenty.

- Don’t force people to rank items that don’t belong together. Ranking works for features and preferences, but is pointless for unrelated things.

- Mixing positive and negative wording haphazardly in one block causes misreads. Keep each question block consistent in tone and direction.

Avoid these, and your data will be so clean it practically sparkles.

Conclusion & Key Takeaways

Every ordinal question type brings a strategic edge—from Likert’s nuance to rankings that inspire action. Test your approaches to find which scales suit your audience and unlock their insights. Collecting well-ordered feedback enables smarter, more confident decisions. For pro-level surveys, explore templates, tools, and further resources to make every question count.

Related Question Design Surveys

29 Quantitative Survey Research Questions Example for Success

Explore 25+ quantitative survey research questions example with clear explanations and tips for c...

32 Good Survey Question to Boost Your Data Quality

Discover how to craft good survey questions with 30 sample questions across 8 types for better da...

31 Survey Question Mistakes You Need to Avoid Today

Discover 25 common survey questions mistakes with real examples and expert tips to craft clear, u...