31 Survey Questions to Ask Customers About Your Product

Explore 27 expert survey questions to ask customers about your product and learn how to collect product feedback that boosts satisfaction and growth.

Customer product surveys are powerful tools—they let you collect product feedback that’s honest, actionable, and laser-focused. These surveys are crucial for companies riding the wave of product-led growth, helping you improve customer satisfaction while keeping a curious finger on the pulse of your audience. The right “survey questions to ask customers about your product” can transform bland data into gold, but how you ask—and which format you pick—is key. Below, you’ll discover eight essential survey types, each suited for different moments and goals, plus practical tips to ensure your next survey earns the thoughtful answers and business impact you need.

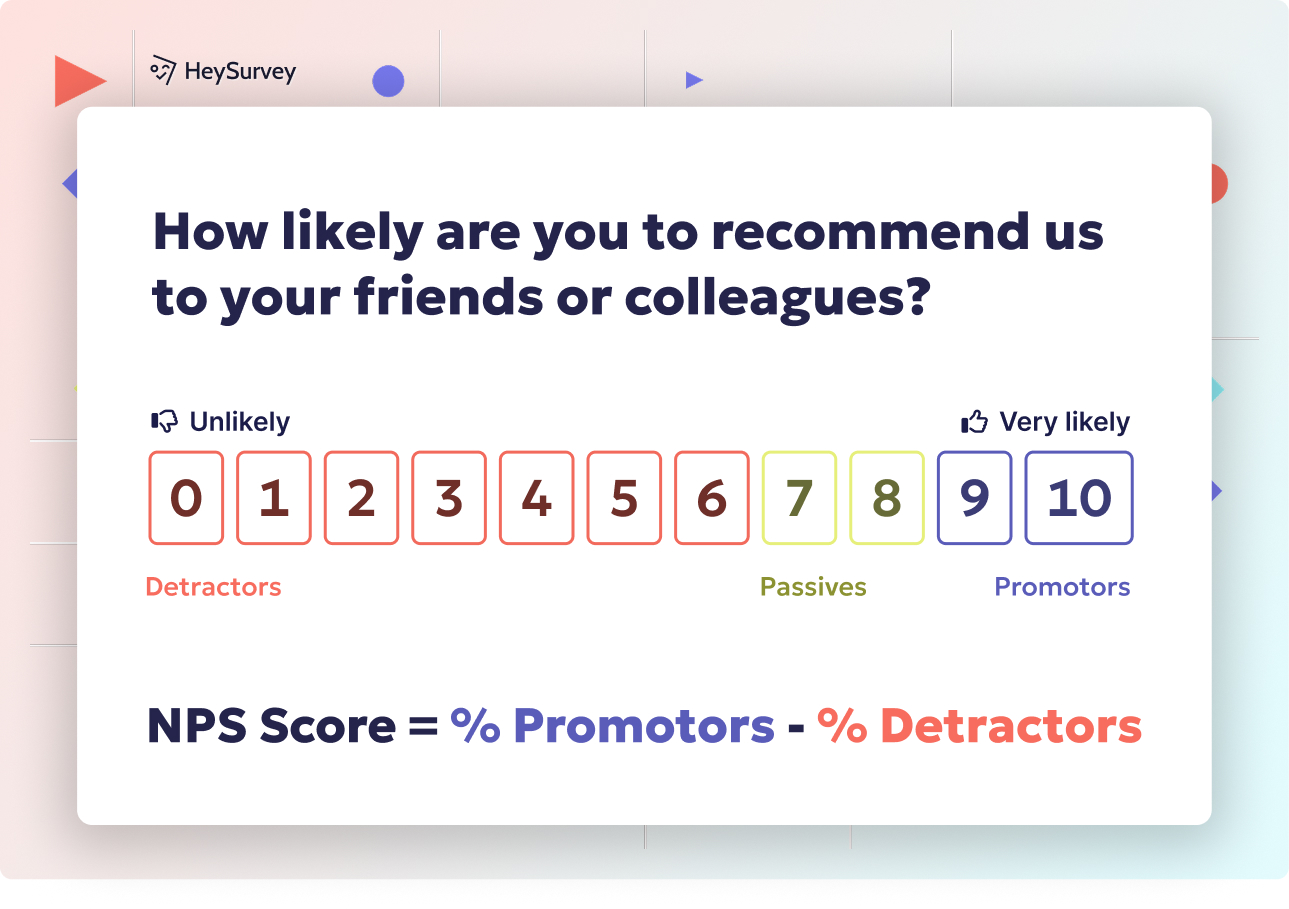

Net Promoter Score (NPS) Survey – Measuring Loyalty & Word-of-Mouth Potential

Why and When to Use

The Net Promoter Score (NPS) survey is one of the simplest, yet most powerful, ways to measure how likely your customers are to stick around and recommend you. It’s the secret sauce behind many top brands’ growth—it gauges overall satisfaction, brand advocacy, and potential for organic referrals. You’ll want to deploy this survey once your customers have had enough time to experience your product’s true value—think 30 to 60 days after they buy, or quarterly for subscription services.

Choosing the right timing for an NPS survey means customers can give authentic feedback based on real usage. It’s also a great resource for benchmarking loyalty over time. By targeting previous buyers and active users, you’re not just guessing—you’re gathering data that’s tied directly to performance and user sentiment.

NPS surveys reveal the story behind your numbers, shining light on why users are cheering you on—or quietly heading for the door. Knowing how you rank in users’ minds against competitors helps you refine your product, messaging, and retention strategies.

If you want a straightforward, proven method for identifying your crowd of raving fans and early churn risks, NPS is the place to start. Pair it with follow-up questions and you’ll discover what turns customers into promoters—or detractors—in the first place.

Sample Questions

On a scale of 0–10, how likely are you to recommend our product to a friend or colleague?

What is the primary reason for your score?

What one thing could we do to improve your likelihood to recommend us?

Which competitive products did you consider before choosing ours?

Have you recommended our product in the past six months? Why or why not?

Research indicates that the Net Promoter Score (NPS) may not reliably predict customer loyalty or business growth, and often lacks detailed insights into specific areas for improvement. (emerald.com)

Creating your survey with HeySurvey is super straightforward—even if you’re brand new to this whole thing. Just follow these easy steps to get your customer feedback survey up and running in no time!

Step 1: Create a New Survey

- Head over to HeySurvey and click “Create Survey”.

- Choose whether you want to start from scratch (Empty Sheet) or pick a handy pre-built template to jumpstart your survey with suggested questions.

- Give your survey a name inside the Survey Editor—this helps keep your projects organized.

- Voilà! You’ve got a fresh survey ready to polish.

Step 2: Add Questions

- Hit the “Add Question” button at the top or in between existing questions.

- Pick your question type: whether it’s Scale (great for NPS or ratings), Choice (single or multiple answers), or Text (for open feedback).

- Type your question text and tweak any optional settings like making questions required or adding descriptive hints.

- If you want to get fancy, add images or gifs to spice up your questions—HeySurvey has built-in access to Giphy and Unsplash!

- Keep adding as many questions as needed to capture the full story from your users.

Step 3: Publish Your Survey

- Once you’re happy with your questions and layout, click “Preview” to see how it looks on both desktop and mobile.

- In the preview, you can still adjust design elements from the Designer Sidebar like colors, fonts, or question animations.

- When ready, hit “Publish”—you’ll get a link to share with your customers. (Note: You’ll need a HeySurvey account to publish and collect results.)

- Share your survey link anywhere—emails, social media, or embed it on your website with an iframe.

Bonus Step: Apply Branding

- Want your survey to look unmistakably YOU? Upload your company logo in the top-left corner via the Branding panel.

- Customize colors, fonts, and backgrounds in the Designer Sidebar to match your brand’s vibe effortlessly.

Bonus Step: Define Survey Settings

Use the Settings panel to:

- Set your survey’s start and end dates, so responses are collected exactly when you want.

- Limit responses if you’re targeting a specific number of participants.

- Redirect users to a custom webpage after survey completion (like a thank-you or offer page).

- Enable respondents to view progress or even see survey results if it makes sense.

- Set your survey’s start and end dates, so responses are collected exactly when you want.

Bonus Step: Skip Into Branches

- For a cooler, more tailored experience, apply branching logic to your questions.

- Depending on previous answers, you can send respondents down different paths—keeping things relevant and engaging.

- Add multiple endings if you want respondents to see messages or images based on their responses.

And that’s it! If you want to hit the ground running, try opening one of our ready-made survey templates with the button below. Your next great customer insights journey begins here.

Customer Effort Score (CES) Survey – Evaluating Ease of Use & Support

Why and When to Use

The Customer Effort Score (CES) survey zooms in on how hard it is for customers to get things done with your product or team. If confusion, frustration, or repeated support tickets sound familiar, this is your go-to solution. Best practice? Drop a CES survey right after key product moments—like onboarding, using a new feature, or reaching out for help.

Surveying immediately after a touchpoint uncovers points of friction while memories are fresh. That means less guesswork about where your experience trips people up. You can use the insights to prioritize updates and quick wins that make life easier for your customers.

The CES survey isn’t about identifying every irritation—just the ones that actually drive people to leave, complain, or sigh loudly at their screens. Your support team will thank you; your churn numbers might too. Getting this feedback in real time gives product managers clear evidence for refining onboarding guides, fixing awkward flows, and smoothing out technical hiccups.

By focusing on effort, you’re showing customers you respect their time and want their journey to be smooth. After all, nobody loves a product that feels like a chore.

Sample Questions

The company made it easy for me to accomplish my goal. (1–7 agreement scale)

How much effort did you personally have to put forth to resolve your issue today?

Which step in the setup process felt most difficult?

If you encountered friction, what was the main cause?

How could we make this task easier next time?

Research indicates that increasing Customer Effort Score (CES) responses from 1 (very difficult) to 5 (relatively easy) can lead to a 22% increase in customer loyalty. (helpscout.com)

Product-Market Fit (PMF) Survey – Validating Core Value Proposition

Why and When to Use

The Product-Market Fit (PMF) survey cuts through the noise to test whether your product solves a must-have problem for real customers. Perfect for early-stage launches, beta tests, or just before a radical product shift, this survey is about nailing your core value—not superficial likes or bonus features.

Identifying if your product is a “must-have” helps you focus development on what actually matters to your users. If more than 40% say they’d be “very disappointed” to lose your product, you’re onto something special. The rest of the responses? They contain clues for what you can double down on—or what’s missing the mark.

This survey gives voice to the gap between what you think you’re solving and what your customers actually crave. PMF feedback uncovers core user segments and their burning pain points, beyond the shiny surface of your latest release. Use it as your compass for future product pivots, feature investments, and marketing messages.

Collecting this feedback often feels humbling, but it delivers brutal clarity—sometimes it’s the wake-up call you need to build better.

Sample Questions

How disappointed would you be if you could no longer use our product? (Very / Somewhat / Not)

Which type of people do you think would most benefit from our product?

What is the main benefit you receive from the product?

How does the product compare to other solutions you’ve tried?

What is the biggest obstacle preventing you from getting value?

Feature Prioritization Survey – Deciding What to Build Next

Why and When to Use

The Feature Prioritization survey is your north star for deciding what ends up on the product roadmap. When you face a buffet of feature requests, this survey shines a spotlight on what your customers truly need—so your team doesn’t chase every shiny idea that pops up in the suggestion box.

Launching this survey before sprint planning aligns engineering with market demand, minimizing wasted resources. You can run it with your most active users, or sample a broader group when prepping for bigger releases. By presenting real choices—not just open-ended wishes—you discover what would make the biggest impact for your audience.

This survey is great for avoiding “feature bloat” and validating whether that next big idea is really worth the sweat. It also spotlights unpopular or little-used items that could be pruned or reimagined, freeing you to focus on what truly moves the needle.

Done right, feature prioritization isn’t just a to-do list—it’s a collaborative process. Your users become partners in the building journey, and your team gets clear, data-driven priorities—not vote-by-shouting matches.

Sample Questions

Rank the following features from most to least valuable.

If we could add only one new feature, which would you choose?

Which existing feature do you use least and why?

How would Feature X impact your productivity? (1–5 scale)

What problems remain unsolved that a new feature could address?

Implementing MaxDiff analysis in surveys effectively identifies which product features customers value most, enabling data-driven prioritization decisions. (surveymonkey.com)

Usability Benchmark Survey (e.g., System Usability Scale) – Quantifying Product Ease-of-Use

Why and When to Use

A Usability Benchmark Survey—like the System Usability Scale (SUS) or SUPR-Q—lets you measure just how easy your product is to live with, not just how flashy it looks. Deploy this after a major user interface overhaul, or every 6 to 12 months, to track how new releases affect daily usage.

These surveys give you concrete numbers to benchmark changes, so you can spot trends and justify future investments. By collecting both ratings and open-ended impressions, you get rich insight into what’s intuitive versus what’s still a head-scratcher.

This feedback is a designer’s best friend: it cuts through heated debates about menu placement, confusing steps, or unexpected bugs. For product managers, it’s a sanity check—just because something works for your engineers doesn’t mean it works for a customer on their first try.

Usability surveys also highlight just how much extra training, documentation, or support is required to get new users up to speed. If scores start to slip, it’s your cue for another round of improvements. High scores, meanwhile, become potent proof points when pitching your product to new enterprise customers.

Sample Questions

I think that I would like to use this product frequently. (1–5 agreement)

I found the product unnecessarily complex.

I felt very confident using the product.

I needed to learn a lot before I could get going with this product.

How would you rate the overall usability of the product? (0–100 slider)

Pricing Sensitivity (Van Westendorp) Survey – Finding the Sweet Spot

Why and When to Use

The Pricing Sensitivity survey, often based on the Van Westendorp model, takes the guesswork out of figuring out what customers really think about your price tag. These insights are invaluable before launching a new product, adjusting your packaging, or making the annual pricing review less of a nerve-wracking leap.

Discovering customers’ willingness to pay helps you avoid leaving money on the table or scaring buyers away with sticker shock. The Van Westendorp method delivers a “sweet spot” range, balancing perceived value with what’s actually affordable. That’s a win for both sales and long-term retention.

This survey also uncovers psychological thresholds—like whether users equate low prices with poor quality, or how high you can go before eyebrows (and wallets) start closing. It’s particularly powerful when used alongside competitor research, letting you benchmark your offer against what’s already out there.

With solid pricing data in hand, you can structure special offers, bonuses, and packaging that maximize revenue while still keeping your best features within reach for your core customers. No more throwing darts in the dark.

Sample Questions

At what price would you consider the product to be so expensive that you would not consider buying it?

At what price would you consider the product to be priced so low that you feel the quality can’t be very good?

At what price would you consider the product starting to get expensive, but still worth buying?

At what price would you consider the product to be a bargain?

How would you rate the value for money of our current pricing? (1–10)

Post-Purchase Experience Survey – Capturing First Impressions

Why and When to Use

The Post-Purchase Experience survey plugs you directly into your customers’ minds in the crucial window right after they buy. This is the perfect time to spot confusion, doubts, or missing pieces in your onboarding process—while customers are still in “honeymoon” mode and everything’s fresh.

Early feedback helps you reduce buyer’s remorse and close any gaps in your setup or communication. By reaching out within a week, you ensure any rough spots are caught before they become negative reviews or lead to churn. This first impression can shape the tone of your whole customer relationship.

What sets this survey apart is its focus on emotion and experience rather than just functions. It digs into why users chose you, how clearly they understood what they were getting, and what might have nearly derailed the purchase. Those stories provide pure gold for sales and marketing teams looking to smooth out every step of your funnel.

Well-timed post-purchase surveys turn happy buyers into repeat customers, while frustrated buyers become the source of your most actionable insights. It’s a win-win.

Sample Questions

How satisfied are you with your purchase experience so far?

What was the main reason you chose our product?

How clear were the setup instructions?

What nearly stopped you from completing your purchase?

What could we have done to improve your first week with the product?

Churn / Exit Survey – Understanding Why Customers Leave

Why and When to Use

Few things sting like losing a customer, but an Exit or Churn survey can turn that loss into your biggest opportunity for growth. Rather than guessing at the reasons behind cancellations or downgrades, these surveys invite customers to share their honest exit interviews—no hard feelings.

Exit surveys surface root causes of churn, letting you fix systemic issues before more customers walk out. Timing is everything: send immediately after a cancellation, so customers’ reasoning and emotions are crystal clear. Whether it’s pricing, competitors, missing features, or unmet support expectations, every answer directs you to your next fix.

Running these surveys consistently helps you recognize patterns—like which segments are most likely to leave, or whether a recent change triggered a spike in downgrades. Plus, closing the feedback loop with ex-customers sometimes persuades them to give you another chance down the road.

The best exit surveys are a mix of multiple choice and open-ended “tell us more” sections. The latter can deliver the “aha” moments that charts and dashboards rarely reveal.

Sample Questions

What is the primary reason you’re canceling your subscription?

Which alternative solution will you use instead?

What could we have done to keep you as a customer?

How satisfied were you with our support during your tenure?

Would you consider returning in the future? Under what circumstances?

Best Practices: Dos and Don’ts for High-Performing Customer-Product Surveys

Getting surveys right is both art and science—follow these dos and don’ts to maximize value:

Do segment your survey audience: Tailor questions to new users, power users, or churned customers for more relevant feedback.

Do keep surveys short and crisp: Aim for five minutes or less to encourage honest, thoughtful completion.

Do offer incentives: Small perks like discounts, exclusive content, or raffles can boost response rates.

Do close the feedback loop: Thank respondents and share what you’ll do with their feedback. Customers love knowing their voice counts.

Do use clear, jargon-free language: Keep questions simple and free of tech talk to avoid confusion.

Do test surveys on a small group first: Gather quick feedback before a full rollout to catch confusing questions or bugs.

Do make surveys mobile-friendly: Design your survey so it looks and works great on a phone—most people won’t complete it at a desk.

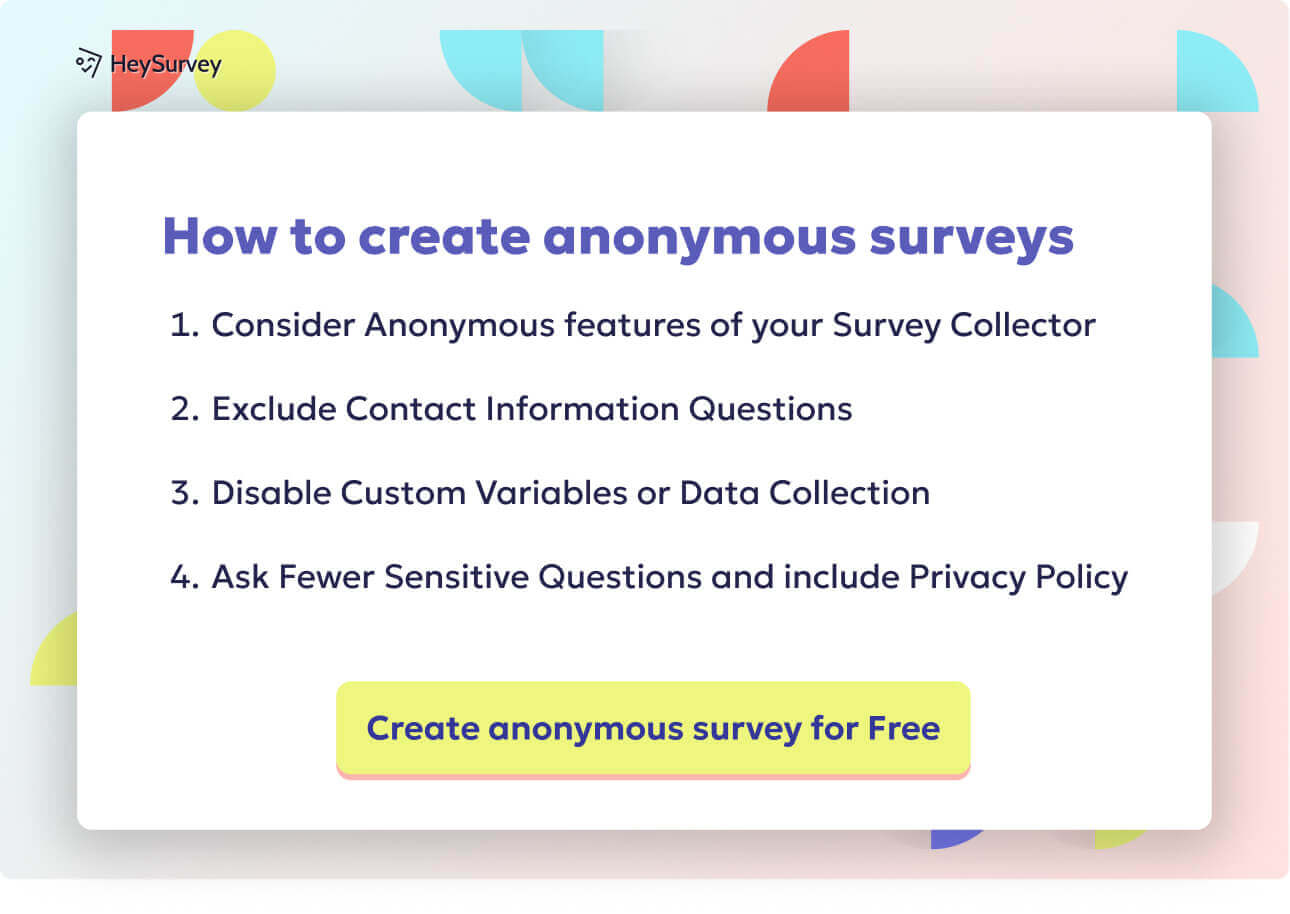

Do handle data ethically: Respect privacy, ask only for info you need, and be transparent about how answers will be used.

And here’s what to avoid:

Don’t ask leading or biased questions: These skew your results and miss what customers really think.

Don’t bombard users with surveys: Spamming invites fatigue and plummeting response rates.

Don’t ignore open-ended feedback: These insights might sting but are where the real value lies.

Don’t use confusing or double-barreled questions: Stick to one idea per question for clarity.

Don’t make everything mandatory: Allow users to skip what they don’t want to answer.

Don’t overlook follow-up: If someone flags a big issue, reach out to resolve it personally—not just with a generic “thanks.”

Don’t forget to optimize cadence: Find the balance: often enough to be useful, but not so often you become a nuisance.

Don’t hoard results in a silo: Share findings with all relevant teams—product, support, marketing, and executives alike.

Survey cadence, mobile optimization, and ethical data collection can transform your feedback process from a box-checking exercise into a powerful business driver. Keep these touchpoints consistent but humane, always respecting your users’ time and privacy.

Conclusion

Surveying your customers isn’t just about collecting numbers—it’s about hearing, adapting, and truly putting your users at the heart of every product decision. Each survey type serves a unique purpose on your feedback journey, turning curiosity into actionable change. Done well, product surveys drive loyalty, validate new ideas, and spark the insights that keep you ahead of the market. Respect your users’ time, respond to their input, and never stop learning from what they share. Every thoughtful question is a chance to delight someone anew.

Related Product Survey Surveys

31 Beta Testing Survey Feedback Questions Form Template Guide

Explore a comprehensive beta testing survey feedback questions form template with 35 sample quest...

29 Product Testing Survey Questions: Types, When to Use & Samples

Discover 27 proven product testing survey questions with 9 expert survey types to validate ideas,...

30 Proven Product Market Fit Survey Questions for Success

Discover 25+ proven product market fit survey questions with templates, best practices, and perfe...