25 Cereal Survey Questions to Capture Actionable Breakfast Insights

Discover 30+ actionable cereal survey questions to capture breakfast insights—from consumption to new product concepts and pricing strategies.

Introduction: Why Cereal Surveys Matter Right Now

The breakfast cereal market is a $12 billion industry in the U.S., but it's facing challenges. Sales have declined from 2.1 million tonnes in 2008 to 1.6 million tonnes in 2023, with expectations of further decreases. (ft.com) Consumers are shifting towards healthier options like smoothies and overnight oats. In this competitive landscape, understanding consumer preferences is crucial. Surveys offer direct insights that sales data and social listening can't always provide, especially during pre-launch phases, seasonality checks, or loyalty program updates. We'll explore six survey types that align with the product development and marketing funnel.

Consumption Frequency Surveys

Understanding how often consumers eat cereal, their preferred times, and situational triggers is vital. This data aids in demand forecasting, production planning, and optimizing promotional calendars. Conducting these surveys before peak seasons like back-to-school or prior to budgeting media spend ensures relevance.

Sample Questions:

- How many days per week do you typically eat cereal?

- At what time of day do you most often consume cereal?

- Which of the following occasions prompt you to eat cereal? (breakfast, snack, dessert, post-workout, other)

- During the last 30 days, how many cereal boxes have you purchased?

- Rank the importance of convenience, taste, nutrition, and cost in your cereal consumption.

A study found that 70.7% of adults reported eating cereal at least once during a 14-day period, with 23% consuming it frequently (more than seven times). (longdom.org)

How to Create Your Cereal Survey in 3 Easy Steps with HeySurvey

Ready to bring your cereal survey to life? HeySurvey makes it simple to get started, even if you’ve never created a survey before! Follow these three easy steps, and you’ll be collecting breakfast insights in no time.

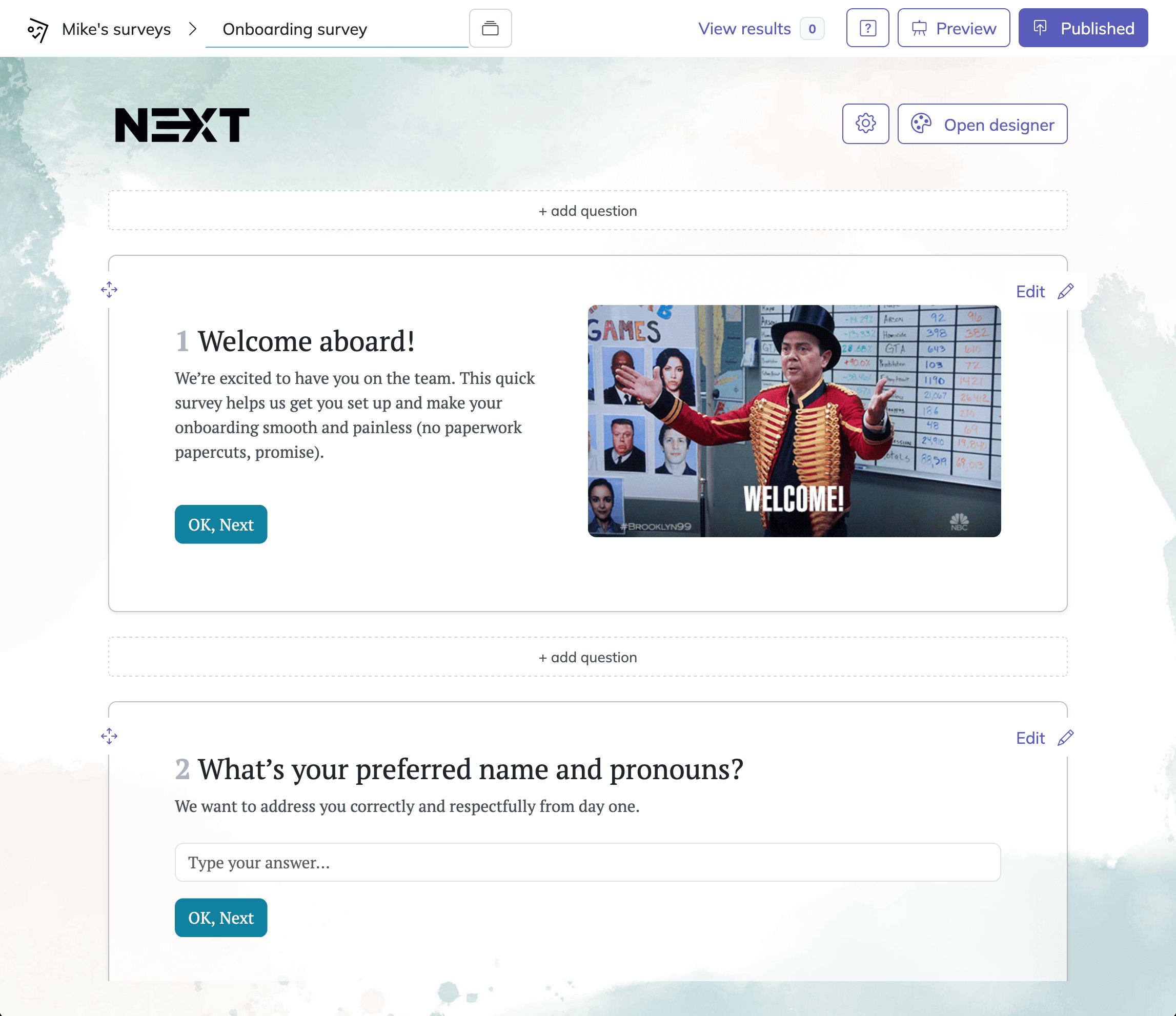

Step 1: Create a New Survey

Start by clicking Create New Survey and choose either a blank survey, or even better, select a pre-built cereal survey template if available. This jump-starts your project with ready-made questions and saves time. You can name your survey to keep things organized — something like “Breakfast Cereal Insights” works perfectly.

Step 2: Add Your Questions

Next, hit the Add Question button to drop in questions that fit your survey goals. Choose from multiple-choice, scale, text input, or other types depending on what you need. For cereal surveys, mix in questions about consumption habits, brand preferences, flavor likes, packaging appeal, pricing sensitivity, and new product concepts. You can mark questions as required and even add an “Other” option for open-ended responses.

Step 3: Publish Your Survey

When your questions are set, preview the survey to make sure it flows smoothly on desktop and mobile. Then hit the Publish button to get your shareable survey link. You’ll need to sign up or log in to save responses securely, but hey, it’s free to start! Share your survey on social media, in emails, or embedded on a website to reach breakfast lovers everywhere.

Bonus Tips for Extra Crunch

- Apply Your Branding: Upload your logo and customize colors in the Designer Sidebar to make your survey uniquely yours.

- Define Settings: Set survey start and end dates, limit responses, or add custom redirect URLs to control timing and user experience.

- Use Branching: Guide respondents down different paths based on their answers—perfect for personalized cereal preferences or testing multiple concepts.

Now you’re all set to capture actionable breakfast data using HeySurvey with ease! Get started instantly by opening a cereal survey template with the button below.

Brand Preference Surveys

Gaining insights into brand loyalty, awareness, and factors influencing brand-switching is essential. These surveys are perfect before launching brand-switch campaigns or evaluating co-branding partnerships. Running them quarterly helps benchmark share-of-mind.

Sample Questions:

- Which cereal brand do you buy most often?

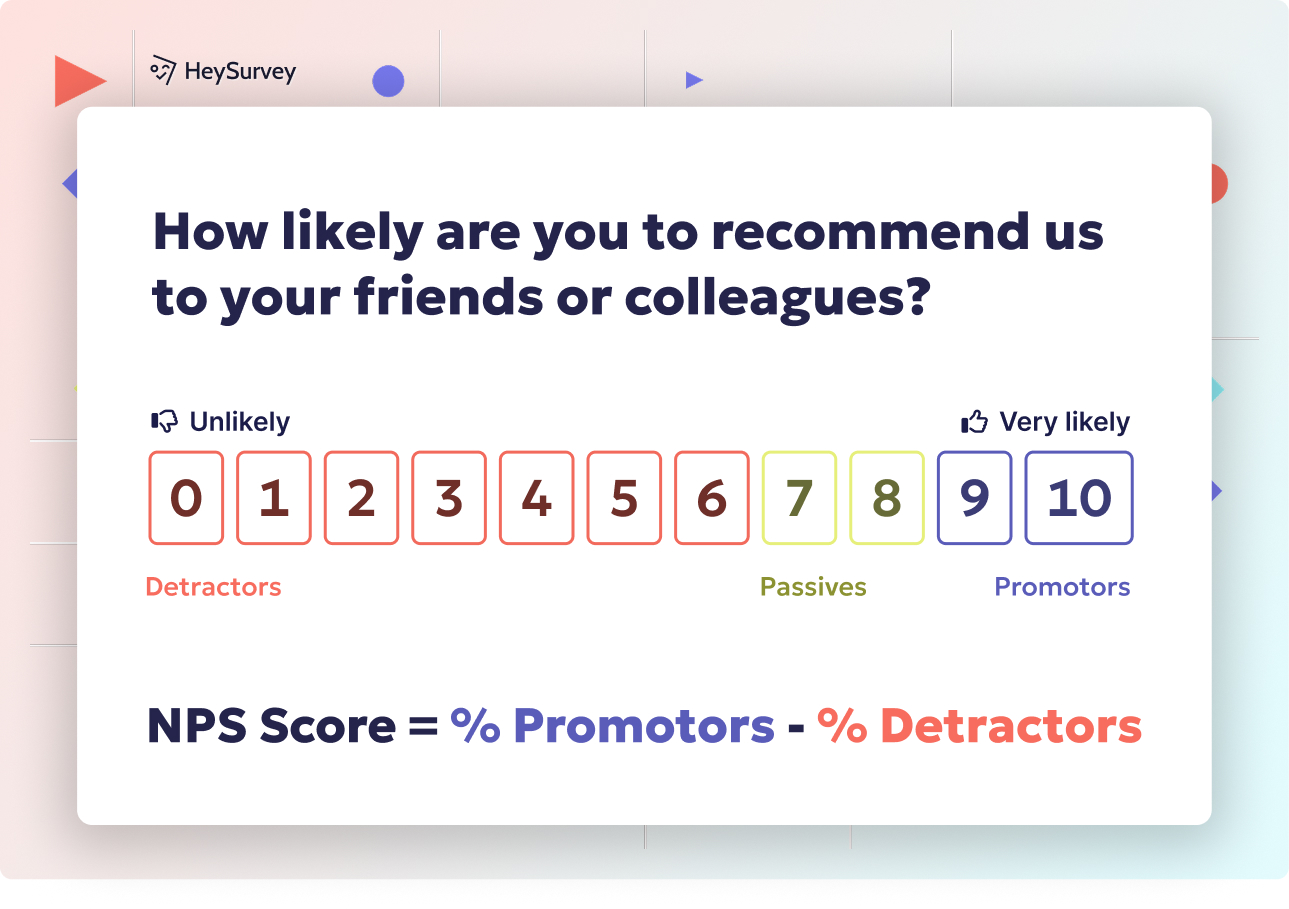

- How likely are you to recommend your preferred brand to a friend? (0–10)

- What would motivate you to switch cereal brands?

- List up to three cereal brands you are aware of but have never tried.

- Rate your satisfaction with your primary cereal brand on taste, price, and nutrition.

A 2023 survey revealed that 89% of retailers consider trusted brands crucial in the cereal category, while 65% of consumers prioritize price when choosing cereals. (grocerygazette.co.uk)

Flavor & Ingredient Preference Surveys

Identifying desired sweetness levels, trending flavors, preferred grains, and add-ins is crucial for product development. These surveys are vital during R&D sprints and for limited-edition flavor drops. Deploying them in early concept testing or to refresh a legacy SKU ensures products meet consumer desires.

Sample Questions:

- Which flavor profiles excite you most? (chocolatey, fruity, nutty, savory, other)

- How important is reduced sugar in your cereal choice?

- Would you purchase a cereal that includes functional add-ins like probiotics or protein crisps?

- Rank these grains by preference: oats, rice, corn, quinoa, wheat.

- Which seasonal flavor would you buy if available for a limited time?

Packaging & Shelf Appeal Surveys

Assessing box design, resealability, portion sizes, sustainability cues, and on-pack claims helps in creating appealing products. These surveys are crucial before a packaging redesign, SKU rationalization, or sustainability initiative. Running them in A/B tests with prototype visuals provides actionable feedback.

Sample Questions:

- How likely are you to try a cereal that comes in a resealable pouch instead of a box?

- Which front-of-pack claim most influences your purchase? (high fiber, organic, gluten-free, low sugar, other)

- Rate the importance of recyclable packaging when choosing cereal.

- Does clear window packaging make you more confident about product freshness?

- Which box size best fits your household consumption?

Cereal packaging often depicts serving sizes approximately 65% larger than those recommended, leading consumers to serve themselves 17.8% more cereal, potentially contributing to overeating. (bmcpublichealth.biomedcentral.com)

Price Sensitivity Surveys

Understanding acceptable price ranges, reactions to promotions, and perceived value versus competitors is essential for pricing strategies. These surveys are vital for price-pack architecture and promo planning. Conducting them before retailer line reviews or inflation-driven repricing ensures competitiveness.

Sample Questions:

- What is the maximum price you would pay for your favorite cereal?

- How often do discounts influence your cereal purchase?

- Would you buy in bulk (family size) if the unit price were 15% lower?

- Rank the following offers by appeal: coupon, BOGO, loyalty points, free shipping.

- If your preferred cereal increased in price by 10%, what would you do?

New Product Concept Surveys

Evaluating reactions to innovative ideas like high-protein keto cereal or augmented-reality games on packaging helps in de-risking innovation spend. These surveys are ideal during Stage-Gate idea screening, crowdfunding validation, or retailer pitch decks.

Sample Questions:

- How appealing is a cereal fortified with collagen for skin health?

- Would you buy a cereal that turns milk into a functional sports drink?

- Rate your interest in cereal single-serves that are microwave-ready.

- How much extra would you pay for a cereal that includes a QR code to unlock exclusive online games?

- Which of these new cereal formats would you most likely try first?

Dos and Don’ts: Crafting High-Converting Cereal Survey Questions

Dos:

- Keep questions single-minded.

- Use everyday language.

- Randomize option order.

- Include "other" with open text.

- Test on mobile.

Don’ts:

- Double-barrel questions.

- Leading wording.

- Excessive grids.

- Mandatory personal data.

- Ignoring survey length (max 8–10 minutes).

Conclusion: Turning Survey Insights into Breakfast-Table Wins

By leveraging these survey types, brands can make informed decisions on product tweaks, messaging, and pricing. Continuous feedback loops and A/B testing are key to staying ahead. Ready to dive deeper? Download our free, customizable cereal survey template to get started.

Related Market Survey Surveys

32 Market Research Survey Questions: Types, Samples & Tips

Explore 30+ market research survey questions with examples across types like CSAT, concept testin...

30 Coffee Survey Questions: The Complete Guide for Cafés & Brands

Discover 25+ expert coffee survey questions to boost cafés, product development, and brand insigh...

31 Content Marketing Survey Questions for Actionable Insights

Discover 25+ content marketing survey questions to gather actionable insights—boost audience alig...