32 Market Research Survey Questions: Types, Samples & Tips

Explore 30+ market research survey questions with examples across types like CSAT, concept testing, pricing, brand, and competitive insights.

When companies want to unlock real market insights, they often turn to market research surveys. These versatile tools collect consumer feedback, shape product roadmaps, and pinpoint what makes competitors sweat. Brands deploy them at every stage—from pre-launch buzz-building to post-launch pulse checks, or just to keep tabs on quarterly performance. Asking the right market research survey questions isn’t just about gathering respondent data; it’s about amplifying the true voice of the customer.

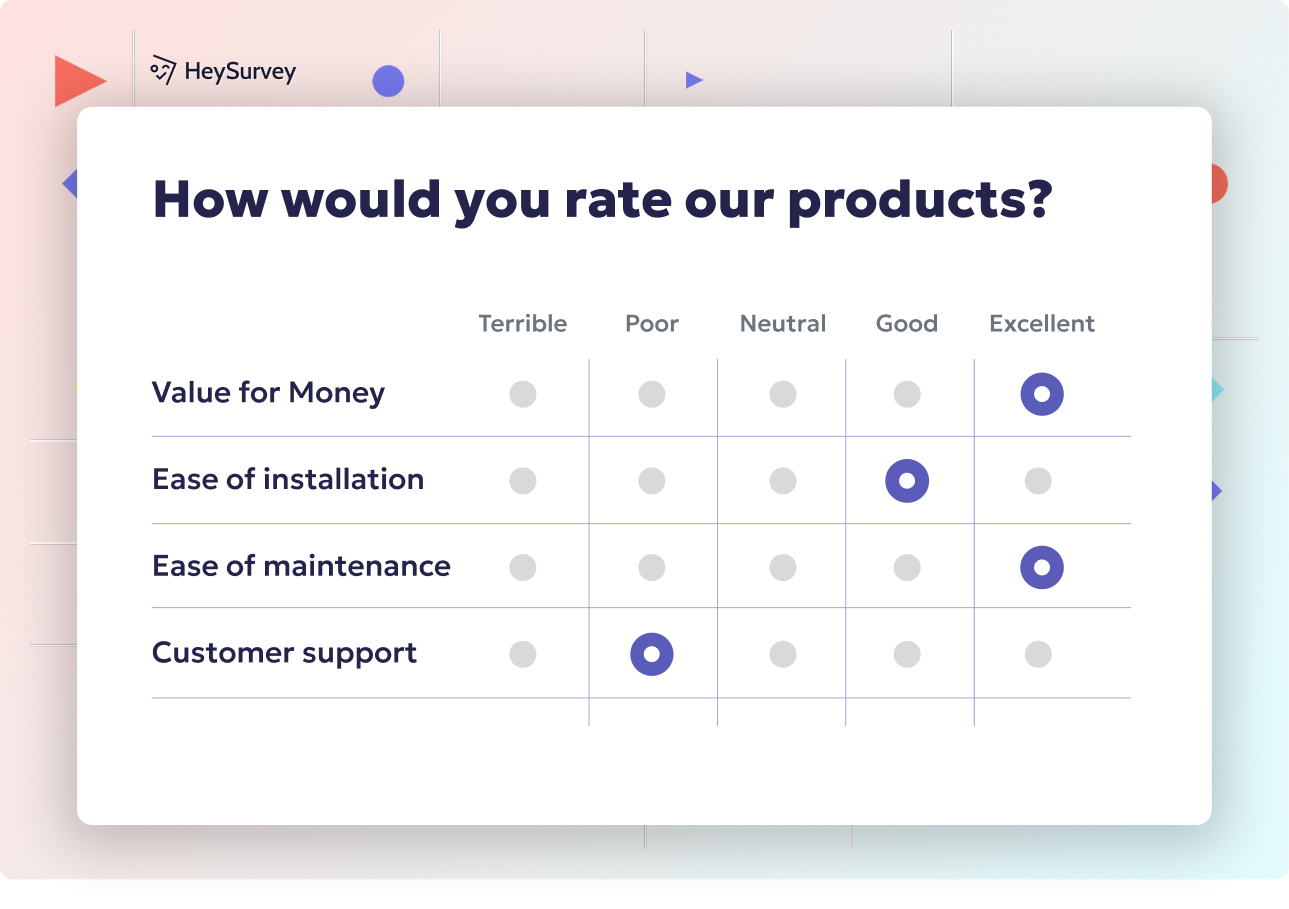

Customer Satisfaction (CSAT) Surveys

Why Customer Satisfaction Surveys Matter

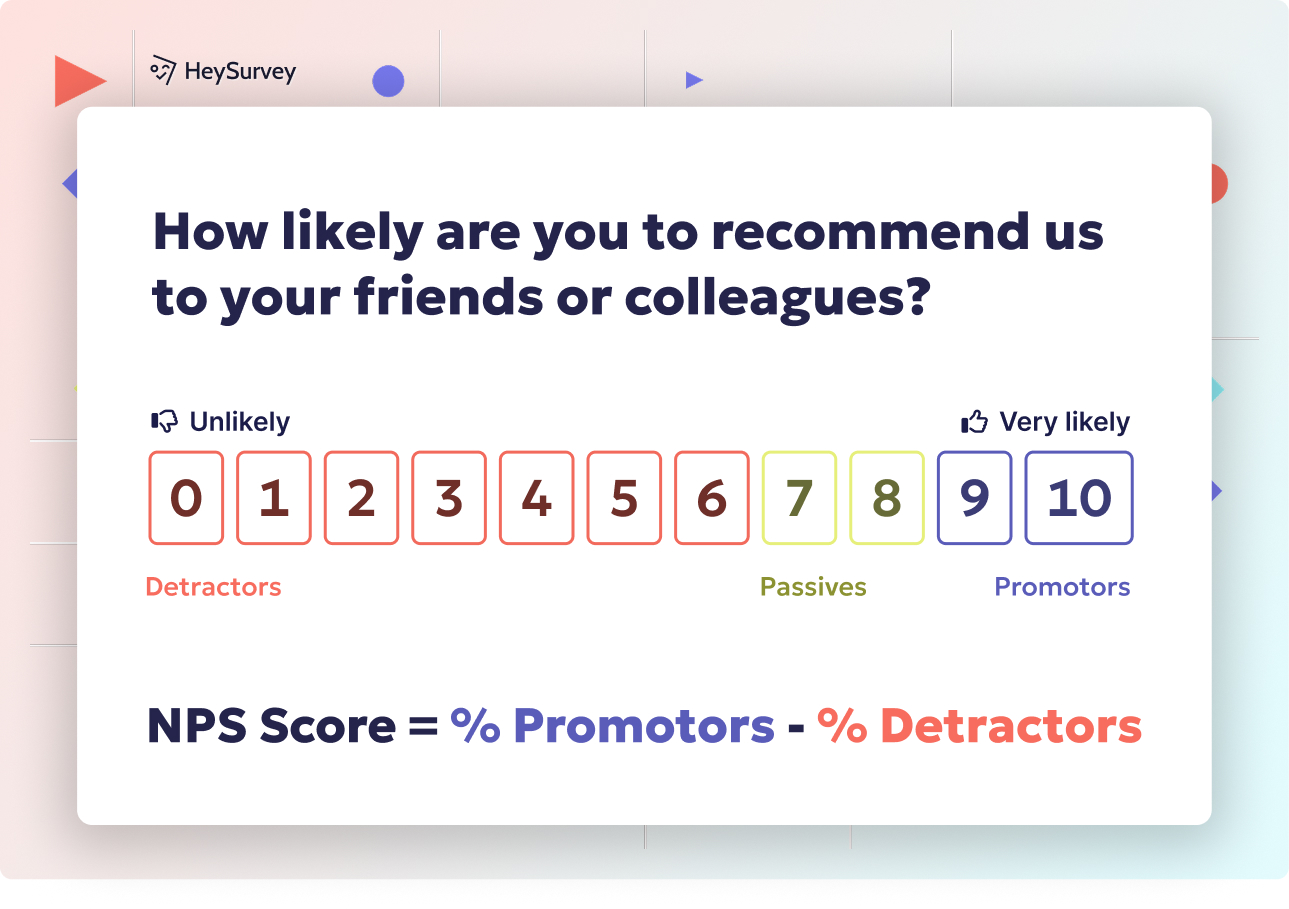

Customer satisfaction questionnaire items are your trusty crystal ball for predicting future loyalty. By regularly checking in on current customers, you discover their honest thoughts on your product or service quality. Brands use these surveys when launching loyalty programs, running quarterly NPS tie-ins, or simply making sure no one is unhappy post-purchase.

When and How to Use CSAT Surveys

CSAT surveys sweep in during major milestones:

- Right after a customer makes a purchase

- Quarterly brand health checks

- When rolling out new loyalty incentives

- After support interactions

- To track ongoing retention

Regular use of these surveys creates a customer-focused roadmap that goes far beyond guesswork.

5 Sample CSAT Survey Questions

Here are some sample CSAT survey questions to spark your next feedback spree:

How satisfied are you with your overall experience with [Product/Brand]?

Which features met, exceeded, or fell short of your expectations?

How likely are you to purchase from us again within the next 3 months?

What is the single biggest improvement we could make?

How does our customer support compare to competitors you’ve used?

Best Practices for CSAT Surveys

Stand-out CSAT surveys:

- Use clear, simple language

- Focus tightly on customer experience specifics

- Leave enough space for indecisive or neutral answers

- Follow up with the most dissatisfied voices

- Measure trends, not just snapshots

Every time you deploy a customer satisfaction survey, you’re mapping all the little path lights that keep your customers happy—and loyal.

Balancing quantitative and qualitative questions in customer satisfaction surveys enhances the depth and accuracy of feedback. (qualaroo.com)

How to Create Your Survey with HeySurvey in 3 Easy Steps

Curious how to get your survey humming with HeySurvey? Here’s the no-fuss, simple guide to turn your survey dreams into reality — even if you’re a total newbie.

Step 1: Create a New Survey

- Head over to HeySurvey and click "Create New Survey".

- Pick either an empty sheet if you want full control or select a pre-built template tailored for your survey type.

- Give your survey a name—something catchy and clear so you can spot it in your dashboard later.

That’s it! Your survey shell is ready for the magic to begin.

Step 2: Add Your Questions

- Click “Add Question” at the top or in between existing questions.

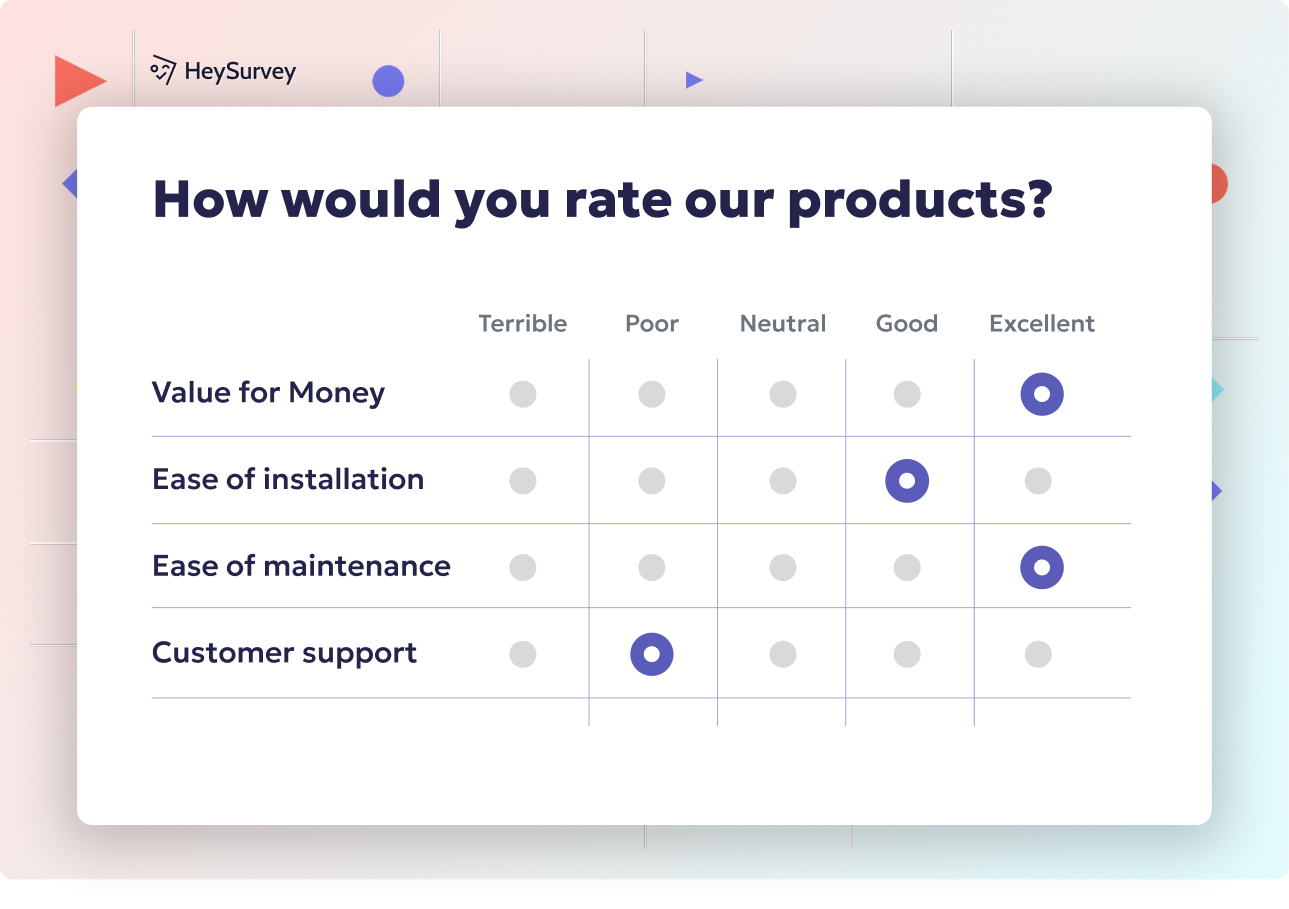

- Choose the question type (text, choice, scale, etc.) that fits what you want to ask.

- Write your market research survey questions clearly, customizing each question’s wording and answer options.

- Mark questions as required if you want to make sure no one skips them.

- Fancy? Add images or tweak formatting with markdown to make questions pop.

Keep building until your survey reflects your insights needs perfectly.

Step 3: Publish Your Survey

- When you’re happy with your masterpiece, hit the “Preview” button to see how it looks on different devices.

- If everything feels smooth, click “Publish.”

- HeySurvey will generate a shareable link you can send to your audience or embed on your website.

- Remember, publishing requires an account to collect and view responses.

You’re officially live and ready to gather that all-important consumer feedback!

Bonus Steps for a Polished Survey

Apply Your Branding

- Upload your company logo at the top left, so your audience knows the survey is legit and on-brand.

- Use the Designer Sidebar to customize colors, fonts, and backgrounds. This little sparkle makes your survey look professional and on-theme.

Define Survey Settings

- Use the Settings Panel to set start/end dates or limit how many responses you’ll accept.

- Add a redirect URL for when participants finish the survey (like your thank-you page).

- Optionally, allow respondents to view certain results for increased engagement.

Skip into Branches

- Want different questions based on previous answers? Use branching to tailor the survey path individually.

- This keeps your survey relevant and snappy, avoiding boring questions that don’t apply.

Ready to get started? Click the button below to open a template and watch your perfect survey take shape with HeySurvey!

Product Concept Testing Surveys

Understanding Product Concept Surveys

Before costly development begins, product concept survey example items help you validate ideas with real users. These questions gauge whether a new concept solves genuine problems or just dazzles internally. Used early and often, concept surveys uncover both risks and opportunities for future hits.

When to Tap Into Concept Testing

These surveys step in during:

- The earliest stages of ideation

- A/B screening of multiple competing concepts

- Proving value for funding presentations

- Prioritizing features before development

- Sussing out market fit pre-launch

This pre-launch feedback can make or break your budget—and reputation.

5 Product Concept Survey Questions

Here are five product concept survey example questions to test before you invest big:

How appealing is Concept A on a scale of 1–10?

What first caught your attention about this concept?

How well does the concept solve your current problem?

What price range would you expect for this product?

Which features would make you more likely to purchase?

Optimizing Concept Surveys

The secret sauce in product concept testing:

- Get feedback from both current customers and total strangers

- Ask open-ended questions alongside scales

- Avoid jargon and technical terms

- Never test more than 2–3 concepts at once

- Mix quantitative scoring with qualitative color

By gathering pre-launch feedback with these sharp questions, you skip the guesswork and launch only what the market genuinely wants.

Concept testing surveys are a cost-effective method to gather quick, actionable insights from target audiences, enhancing marketing ROI and reducing the risk of unsuccessful product launches. (quirks.com)

Brand Awareness & Perception Surveys

The Power of Brand Perception

Peeking into the minds of your audience with brand awareness and perception surveys reveals more than just recognition. You can track how people feel about your brand, how it stacks against rivals, and what makes you unforgettable. This survey type is the not-so-secret weapon behind every successful rebranding, campaign, or quarterly check-up.

When to Use Brand Surveys

Brand surveys shine for:

- Benchmarking before and after major campaigns

- Ongoing quarterly brand health check-ins

- Sizing up your brand’s place in the market

- Understanding competitive differentiation

- Tracking logo or slogan recognition

These pulses ensure your branding isn’t just noticed, but remembered—fondly.

5 Sample Brand Survey Questions

Here’s how you spark revealing insights with five sharp brand questions:

Which brands come to mind when you think of [industry/product]?

How familiar are you with the [Brand] logo?

Which words best describe your perception of [Brand]?

How likely are you to recommend [Brand] to a friend?

What differentiates [Brand] from its competitors in your opinion?

Tips for Effective Brand Surveys

For winning brand awareness surveys:

- Mix unaided and aided recall questions

- Test logos, taglines, and key messages

- Use both emotional and rational descriptors

- Benchmark against one or two top competitors

- Probe for both positive and negative associations

Done right, these surveys help you measure—and magnify—your brand’s magic in the market.

Pricing Research Surveys

The Art and Science of Pricing Surveys

Pricing can be more art than science… but only if you skip pricing research surveys. With the right questions, you can nail the sweet spot between “too much” and “too little,” making your offers irresistible and maximizing value perception.

Timing Your Pricing Research

Conduct pricing research:

- During launch planning for new products

- When considering price hikes

- Launching new subscription tiers

- Testing bundling or promotional offers

- Prior to entering new markets

Each survey delivers data on what customers value—and what they’ll pay for it.

5 Sample Pricing Survey Questions

Use these questions to zero in on value and affordability:

At what price would you consider the product too expensive to purchase?

What price feels like a bargain for you?

Which of these price ranges seems most reasonable for the value offered?

How does the proposed price compare to alternatives you’ve used?

Would you pay extra for expedited shipping or premium support?

Best Practices for Pricing Surveys

Unlocking true pricing power means:

- Testing a range of price points, not just one

- Mixing direct and indirect questions

- Asking about premium add-ons and trade-offs

- Keeping surveys anonymous to avoid social desirability bias

- Following up with interviews or focus groups for deeper insights

Every time you use market research survey questions about price, you move one step closer to a more profitable business.

Effective pricing surveys utilize clear, unbiased questions and test multiple price points to accurately gauge consumer price sensitivity and willingness to pay. (blog.surveyplanet.com)

Usage & Attitude (U&A) Surveys

Mapping Behaviors and Beliefs

Usage & Attitude surveys explore how—and why—consumers use products in a certain category. Brands leverage these to understand market sizing, use-cases, occasions, and the reasons behind purchase decisions. The result? Smarter positioning and more targeted offerings.

When U&A Surveys Shine

Deploy U&A surveys when:

- Entering new categories or markets

- Repositioning an existing product

- Gauging competitive entry risks

- Sizing the total addressable market

- Probing seasonal or trend-driven shifts

Mapping these behaviors lets you see your market beyond the surface.

5 Sample Usage & Attitude Questions

Here are top examples to map the lay of your brand land:

How often do you use products in this category?

Which occasions trigger your usage most frequently?

What factors influence your brand selection?

Rank these product attributes in order of importance.

What frustrates you most about current offerings?

Dos and Don’ts for U&A Surveys

To run insightful U&A surveys:

- Use simple, direct language about habits

- Include both frequency and motivation questions

- Allow for ranking and open comments

- Segment results by user type or persona

- Avoid overwhelming with too many questions

A clear view of real-world usage and attitudes helps you outmaneuver the competition and serve unmet needs.

Competitive Analysis Surveys

Benchmarking The Competition

Want to know how you stack up directly against your biggest rivals? Competitive analysis surveys deliver this crucial benchmarking data, shining a light not only on your strengths but also on those pesky areas where competitors are pulling ahead.

When to Use These Surveys

These surveys work best when:

- Prepping for big market share pushes

- Reviewing possible feature parity gaps

- Shaping a rebranding effort

- Checking the impact of new competitor campaigns

- Tracing lost win-back opportunities

They act as your secret weapon in the never-ending market chess game.

5 Sample Competitive Survey Questions

Get the inside scoop with these smart competitive questions:

Which brand do you currently purchase most often in this category?

Rate [Brand] vs. Competitor X on quality, price, and service.

What would persuade you to switch brands?

Which competitor advertising messages have you noticed recently?

What new features offered by competitors interest you?

How to Maximize Competitive Surveys

Powerful competitive analysis means:

- Always include direct head-to-head comparisons

- Ask what influences switching, not just loyalty

- Probe for awareness of competitor innovations

- Measure not only brand usage but advocacy

- Use open fields for spontaneous recall of competitors’ marketing

Armed with these insights, your brand can claim its place—and keep it—on the leaderboard.

Post-Purchase Experience Surveys

Why Post-Purchase Matters

Catching feedback moments after the sale (or onboarding) delivers gold. Post-purchase experience surveys reveal whether your product truly dazzled or fizzled and spot pain points before they turn into churn. This type of survey anchors your customer success playbook.

When to Deploy Post-Purchase Surveys

Try these after:

- A transaction or first use

- Activating a new account or service

- Completing the delivery or installation

- Upgrading or renewing a subscription

- Registering a product warranty

The sooner you ask, the fresher—and more actionable—the feedback.

5 Sample Post-Purchase Questions

Discover the post-purchase truth with these revealing questions:

How easy was the checkout/activation process?

Did the product meet your expectations upon first use?

What additional resources would improve your experience?

How likely are you to become a repeat customer?

Were there any barriers or pain points during delivery/installation?

Making the Most of Post-Purchase Surveys

Unlock maximum value by:

- Keeping questions brief and relevant

- Always linking back to specific touchpoints

- Acting instantly on negative feedback

- Asking follow-ups for success stories and testimonials

- Tracking improvements over time

The right post-purchase survey can turn a one-time customer into your boldest advocate.

Best Practices: Dos & Don’ts for Crafting High-Impact Market Research Survey Questions

Dos: Build On Best Practices

Surveys shine brightest when built with care. Here’s how to craft high-impact market research survey questions:

- Always use clear, everyday language

- Maintain a logical flow—group by topic and lead the respondent naturally

- Ensure your design is mobile-friendly

- Use balanced scales (like 1–5 or 1–10)

- Pilot test your survey before launch

Don’ts: Common Survey Pitfalls

A few survey “no-nos” can send your response rates plummeting:

- Don’t use leading or loaded questions

- Avoid double-barreled items (“How satisfied are you with price and quality?”)

- Steer clear of technical jargon or internal acronyms

- Say no to endless questions that cause fatigue

- Never ignore or compromise respondent anonymity

Tips for Survey Excellence

To keep your survey design on point:

- Mix quantitative scales with open-ended prompts

- Limit each survey to what’s truly essential

- Test drive on multiple devices and browsers

- Always say “thank you”—genuinely

- Use branching logic when appropriate

The right mix of artful phrasing and smart design makes your market research survey not just a data collection tool, but a loyalty-building experience.

Conclusion & Next Steps

Each survey type—CSAT, concept testing, brand, pricing, U&A, competitive, and post-purchase—answers a specific business question. Use them to segment your audiences, learn, and always iterate. Pair numbers with stories to make insights actionable and human. Ready to level up your insights game? Download your template or join our newsletter for more ways to supercharge your surveys!

Related Market Survey Surveys

30 Coffee Survey Questions: The Complete Guide for Cafés & Brands

Discover 25+ expert coffee survey questions to boost cafés, product development, and brand insigh...

31 Content Marketing Survey Questions for Actionable Insights

Discover 25+ content marketing survey questions to gather actionable insights—boost audience alig...

32 Persona Survey Questions to Build Perfect Buyer Personas

Discover 28 expertly crafted persona survey questions across demographics, psychographics, behavi...