30 Proven Product Market Fit Survey Questions for Success

Discover 25+ proven product market fit survey questions with templates, best practices, and perfect timing to validate and grow your product.

Product-market fit survey questions are the secret weapon for startups looking to prove their concept, fuel growth, and unlock funding. These surveys dig deep into value perception, unmet needs, and what customers would truly pay for. By layering different types of product validation surveys, founders get a 360° view of what matters most: Are people truly in love with your product—or just casually dating it? In this article, you’ll learn how and when to use six essential PMF survey templates, from the classic Sean Ellis test to NPS, CSAT, JTBD, feature prioritization, and churn insight. Let’s dive into each, and see why mixing methods gives your product the highest odds of breakout success.

Sean Ellis 40% Rule Survey (Core PMF Test)

The Origins and Why It Matters

The Sean Ellis 40% Rule survey is the gold standard for early product-market fit testing. Born from the insights of Sean Ellis (the growth hacker behind Dropbox and Eventbrite), this benchmark zeroes in on one powerful question: How would users feel if your product vanished tomorrow? Ellis found that if at least 40% of customers would be “very disappointed,” you’re within striking distance of product-market fit. Anything less and—sorry—work remains.

This survey is especially relevant for early-stage startups. Think pre-Series A, just before talking to investors, or when you spot the first sign of traction. If you’re prepping for a big pitch or deciding whether to double down, this tool unlocks clarity fast.

When and How to Deploy

Unleash this survey when your MVP is being used by real customers, but you’re unsure if you’ve hit “must-have” status. It’s best right after a user completes a core action: their first project, first successful outcome, or any ‘aha’ moment.

Sample Sean Ellis PMF Questions

How disappointed would you be if [product] were no longer available? (Very disappointed / Somewhat disappointed / Not at all disappointed)

What type of people do you think would most benefit from [product]?

What is the main benefit you receive from [product]?

How could we improve [product] for you?

Which alternative would you use if [product] didn’t exist?

What made you first try [product]?

What stands out about this approach is its brutal simplicity. Quickly, you see if your solution is irreplaceable—or just “nice to have.”

Interpreting Results

The magic threshold is clear: If ≥40% respond “very disappointed,” you’ve got a viable product-market fit signal. You can reference the original Sean Ellis research for deeper context and credibility.

Consider this your early warning system for runaway success—or your roadmap for what’s missing. Either way, this survey focuses your team on what matters most: building something people can’t live without.

Sean Ellis's research indicates that companies with at least 40% of users stating they would be "very disappointed" if they could no longer use the product typically experience strong traction and growth. (cobloom.com)

Creating a survey with HeySurvey for your product-market fit research is as easy as 1-2-3. Here’s a simple, newbie-friendly walkthrough to get your survey live and collecting insights fast:

Step 1: Create a New Survey

- Head over to HeySurvey and select “Create New Survey.”

- Choose a template if you want a quick start (perfect if you’re using product-market fit survey questions) or start from a blank slate.

- Give your survey a clear internal name to keep things organized, like “PMF Survey Q2 2024.”

Step 2: Add Your Questions

- Click the “Add Question” button to start building your question list.

- Pick the right question type for each item: single choice, multiple choice, scale (for NPS), or text (for open-ended feedback).

- Enter your product-market fit survey questions exactly as you want to ask them, using markdown formatting for bold or lists if desired.

- Mark questions as required if respondents must answer before moving on.

- Add images or descriptions to clarify when needed.

Step 3: Publish Your Survey

- Hit “Preview” to test how your survey flows and looks on different devices.

- When happy, click “Publish”—HeySurvey will generate a shareable link you can send to your customers or embed in your website.

- Note: You’ll need a HeySurvey account to publish and view results.

Bonus Steps for Supercharged Surveys

Apply Branding: Upload your company logo and customize colors and fonts from the Designer Sidebar to create a polished, on-brand experience.

Define Survey Settings: Set start and end dates, specify a response limit, and configure a redirect URL after completion. These options ensure your survey runs on your schedule and sends users where you want them next.

Skip Into Branches: Use branching to customize the path respondents take based on their answers. For example, if a user says they don’t use a feature, branch them past related questions to keep things relevant and quick.

Ready to start? Use the button below to open a product-market fit survey template in HeySurvey and customize it for your product today!

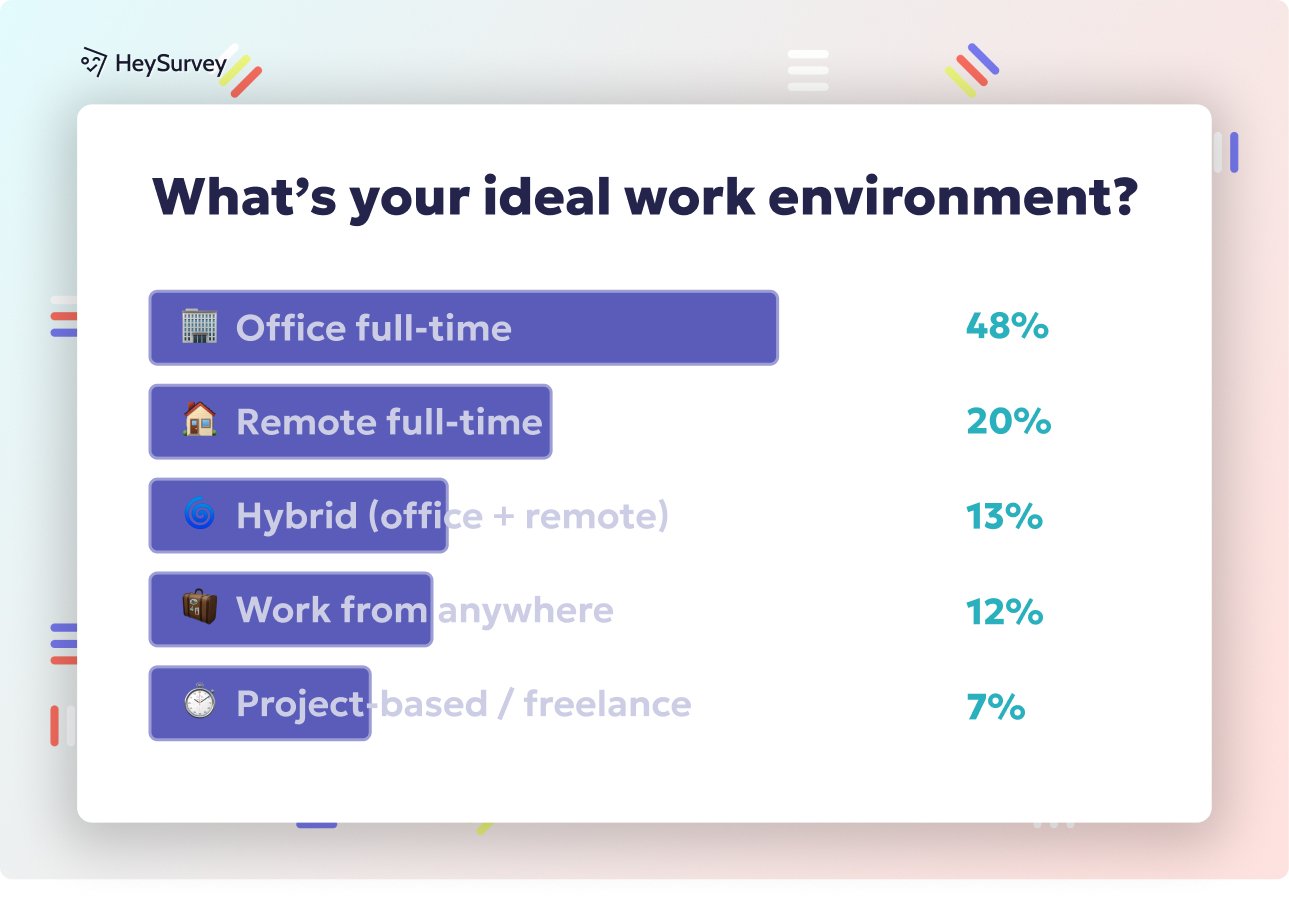

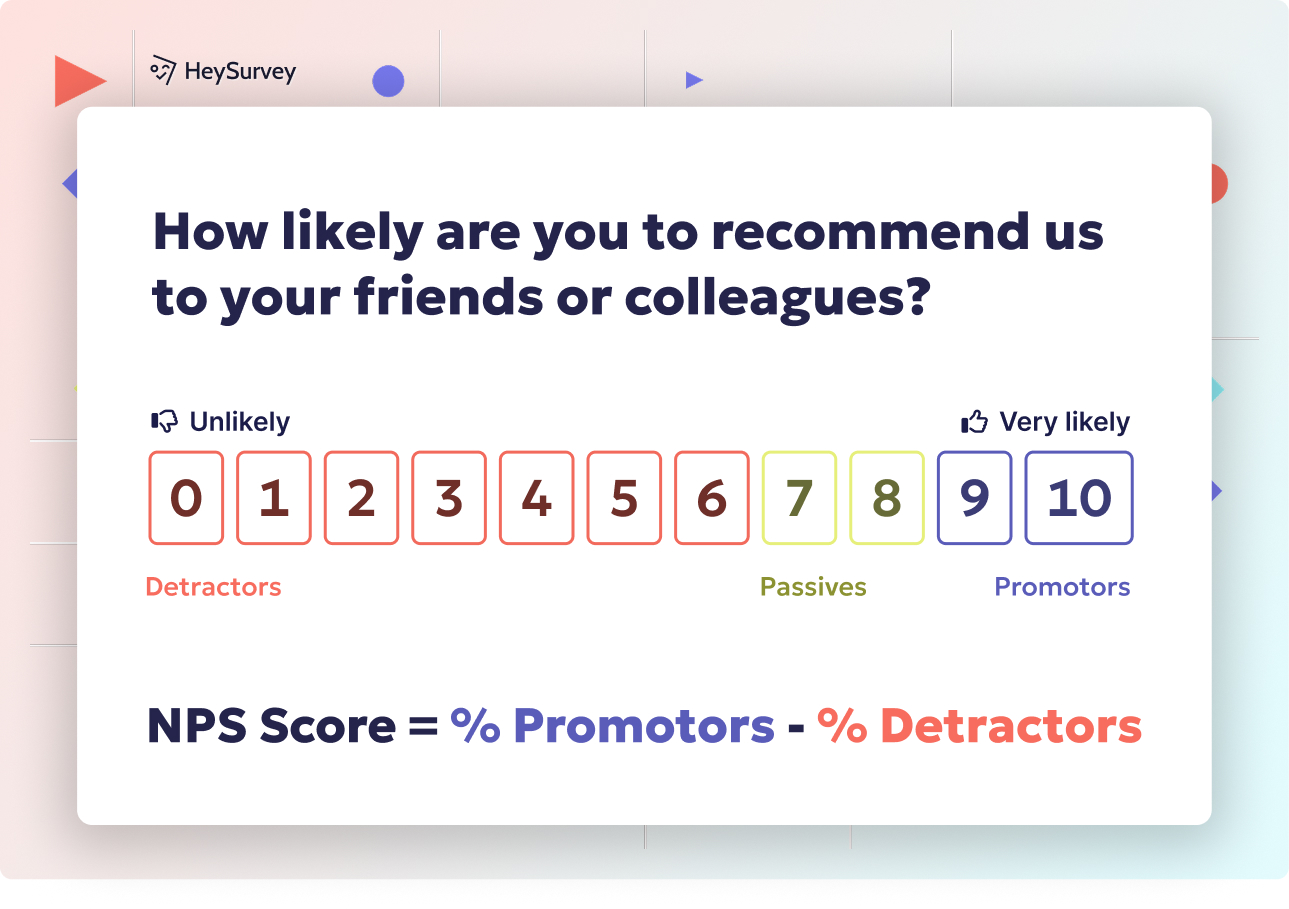

Net Promoter Score (NPS) Survey for Referral Intent

Unlocking Virality With NPS Product-Market Fit Surveys

The Net Promoter Score (NPS) survey is the pulse check for your product’s word-of-mouth potential. While not exclusive to SaaS or tech, it tells you exactly how likely a user is to recommend your solution. Think of it as the “friend test”—if customers aren’t bragging to others, you’re probably not solving their deepest pain.

You want to launch your NPS product-market fit survey soon after users experience the “aha” moment. That’s when your value proposition is freshest in their minds. It’s also smart to include this survey post-onboarding or after releasing a game-changing feature.

Key Questions for NPS Product-Market Fit

On a scale of 0-10, how likely are you to recommend [product] to a friend or colleague?

What is the primary reason for your score?

Which feature drove you to rate us highest?

What is one thing holding you back from giving us a 10?

Which competitor would you recommend instead, if any?

If you had to describe [product] in one sentence to a friend, what would you say?

How to Interpret the Results

An NPS survey doesn’t just reveal enthusiastic users (promoters). It spotlights detractors and passives—those quietly drifting away, or outright warning folks to steer clear. These insights let you:

- Spot potential evangelists for referral campaigns

- Pinpoint areas of improvement

- Use competitive mention data to refine differentiation

Benchmarks vary but scores above 50 are excellent in the SaaS world; negative numbers are a red flag. Always focus on verbatims—what’s said alongside the score matters as much as the number.

Visual and Strategic Bonus

Don’t forget to use images or icons when you can, especially illustrating promoter/detractor splits—this keeps reports lively and accessible. The NPS question, coupled with emotionally loaded follow-ups, delivers a double punch of quant and qual evidence for investors and product leaders alike.

Achieving a Net Promoter Score (NPS) above 50 is considered excellent in the SaaS industry, indicating strong customer satisfaction and potential for organic growth. (rizevault.razorpay.com)

Customer Satisfaction (CSAT) Snap-Shot Survey

The Go-To Metric for Pinpointing PMF Gaps

The world of customer satisfaction (CSAT) surveys is fast, friendly, and direct—a single pulse-check survey right after a key interaction. This is your tool of choice post-support ticket, training session, or after a user tries a new feature. Think of it as asking, “How’d that feel?” at the exact moment you want honest feedback.

CSAT surveys are mission-critical when you need to see if your solution is delivering as promised. They help reveal if you’re meeting, exceeding, or missing the mark, which directly supports (or undermines) your product-market fit.

Sample CSAT Product Validation Survey Questions

Overall, how satisfied are you with [product/feature] today? (1-5 stars)

Did [product] meet your expectations for solving [specific job]?

How easy was it to achieve your goal with [product] today?

What almost stopped you from succeeding?

What would you change to make your experience perfect?

Would you use [product] again, based on today’s experience?

Making Sense of CSAT Scores

Industry wisdom pegs CSAT ≥ 80% as a “this is working” indicator—a strong signal of product-market fit. If users are consistently rating you high after real-life tasks, your product is likely solving real problems, not theoretical ones.

How to Use CSAT Effectively

Benefits of the CSAT snapshot approach include:

- Getting actionable feedback instantly

- Tying satisfaction to specific features or services

- Uncovering “hidden” product friction

When users are consistently satisfied, you build long-term retention. But any dip below 70% should trigger a deeper investigation. Use this as a guide for continuous improvement, always asking: “What nearly broke our promise today?”

Jobs-to-Be-Done (JTBD) Problem Discovery Survey

Digging Deep: Discover the Job Your Product Is Hired To Do

Jobs-to-Be-Done (JTBD) surveys are where the big “why” comes out to play. When launching a new product, pivoting directions, or updating messaging, you need to understand what core job customers are hiring your product for. Forget features for a minute—JTBD is about outcomes and pain points.

You should deploy this tool in the pre-launch phase, or when pivoting, to get true voice-of-customer insights. JTBD surveys are invaluable for discovering “hidden” jobs or emotional triggers that drive adoption.

JTBD Survey Template: Sample Questions

When you’re trying to [job], what frustrates you most?

What solutions have you tried and why did they fall short?

Describe the moment you realized you needed something better.

What would a perfect solution enable you to do?

How do you measure success in [job]?

What are the hidden obstacles that slow you down?

Mining Voice-of-Customer Gold

Long-form answers are gold mines for product teams. By letting users speak freely, you capture:

- Actual language for copywriting

- Unexpected complaints and blockers

- “Aha” moments that signal readiness to pay

Use open-ended responses to build your keyword list and improve roadmap decisions. Sometimes the job your product gets “hired” to do is not the job you thought you were solving.

JTBD Survey Best Practices

A good JTBD survey avoids CEO bias and sales lingo. Just ask, listen, and look for emotional words. These surveys complement analytics by explaining not just what users do—but why they do it. Product-market fit happens when your solution solves the real job, in their own words.

Implementing Jobs-to-Be-Done (JTBD) surveys enables startups to uncover deep customer insights, leading to products that effectively address real user needs and achieve product-market fit. (useresonant.com)

Feature Importance & Prioritization Survey

Avoiding Feature Bloat While Zeroing In on PMF

Feature creep is a startup killer. Use the feature importance and prioritization survey to find what matters—and what doesn’t—straight from your users. Once you’ve shipped your MVP, this survey helps decide the next steps on your roadmap.

Run these surveys when upgrading pricing tiers, planning the next quarter, or fielding a wave of “can you add X?” requests. Making data-driven decisions on what to build next keeps your team both efficient and customer-centric.

Feature Prioritization Survey Questions

Rank the following features by importance to you.

Which feature would make you upgrade to a paid tier?

Which existing feature could you live without?

What feature would you use daily?

If you could add one missing capability, what would it be?

What’s your least-used feature, and why don’t you use it more?

The Power of Data-Driven Roadmaps

This survey:

- Prevents wasting hours on low-impact features

- Surfaces “hidden gems” users adore

- Helps tell a compelling investor story

For added impact, use a Kano model matrix to visualize user attitudes toward different features. This highlights which add delight, and which simply stave off dissatisfaction.

Optimizing Your Feature Set

Dreaming of all-in-one perfection can sabotage your focus. This survey keeps you grounded. Quantify which features drive upgrades, which could be cut, and which are wishlist material. Your aim? Hone in relentlessly on the capabilities that expand value and spark loyalty—your clearest PMF clues.

User Retention & Churn Reason Survey

Keep Customers (and Insights) From Walking Away

When users leave, downgrade, or ghost your platform, they’re sending strong signals about product-market fit erosion. The user retention and churn reason survey is your last line of defense before that hard goodbye.

Deploy this survey when a user cancels, hits 30+ days of inactivity, or downgrades their plan. Fast, candid feedback here helps you patch PMF leaks and improve retention curves.

Sample Churn Survey Questions

What is the primary reason you’re leaving [product]?

Which goal did [product] fail to help you achieve?

How likely are you to return if we fix the issue?

Which competitor are you switching to, if any?

What one improvement would win you back?

Is anything unclear or frustrating about our pricing?

Closing The Feedback Loop

Churn feedback isn’t just for exit interviews. It can help:

- Identify misaligned features, pricing, or use cases

- Trigger win-back campaigns or targeted improvements

- Spot industry shifts or new competitors early

Analyzing these responses over time helps clarify your PMF metrics—where you’re winning back users and where you’re leaking value. The best teams use churn insights to plug holes and sharpen positioning for the next wave of users.

Making Churn Reviews Constructive

Ask for feedback in a low-pressure, no-guilt way. Don’t try to “save” everyone—listen to trends. When you act on these reasons for leaving, your overall retention curve becomes stronger proof of true product-market fit.

Best Practices: Dos and Don’ts for Product-Market Fit Surveys

Dos for Crafting Effective PMF Surveys

Segment by lifecycle stage to personalize questions and interpret results better.

Keep surveys under 3 minutes to maximize completion rates.

Use A/B testing on subject lines or survey intros to boost engagement.

Incentivize thoughtfully: a small thank-you, not lavish rewards.

Combine quant and qual questions for richer insight.

Leverage progress bars—people love to know how close they are to done.

Ask permission for a follow-up call to capture deeper context.

Randomize answer order to minimize bias.

Send surveys at different touchpoints to map “journeys” over static points.

Always close the loop by sharing feedback-driven changes with respondents.

Don’ts to Avoid Survey Fatigue and Bad Data

Don’t bombard the same users with excessive requests—monitor your survey cadence and avoid survey fatigue.

Don’t focus only on vanity metrics—dig into actionable product insights.

Don’t over-incentivize; this can attract disengaged or “professional” survey takers.

Avoid jargon, abbreviations, or inside-baseball tech speak.

Don’t ask double-barrel questions (two concepts in one question).

Don’t ignore poor response rates—review timing, relevance, and delivery channel.

Don’t treat “neutral” answers as positive—they often flag hidden churn risk.

Skip mandatory open-ends unless truly necessary; balance detail and effort.

Don’t underestimate the value of “none of the above” or “other” responses.

Don’t forget to act on what you learn; closing the loop raises engagement next time.

Following these best practices ensures every survey adds actionable value—without overloading your users or your roadmap.

Conclusion & Action Plan

Triangulating product-market fit is an art as much as a science. By layering these six surveys, you get both leading and lagging indicators to steer your product’s destiny. Next, make survey-driven roadmap tweaks, polish your messaging, and tell a heartfelt PMF story to investors. For even deeper insight, download our free bundle of ready-to-use PMF survey templates. And don’t forget—these insights are more powerful when paired with analytics, user interviews, and cohort analysis as you evolve.

Related Product Survey Surveys

31 Beta Testing Survey Feedback Questions Form Template Guide

Explore a comprehensive beta testing survey feedback questions form template with 35 sample quest...

29 Product Testing Survey Questions: Types, When to Use & Samples

Discover 27 proven product testing survey questions with 9 expert survey types to validate ideas,...

29 New Product Survey Questions Examples: Guide & Templates

Discover 25+ new product survey questions examples with expert tips to reduce launch risk, priori...