29 Product Survey Questions: Templates, Use-Cases & Best Practices

Discover 25+ essential product survey questions with templates, use-cases, and best practices to boost customer satisfaction and feature prioritization.

Ever wonder why product survey questions aren’t just a nice-to-have, but the backbone of building winning products? Product feedback is the engine that powers smart tweaks, keeps customer satisfaction high, and moves you from guesswork to rocket-fueled launches. No matter if you’re validating that shiny new idea, sweating through a post-launch bug fix, or polishing your pricing—timely feedback helps at every stop along the way. In this guide, you’ll discover exactly when to deploy the right survey, get proven question templates, and master the art of crafting killer usability surveys, feature prioritization questionnaires, and more.

Customer Satisfaction (CSAT/NPS) Surveys

Why & When to Use

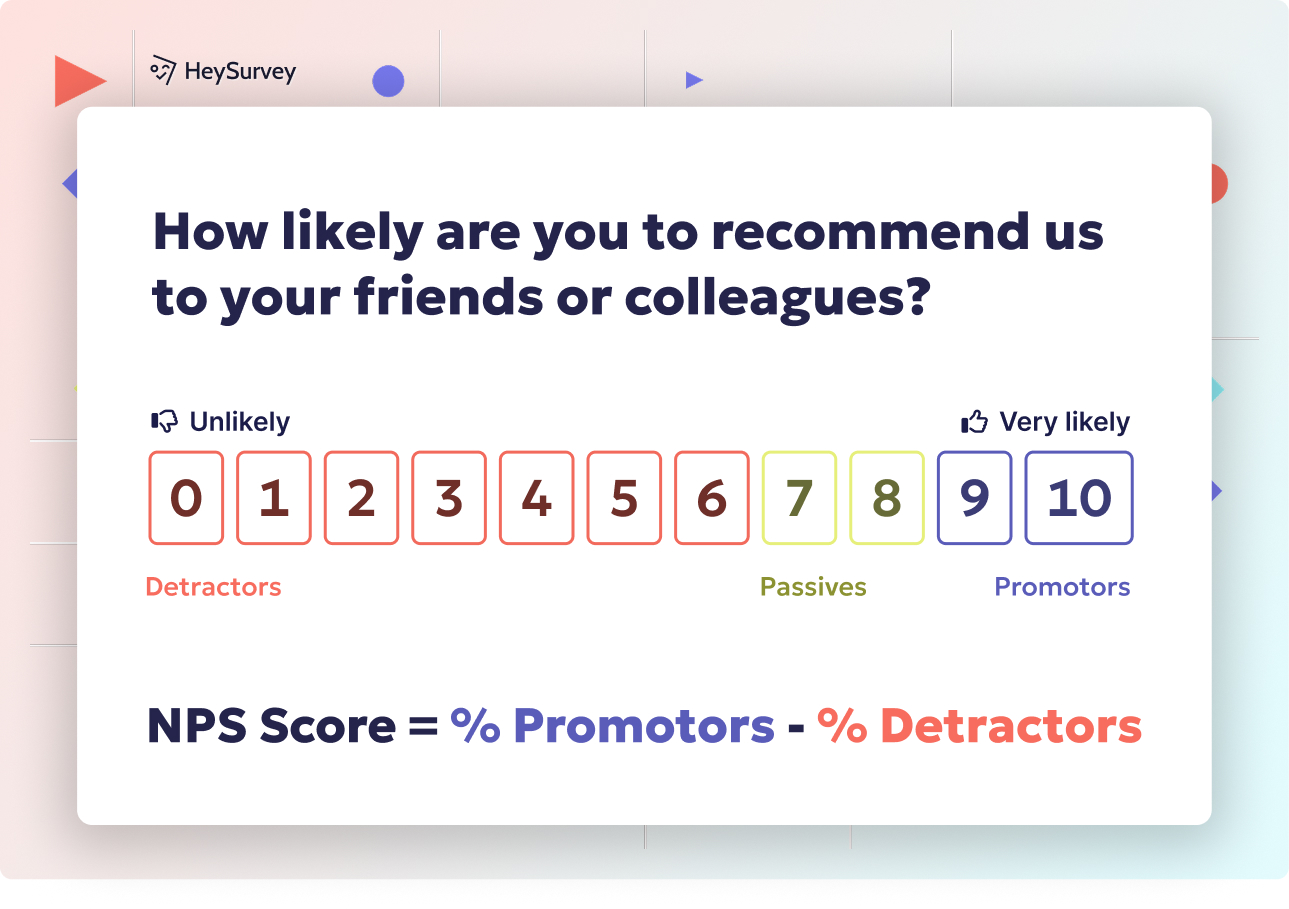

Customer satisfaction surveys (think CSAT and Net Promoter Score) are the MVP of product feedback. Picture a scenario: your customer just made a purchase, breezed through onboarding, or finished chatting with support. This is the golden moment to ask how things went. By capturing sentiment while it’s fresh, you build a benchmark for happiness and can track how it evolves over time.

Smart teams use CSAT survey questions after every pivotal product interaction. Want to spot churn before it strikes? These surveys pick up on subtle dissatisfaction trends that, if ignored, could send your users running for the hills. They also give you a solid comparison point against industry benchmarks, so you know if you’re merely “meh” or truly a market leader.

It’s not all about patting yourself on the back for high scores, though. Track dips in satisfaction and quickly identify if a release, feature, or process needs urgent improvement. Repeating these surveys at regular intervals (monthly, quarterly, or after major milestones) keeps your finger on the pulse and shows customers you care.

5+ Sample Questions

How satisfied are you with your recent purchase of [product]? (1–5 scale)

On a scale of 0–10, how likely are you to recommend [product] to a friend or colleague?

What is the primary reason for your score above?

Which feature delivers the most value for you?

Which feature needs the most improvement?

How does [product] compare to alternatives you’ve used?

By sprinkling these straightforward Net Promoter Score questions into your feedback routine, you’ll build a never-ending loop of insight. Customers feel heard, and your product team always knows exactly where to level-up.

Customer Satisfaction (CSAT) surveys effectively measure immediate satisfaction with specific interactions, while Net Promoter Score (NPS) surveys assess long-term customer loyalty and likelihood to recommend. (surveymonkey.com)

Here’s how to create your survey with HeySurvey in just three easy steps:

Step 1: Create a New Survey

- Start by logging into HeySurvey or jump straight in without an account to explore.

- Click Create Survey, then choose either an Empty Sheet to start from scratch or pick a Pre-built Template that matches your survey type.

- Give your survey an internal name—this helps keep things organized as you build.

Step 2: Add Questions

- Hit the Add Question button at the top or between existing questions.

- Select the question type that fits your needs: Choice, Scale, Text, or others.

- Enter your question text, add instructions or descriptions if needed, and configure options such as required fields and answer formats.

- Repeat adding questions until your survey covers all key points. You can also duplicate or reorder questions to speed things up.

Step 3: Publish Your Survey

- Preview your survey using the Preview button to test the flow and appearance.

- When you’re ready, click Publish to get your shareable link. Note: Publishing requires creating an account if you started without one.

- Share your survey with your audience and start collecting responses!

Bonus Step 1: Apply Branding

- In the Designer Sidebar, upload your logo to add your brand’s personality to the survey.

- Customize colors, fonts, and backgrounds to match your style and boost recognition.

Bonus Step 2: Define Settings

- Open the Settings Panel to set start/end dates or limit responses.

- Choose whether respondents see results after completion, or redirect them to a thank-you page or website.

Bonus Step 3: Skip Into Branches

- Use the Branching feature to tailor the survey flow based on answers—perfect for asking follow-ups or skipping irrelevant questions.

- Define multiple endings to provide personalized conclusions based on respondent input.

Now you’re all set to build, brand, and launch effective surveys with HeySurvey effortlessly! Ready to dive in? Scroll down and hit the button below to open a ready-made template tailored just for your survey type.

Post-Launch Product Feedback Surveys

Why & When to Use

After a sizzle of anticipation, your shiny feature or product has finally launched—now what? This is prime time for product feedback surveys. Around 1–4 weeks after launch is when real users have kicked the tires, and their opinions pack the most actionable punch. They’ll spot bugs you missed, clarify if your roadmap hit the target, and share enhancement ideas that never crossed your mind.

Post-launch surveys are your reality check. They cut through internal assumptions and surface the truth: what actually works and what’s just collecting dust. If you want to spot cracks before they become craters, regular post-release feedback brings hidden friction to light.

Product teams love this stage for its honesty. Whether feedback is glowing, candid, or “oof, did we really miss that?”—every insight guides your next sprint or roadmap move. Use these surveys as part of a recurring cadence after each major release, or as a standing open-channel for early adopters and beta testers to chime in.

5+ Sample Questions

What problem were you hoping [product] would solve?

Did the product meet your expectations? Why or why not?

Which new features would you love to see next?

Rate the overall quality of the product on a 1–5 scale.

How easy was it to get started with [product]?

If you could change one thing today, what would it be?

Long story short: blending quantitative ratings with open-ended feedback uncovers both the obvious wins and the “a-ha!” moments for improvement. Everyone wins—you, the team, and most importantly, your users.

Maintaining neutrality in product survey questions is crucial to avoid bias and ensure objective, actionable feedback. (resonio.com)

Feature Prioritization Surveys

Why & When to Use

Imagine your product backlog as an all-you-can-eat buffet. The bad news? You can’t build everything at once. Feature prioritization surveys bring real user voices into the decision table, helping you choose what’s most valuable before betting precious dev time on the wrong dish.

The best moment to use these surveys is during roadmap planning or before you iron out sprint priorities. Pulled in too many directions by stakeholder “must-haves”? Let your customers break the tie! By asking which features they actually want, you dodge feature bloat and focus on what matters.

Not every feature is a golden ticket, even if it feels that way internally. Use feedback to spot hidden gems (or duds) and make sure the things you’re building solve genuine pain points. Feature prioritization questions are also a great way to discover entirely new ideas you might have missed.

5+ Sample Questions

Rank the following potential features from most to least valuable.

Which of these features would you use at least once a week?

How disappointed would you be if [feature X] were not built? (Very / Somewhat / Not at all)

What existing task would [feature X] replace or improve?

Are there any features we missed that should be on this list?

The result: more confident product bets, happier users, and a streamlined dev process that puts value first. Use these feature prioritization survey questions as your secret weapon against scope creep.

Product–Market Fit (PMF) Surveys

Why & When to Use

Before something becomes the next household name, it needs to strike a deep chord with its audience. Enter the Product–Market Fit survey. This is your early-vibe check, usually run during beta or just after you see the first signs of traction. Skip it, and you might end up with a beautifully crafted product that nobody craves.

Running PMF surveys helps pinpoint if your core value proposition actually resonates with early users. Are they singing your praises? Or are they just…silent? Find out who loves your product, why, and what you can do to make more customers feel the same emotion.

Great PMF surveys also help with user segmentation. You’ll learn not just whether users “get” your product, but which groups are your power core—and why some hesitate to jump on board. With this crystal-clear vision, you can fine-tune messaging, features, and go-to-market strategies.

5+ Sample Questions

How would you feel if you could no longer use [product]? (Very disappointed, Somewhat, Not disappointed)

Which type of people do you think would benefit most from [product]?

What is the primary benefit you receive from [product]?

Have you recommended [product] to anyone? If yes, why?

What almost stopped you from signing up?

Armed with thoughtful product–market fit questions, you’re ready to spot your raving fans—and turn mild interest into love at first use.

Achieving a product-market fit score of at least 40%—where users indicate they would be "very disappointed" if they could no longer use the product—is a strong indicator of sustainable growth. (survicate.com)

Usability & User Experience (UX) Surveys

Why & When to Use

You’ve designed a feature and watched a user try it out, fingers crossed. The only way to find out what happens next is with a usability survey. These surveys explore every step in the user journey, shining a spotlight on rough edges that block satisfaction.

Usability and UX surveys are key when onboarding users, after a big design update, or during any moderated testing session. Want to know if labels are clear, buttons are where people expect, or the next step is obvious? Don’t guess. Just ask! Well-crafted usability survey questions translate subjective experiences into actionable improvements.

Deploy them right after users complete a specific task—or bake them into regular product check-ins. They catch friction while it’s top-of-mind and prevent bad UX from becoming a deal-breaker down the line.

5+ Sample Questions

How easy was it to complete [specific task]? (1–7 Likert)

Which step, if any, felt confusing or slow?

Rate the clarity of the interface labels.

Did you encounter any bugs or errors?

What would make the process faster for you?

On a scale of 1–10, how visually appealing is the product?

Incorporate these user experience survey questions to catch frustrations before they snowball. You’ll smooth out the sharp bits—and surprise users with delightful, frustration-free journeys.

Pricing Sensitivity & Willingness-to-Pay Surveys

Why & When to Use

Setting the right price feels a bit like throwing darts blindfolded. With pricing sensitivity and willingness-to-pay surveys, you remove the guesswork and uncover how customers perceive your value. The best time to run these is right before launching a pricing update—or anytime revenue starts to plateau.

Use these surveys to tackle burning questions: Is your price too high? Too low? Would premium support or new features justify an upsell? Feedback here shapes smarter pricing strategies and stops you from leaving hard-earned revenue on the table.

Mix in direct pricing questions with broader perceptions of value. Learn how your pricing stacks up against competitors, and if your target audience prefers a subscription, lifetime purchase, or pay-as-you-go. This insight keeps you ahead of industry changes and market expectations.

5+ Sample Questions

At what price would you consider [product] to be too expensive to purchase?

At what price would you consider [product] to be a good deal?

Which pricing model do you prefer: subscription, one-time fee, or usage-based?

How does our current price compare to the value you receive?

Would you pay extra for premium support or advanced features?

These willingness-to-pay survey questions help bridge the gap between what you think your product’s worth and what customers are happy to spend.

Brand & Product Perception Surveys

Why & When to Use

Your product isn’t just a collection of features—it’s a feeling, a reputation, a brand. Brand and product perception surveys dive into the emotional connections users form with your offering. Run these quarterly, or immediately after a big marketing push, to pulse-check trust, loyalty, and overall sentiment.

It’s easy to skate by on surface metrics, but knowing how users feel about your product drives deeper retention and word-of-mouth. These surveys uncover nuanced opinions: what words they associate with your brand, how much they trust you, and whether your messaging matches their lived experience.

Let the feedback surprise you! You might find that what you want your brand to stand for and how it’s actually perceived are worlds apart. This isn’t a bad thing—it’s crucial intel for your next campaign and product evolution.

5+ Sample Questions

Which three words best describe [product]?

How trustworthy do you find our brand? (1–5 scale)

How does [product] make you feel when you use it?

When you think of [product], what other brands come to mind?

How well does our messaging align with your actual experience?

Perception surveys aren’t just about ego—they tie directly to retention, reputation, and long-term customer love.

Best Practices: Dos & Don’ts for Crafting High-Performing Product Survey Questions

Building perfect product survey questions is as much art as science. The best surveys are clear, concise, and respectful of your users’ time. They also know the difference between asking and annoying.

Do:

- Keep questions neutral—avoid any phrasing that nudges respondents toward a specific answer.

- Use consistent scales (like 1–5 or 1–7) so feedback is easy to interpret.

- Offer an “other” option for picklists; your users’ best ideas might be “off-menu.”

- Limit jargon and keep language simple.

- Personalize surveys when possible—it shows you value their individual input.

Don’t:

- Ask double-barreled questions (don’t try to solve two mysteries with one clue).

- Force answers to every question; sometimes “skip” is the honest reply.

- Overload with technical jargon that only your engineering team will love.

- Make your survey too long—brevity respects your users’ time (aim for 5–10 questions max where possible).

Other tips for survey best practices:

- Optimize for mobile—people love giving feedback on the go!

- Sweeten the deal with a fun incentive or a simple thank you.

- Always follow up with action—let users know how their feedback shaped the product.

When you master the craft of how to write product survey questions, you unlock a stream of insights that guide your next best move—fast.

Conclusion & Next Steps

Matching the right survey to your goal is a game-changer for product teams. Iterate regularly, close the loop with your customers, and let data (not guesses) drive every major decision. If you’re ready to put this wisdom into action, grab a template above and launch your own product survey today. Want to go deeper? Download your free survey question pack or start a free trial of top-rated survey software now. Your users—and your roadmap—will thank you!

Related Product Survey Surveys

31 Beta Testing Survey Feedback Questions Form Template Guide

Explore a comprehensive beta testing survey feedback questions form template with 35 sample quest...

29 Product Testing Survey Questions: Types, When to Use & Samples

Discover 27 proven product testing survey questions with 9 expert survey types to validate ideas,...

30 Proven Product Market Fit Survey Questions for Success

Discover 25+ proven product market fit survey questions with templates, best practices, and perfe...