29 New Product Survey Questions Examples: Guide & Templates

Discover 25+ new product survey questions examples with expert tips to reduce launch risk, prioritize features, and perfect your product strategy.

Every dazzling product launch starts with a single brave idea, but even the boldest innovations need a reality check before they hit the market. That’s where new-product surveys swoop in to save the day. These essential tools help product teams dodge costly mistakes, gauge true customer demand, fine-tune features, and sharpen positioning. They play a starring role in every stage of the product development journey, from wild brainstorming sessions and concept testing to the first thrilling sale (and the inevitable request for version 2.0). In this guide, you’ll find actionable “Why & When to Use” insights for every survey type, topped off with ready-to-copy question sets that’ll make your next launch a surefire hit.

Concept Testing Survey

Why & When to Use

A concept testing survey is your secret weapon for sniff-testing new ideas before you burn time and resources building actual prototypes. Use it during the early ideation phase, when your concepts are still rough sketches or clever descriptions. This stage is all about gauging the initial appeal, relevance, and potential differentiation of your product concepts with real, live potential users.

If you’ve cooked up more than one idea (as most creative teams do), this survey really shines by allowing you to compare concepts side-by-side. It’s a straightforward way to avoid falling in love with your own ideas and instead follow the scent of what genuinely delights future customers. In short, run concept tests any time you’re unsure if an idea truly resonates—it’s a sanity check that protects your roadmaps (and your budget).

Sample Questions

- On a scale of 1–5, how appealing is Concept A to you?

- Which of these concepts best solves your problem with ___?

- What, if anything, would keep you from trying Concept A?

- How unique does Concept A feel compared with what you use today?

- Describe in one sentence the main benefit you perceive in Concept A.

Key Data Points

Well-structured concept surveys spotlight top-box appeal scores (“5 out of 5” responses), which are great quick-takes on whether a concept wows the crowd.

You’ll also want to watch out for purchase intent signals—from the “How likely would you be to try this?” questions, for example—since anything less than a resounding “yes” usually signals room for improvement.

Open-ended responses (a.k.a. verbatim themes) are pure gold: they uncover what buyers love, what stops them cold, and the creative ways your concept might be interpreted.

- Look for common pain points people expect your product to solve.

- Flag any language they use that could sharpen your messaging later.

- Note repeated doubts—these are early red lights.

Get cozy with this data, because it’s your best friend when pitching concepts to skeptical stakeholders or guiding an all-hands roadmap review.

Concept testing surveys are essential in new product development, as they help identify potential challenges early, reducing the risk of costly failures. (quantilope.com)

How to Create Your Survey with HeySurvey in 3 Easy Steps

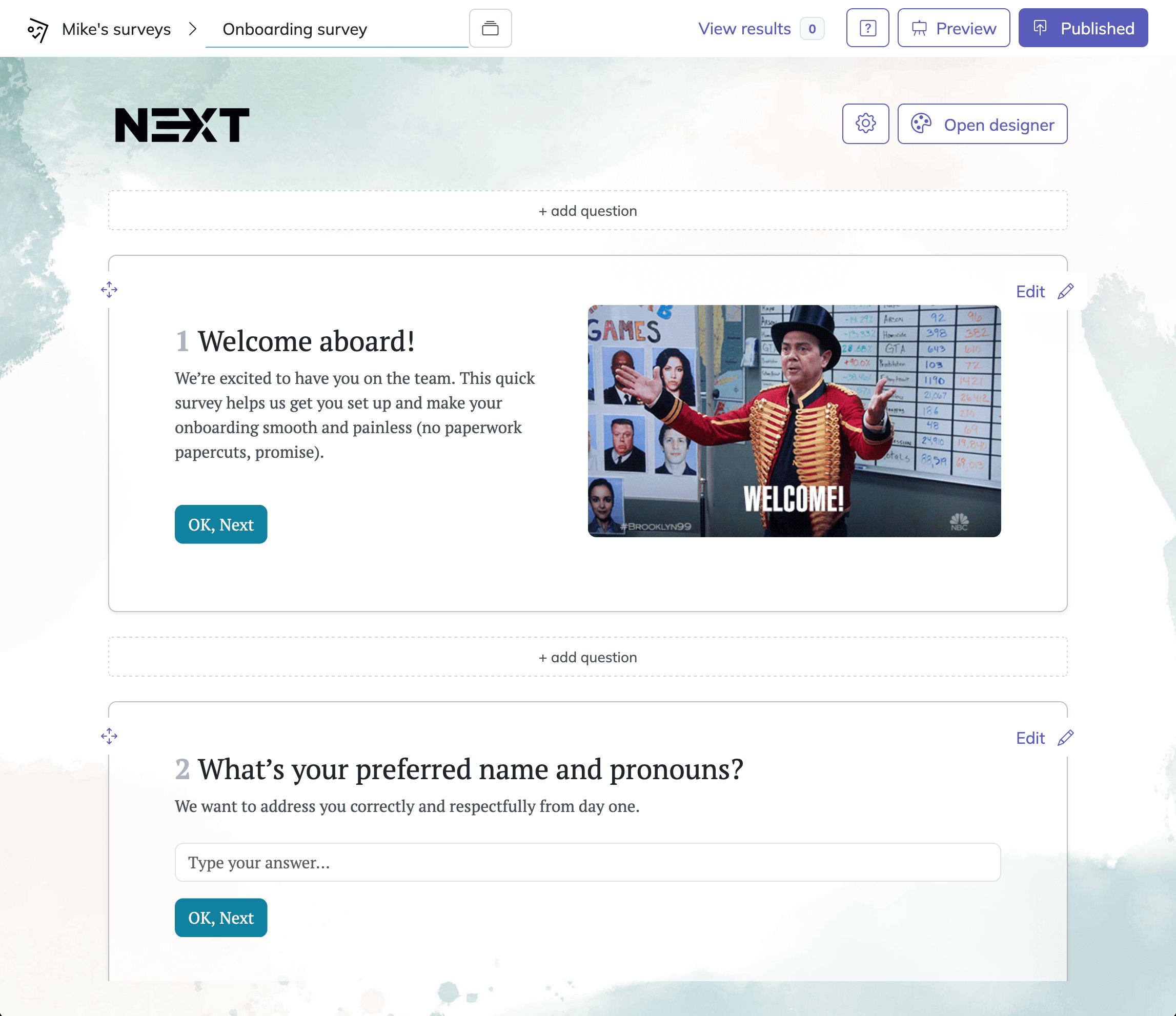

Step 1: Create a New Survey

- Head to HeySurvey and click Create New Survey to get started.

- Choose either an empty survey to build from scratch or pick a pre-built template that fits your survey type (because who wants to reinvent the wheel?).

- Give your survey an internal name to keep things organized behind the scenes.

Step 2: Add Questions

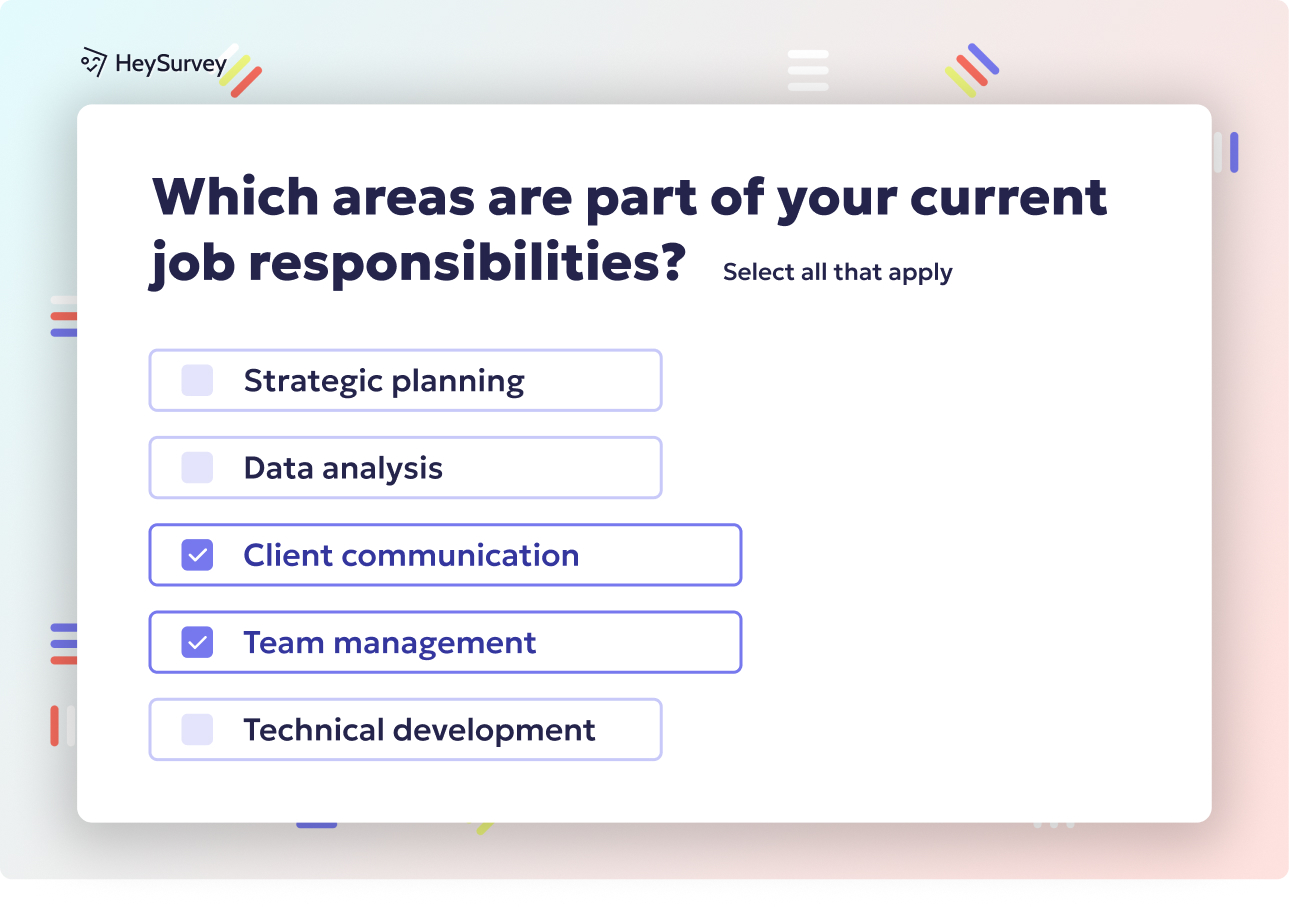

- Click the Add Question button at the top or between existing questions.

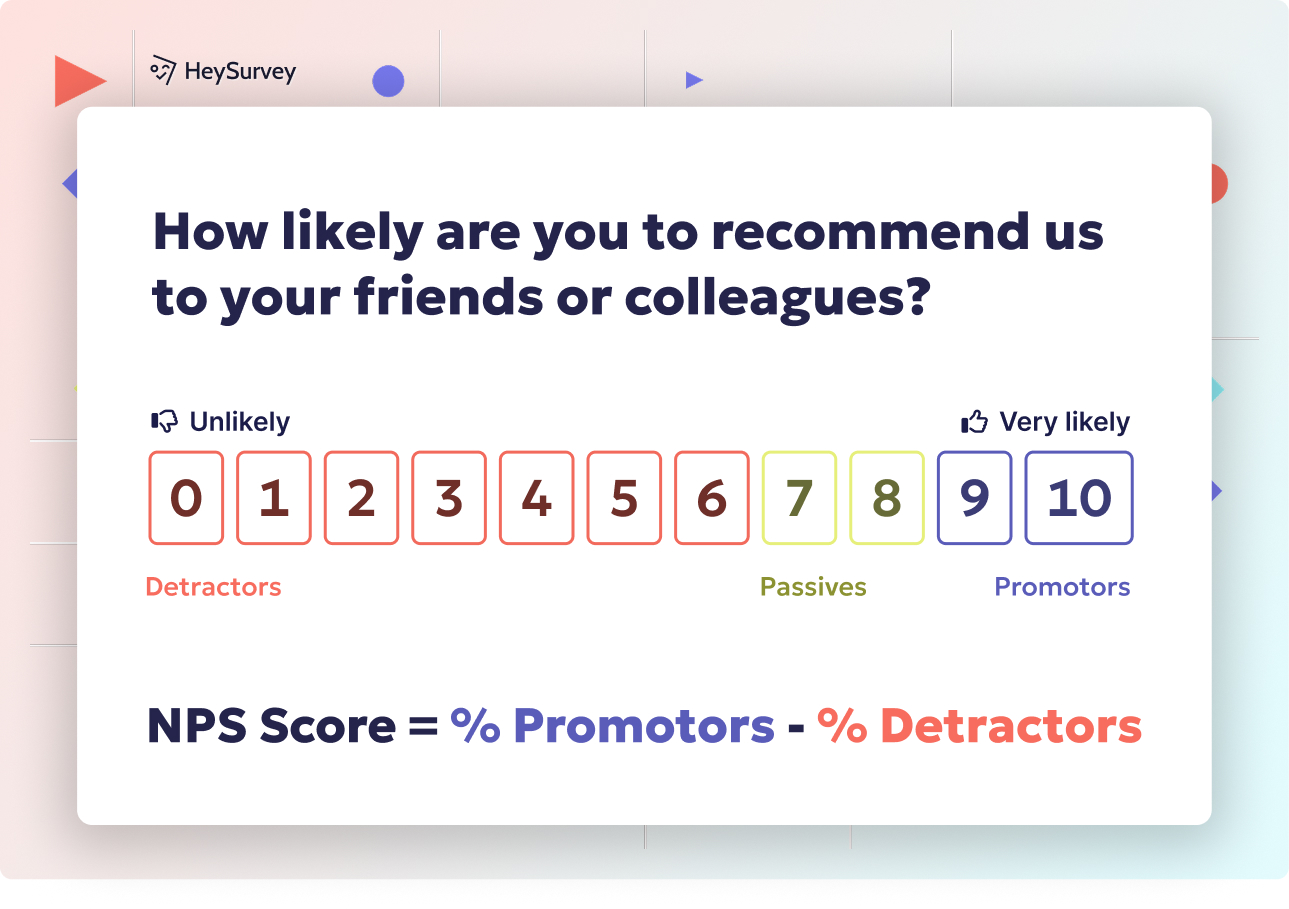

- Pick the question type that matches your needs—whether it’s multiple choice, Likert scale, open-ended text, or something fancy like NPS scales.

- Type in your question text, add descriptions if needed, and customize the answer options. Don’t forget: you can make questions required so nobody skips the good stuff.

- Spice things up by adding images or GIFs to questions if it helps your respondents understand or engage better.

Step 3: Publish Your Survey

- Hit the Preview button to see how your survey looks on desktop and mobile—no surprises, please!

- When happy, click Publish to activate your survey and get a shareable link you can send to your audience.

- Just a heads up: publishing requires a HeySurvey account to track responses securely.

Bonus Steps for Extra Polish and Power

Apply Branding

- Open the Branding panel to upload your logo—this adds a personal touch to every survey page and boosts your pro vibes.

- Head to the Designer Sidebar to tweak colors, fonts, backgrounds, and question card styles so your survey feels aligned with your brand identity.

Define Settings

- In the Settings panel, schedule start/end dates, set response limits, or create a redirect URL for respondents after completion.

- You can also decide if respondents can view summary results—perfect if you want to show real-time feedback or keep data private.

Add Branching to Customize Flow

- Want to tailor questions based on answers? Use branching in question settings to guide respondents to specific follow-ups or skip irrelevant parts—making the survey feel personal and focused.

- Define multiple endings with custom messages/images based on respondent paths to wrap up the experience thoughtfully.

Ready to jump in? Click the button below to open a template tailored to your survey type and start collecting insights like a pro!

Feature-Prioritization Survey

Why & When to Use

You’ve zeroed in on your hero concept—fantastic! Next up: identifying the must-have features versus the flashy nice-to-haves. Feature-prioritization surveys are essential right after you’ve chosen your core concept but before you finalize your minimum viable product (MVP).

Deployment at this moment ensures you’re not just building what’s easy, but delivering features that genuinely matter to customers. It helps teams strike that magical balance between “feasible to build” and “critical for buyers,” so your MVP launches with a real punch.

The results don’t just inform development—they spark vibrant debates, nudge designers to focus on what users crave, and even spark ideas for new, differentiating features. Don’t let your internal wish list set priorities; let customer voices steer the ship.

Sample Questions

- Please rank the following features from most to least important.

- Which three features would make you most likely to purchase?

- If we could only launch with one feature, which should it be?

- How dissatisfied would you be if Feature X were missing? (Very / Somewhat / Not at all)

- What additional feature do you wish we had listed?

Suggested Analytical Frameworks

To mine the richest insights, use frameworks like MaxDiff analysis (which identifies the most and least valued options) and the Kano model (which segments features by basic needs, exciters, and performance requirements).

- MaxDiff works wonders for long lists: users focus on extremes, so you get clearer differentiation between features.

- The Kano method teases out which features spark delight versus those people just assume will be there.

- Forced ranking takes away the “everything is important” excuse and forces users to make real-world trade-offs.

A well-chosen method reveals the few features that move the needle, guides backlog grooming, and keeps your dev team building winners, not just filling sprints.

Combining in-depth user interviews with the Kano model survey enhances feature prioritization by aligning development efforts with user satisfaction. (medium.com)

Pricing Sensitivity (Van Westendorp) Survey

Why & When to Use

When your value proposition is melting hearts (or at least winning nods), it’s time to turn your attention to the fine art of pricing. The pricing sensitivity survey, founded on the Van Westendorp Price Sensitivity Meter, is perfect for this task. Use it after you’ve validated need and settled on your key differentiators, but before public pricing is announced.

Deploying this survey helps you uncover the “sweet spot” price range—where your product seems worth every penny without making anyone’s wallet quake. It’s especially handy for segmenting responses by customer type, showing which groups might pay more or need a bargain. Price too high and you risk scare-offs. Price too low, and buyers might doubt your quality.

Sample Questions

- At what price would you consider the product so expensive that you would not buy it?

- At what price would you consider the product to be priced so low that you’d question its quality?

- At what price would you consider the product starting to get expensive but still worth buying?

- At what price would you consider the product a bargain?

- How likely would you be to purchase at $X? (Very likely → Very unlikely)

Plotting Van Westendorp Curves

Crunching these answers creates simple but powerful Van Westendorp price curves. Plot each question’s cumulative response and look for the magical intersection, revealing your optimal price range.

- The “too expensive” and “too cheap” curves usually frame the acceptable price window.

- Look for a no-brainer intersection (where quality meets affordability).

- Cross-check recommendations by segment to find hidden pricing power in distinct buyer groups.

This practical approach lets you boldly set prices that convert, without fear of leaving money on the table—or pricing yourself out of the running.

Packaging & Positioning Survey

Why & When to Use

By now, your product is shaping up—now it needs a standout outfit and killer first impression. Enter the packaging and positioning survey, your best friend in the pre-launch phase. Use this survey to refine your messaging, visuals, taglines, and benefit hierarchy for everything from landing pages to eye-catching ads.

It excels at A/B testing headlines, imagery, and even product bundle names, so you don’t have to rely on a designer’s hunch or your own gut feeling alone. Let real customers decide which “look and feel” pulls them in. This is your last stop before launch, where your product’s story gets polished into irresistible marketing gold.

Sample Questions

- Which headline resonates with you the most and why?

- How well does this image communicate the product’s main benefit? (1–5)

- Which of these taglines best describes what the product does?

- Which bundle would you prefer? (Basic / Pro / Premium)

- What words would you use to describe the vibe of this packaging?

Metrics to Watch

If you crave numbers, track message clarity (do users “get it” at a glance?), perceived value (which signals willingness to pay), and emotional appeal (who loves your vibe and who finds it ho-hum?).

- Count how many people pick a headline or tagline as “most memorable.”

- Tabulate how many rate images as “very clear” vs. “confusing.”

- Scan open text for words that pop up again and again (these may be your secret weapon in campaigns).

This is where first impressions count. Every tweak you make here pays off in stronger clickthroughs, shares, and—let’s face it—brag-worthy launches.

Effective packaging design significantly influences consumer perception, with attractive packaging enhancing perceived product quality and purchase intent. (startquestion.com)

Usage & Attitude (U&A) Survey for Iteration

Why & When to Use

With your product out in the world or in users’ hands through a beta program, it’s time to watch it live and breathe. The usage and attitude (U&A) survey is your window into reality. Send it to beta testers or early adopters to uncover how your pride and joy fits into daily routines, where it delights, and where it trips up.

This type of survey uncovers habits, pain points, and the features people return for again and again. The feedback you gather is vital for roadmap refinement and building stickier products. If your usage data looks bumpy or unusually quiet, this survey helps you diagnose what’s up—before negative reviews hit the web.

Sample Questions

- How often have you used the product in the past week?

- Which tasks do you complete most frequently with the product?

- What is the biggest obstacle you face when using the product?

- Rate your satisfaction with the product’s speed/performance.

- What’s the one improvement that would make you use the product more?

Valuable Data Outputs

U&A surveys unlock several critical metrics, such as usage frequency curves (daily, weekly, monthly), Net Promoter Score (NPS), and deep open-ended insights that highlight both high fives and forehead slaps.

- Track frequency to spot churn and engagement trends.

- Highlight repeated gripes or delights to prioritize your fix list.

- Open text answers may spark growth features you never imagined.

Connecting with real users post-launch helps you course-correct fast and build a community of raving fans, not fair-weather users.

Product-Market Fit (PMF) Survey

Why & When to Use

Has your product blossomed enough to inspire devotion—or is it just another face in the crowd? The product-market fit (PMF) survey is your report card, run after a few cycles of iteration when your product has fleshed out and stable users are rolling in.

The famous “40% rule,” championed by Sean Ellis, says you’ve struck gold when at least 40% of responders claim they’d be very disappointed if your product vanished. Hitting (or missing) this benchmark tells you if it’s time to step on the marketing gas—or pump the brakes and refine further.

Sample Questions

- How would you feel if you could no longer use this product? (Very disappointed / Somewhat disappointed / Not disappointed)

- What type of person do you think this product is best for?

- What is the primary benefit you receive from the product?

- How does this product compare to alternatives you’ve tried?

- What improvements would make the product indispensable to you?

How to Interpret the Results

After your survey, tally the “very disappointed” responses. If you’re above 40%, you’re field-ready and can confidently grow users, ramp up acquisition, and build out features that loyal fans will love.

If your numbers fall short, listen closely to open-ended feedback. This is your map for the next round of revisions that will turn happiness into head-turning obsession.

- Segment by persona to see if particular groups are raving super-fans.

- Use improvement suggestions to fuel updates or entirely new features.

- Compare against previous rounds to celebrate measurable progress—or spot stagnation.

Nailing PMF is product-market magic. It’s the difference between a forgettable launch and the stuff founders brag about on podcasts.

Post-Launch Satisfaction & Loyalty Survey

Why & When to Use

The confetti’s settled, sales are trickling (or hopefully pouring!) in, and it’s time to check your new product’s first report card. The post-launch satisfaction and loyalty survey is essential 1–3 months after launch for taking the pulse of your earliest adopters.

It’s your best method for spotting happy users, identifying lurking churn risks, and discovering how well your initial promises stack up in the wild. Insights captured here feed right into your customer service, marketing, and product development engines, ensuring a seamless version 2.0.

Sample Questions

- Overall, how satisfied are you with the product? (1–10)

- How likely are you to recommend the product to a friend? (NPS scale)

- Which feature delivers the most value to you?

- What nearly stopped you from purchasing?

- What should we improve for version 2.0?

Key Metrics to Track

Crunch three sets of numbers: customer satisfaction scores (CSAT), NPS (Net Promoter Score), and verbatim praise and criticism. Together, these metrics help you separate your fans from your detractors, spotlight testimonials, and prioritize the fixes that matter.

- Use CSAT to judge your broadest approval level.

- Let NPS tell you where the buzz—or the grief—is strongest.

- Comb open-ended answers for marketing gold (rare but powerful) or critical course corrections.

The sooner you gather and act on this data, the faster you’ll turn a good first outing into lasting loyalty.

Best Practices: Dos and Don’ts for New-Product Surveys

Creating great new-product surveys takes more than copy-pasting questions. For the best results, align your survey type with the stage of your product’s life cycle. Don’t cut corners by sending one generic survey for concept, MVP, launch, and churn. Each moment has unique questions that unlock insightful, actionable feedback.

Keep your surveys short and simple—aim for ten minutes or less, and never drown respondents in unfamiliar terms or industry jargon.

- Combine quantitative questions (think scales and rankings) with open-ended “why” prompts.

- This approach surfaces not only what people think, but also why they feel that way.

- Avoid the trap of ignoring qualitative gems—those quotes make great sales pitches and rallying cries.

Always pilot test your survey internally before you launch. Double-check skip logic, flow, and especially mobile usability to avoid embarrassing jams.

Finally, segment your responses to uncover gold within groups—by persona, intensity of use, or feature adoption. Avoid flattening key findings by averaging them out. Sometimes, the wildest success lies in a passionate minority you’d otherwise miss.

Conclusion

New-product surveys aren’t just checkboxes on a product launch list—they’re your crystal ball and safety net. Each survey type, from concept testing to loyalty check-ins, gives you targeted insight just when you need it most. Use these templates and best practices to create products people can’t wait to try, rave about, and use every day. The right questions spark the right innovations—so ask boldly, iterate often, and enjoy the thrill of watching your next new product shine.

Related Product Survey Surveys

31 Beta Testing Survey Feedback Questions Form Template Guide

Explore a comprehensive beta testing survey feedback questions form template with 35 sample quest...

29 Product Testing Survey Questions: Types, When to Use & Samples

Discover 27 proven product testing survey questions with 9 expert survey types to validate ideas,...

30 Proven Product Market Fit Survey Questions for Success

Discover 25+ proven product market fit survey questions with templates, best practices, and perfe...