32 Product Feedback Survey Questions to Capture Actionable Insights

Discover 26 expertly crafted product feedback survey questions to capture actionable insights and boost product-market fit, reduce churn, and more.

Product Feedback Survey Questions – The Complete Guide to Capturing Actionable Insights

Surveys are the secret sauce to building better products. When used right, product feedback surveys amplify the voice of the customer and spark continuous product discovery. From shaping early concepts to honing roadmap priorities and even reducing churn, surveys unlock actionable insights at every product stage. Ready to finally improve product-market fit the clever way? Read on.

New-Feature Concept Validation Survey

Why and When to Use This Type of Survey

Before you charge ahead with a new feature, wouldn’t it be nice to know if users even want it? That’s where the new-feature concept validation survey shines. Use this approach in the ideation or early prototyping phase—think before you code! By engaging your audience now, you’ll avoid building features no one needs.

A concept validation survey supports:

- A/B prioritization so you deliver the highest-impact features first.

- Confirming that your idea aligns with genuine jobs-to-be-done.

- Providing data-driven ammunition for investor presentations.

The value is simple: you save resources, reduce time to market, and skip fruitless detours. If you’re tasked with building things users will really use, make this survey your first checkpoint.

Sample Questions

- How well does this proposed feature solve your current problem?

- On a scale of 1–10, how likely are you to use this feature weekly?

- Which alternative tools do you rely on today?

- What concerns, if any, would stop you from trying this feature?

- What one improvement would make this feature a ‘must-have’ for you?

By baking these questions into your product discovery, you build products people can’t wait to use. Don’t wait until after launch to discover if a new feature flops—validate early, iterate boldly!

Concept validation surveys are crucial in product development, as they help identify potential issues early, reducing the risk of costly failures. (fuelcycle.com)

How to Create Your Survey with HeySurvey in 3 Easy Steps

Step 1: Create a New Survey

Head over to HeySurvey and start by clicking “Create New Survey”. You can either choose an empty sheet to build your survey from scratch or pick a pre-built template tailored for your survey type. Starting with a template saves time and gives you a solid structure to work from. Give your survey a meaningful internal name to keep things organized.

Step 2: Add Your Questions

Next, jump into the Survey Editor and click “Add Question” wherever you want. Select the question type that fits best — from multiple choice to scales or text input. Fill in your question text, add any descriptions if needed, and set whether the question is required. You can also spice things up with images or attach your branding later. Don’t forget to arrange your questions logically so respondents have a smooth ride.

Step 3: Publish Your Survey

Once happy with your questions and flow, hit Preview to see how it looks. Tweak design or wording if necessary using the Designer Sidebar. When you’re ready, click “Publish”. Keep in mind that publishing requires an account so you can access the results. Then share your survey link far and wide, embed it on your site, or email it to your audience.

Bonus Steps to Make Your Survey Shine

Apply Branding: Open the Branding panel to add your company logo and customize colors and fonts. This makes your survey look professional and on-brand, elevating trust and response rates.

Define Settings: Set your survey's start and end dates, limit the number of responses, or add a redirect URL for when users finish. These tweaks keep your survey on schedule and under control.

Skip Into Branches: Use branching logic to tailor the survey experience. Depending on answers, you can skip irrelevant questions or send users down personalized paths—helping you gather only the most relevant, actionable insights.

Ready to start? Just click the button below to open a relevant HeySurvey template and get your data-driven journey rolling!

Beta / Early-Access Product Feedback Survey

Why and When to Use This Type of Survey

Launching something shiny to a select group of users? Beta or early-access product feedback surveys help you gather rich signals on usability, performance, and value—before you go big. This is about swapping risky assumptions for real data.

Ideal timing:

- Prompt users just after their first session to gauge initial usability.

- Check in after one week for repeat engagement and deeper impressions.

Before you invite the full crowd, this focused pulse check lets you iron out bugs, uncover unexpected friction, and confirm desirability. You’ll sidestep disasters, optimize onboarding, and impress your early champions (they might just become your best advocates).

Sample Questions

- How easy was it to get started with the beta version?

- Did you encounter any bugs or errors? Please specify.

- Which three words best describe your first impression?

- What tasks took longer than expected?

- Would you recommend we open the beta to more users? Why/why not?

By prioritizing these insights, you improve product-market fit before the noise of a wide release. Early access feedback isn’t just a nice-to-have—it’s a shortcut to a smoother launch and happier users down the road.

A 2024 survey indicated that companies achieving organized feedback structures saw a 30% increase in customer satisfaction. (moldstud.com)

Post-Launch Satisfaction & Adoption Survey

Why and When to Use This Type of Survey

The launch confetti has settled—now what? The post-launch satisfaction and adoption survey is your next crucial step. Run it 30–60 days after release to anchor your assumptions in real-world experience.

This is when you measure:

- Genuine user satisfaction with the new release.

- Feature adoption rates and the friction points holding people back.

- KPIs like retention, ARPU, and ongoing engagement.

This survey acts as your north star for continuous improvement, letting you adjust marketing, roadmap, and support based on actual usage. Want to keep your users around and climbing the value ladder? These insights are non-negotiable.

Sample Questions

- Overall, how satisfied are you with the new release?

- Which feature delivers the most value to you?

- What prevented you from using the product more often?

- How has your workflow changed since adopting the product?

- What would make you upgrade your plan?

With answers in hand, you can reduce churn and zero-in on the sticky, addictive features users crave. There’s no better reality check—or treasure map for your next moves.

Product-Market Fit (PMF) Survey

Why and When to Use This Type of Survey

Ready to learn if you’ve truly struck gold? The product-market fit (PMF) survey helps you know what only your bravest friends will tell you: is this product really indispensable? Leverage Sean Ellis’s famed PMF score, particularly the “How disappointed would you be if you could no longer use our product?” question, at key growth milestones.

This survey excels at:

- Revealing whether you’re ready to scale or should keep iterating.

- Pinpointing the sharpest product benefits and gaps.

- Informing big bets, pivots, or gradual tweaks.

Knowing the PMF is the ultimate validation—or humbling call to action—for founders and teams aiming for sustainable traction.

Sample Questions

- How would you feel if you could no longer use our product? (Very disappointed, Somewhat disappointed, Not disappointed)

- Who would most benefit from this product?

- What is the main benefit you receive?

- How can we improve the product for you?

- What alternative would you use if our product disappeared?

Collecting PMF insights is your ticket to continuous product discovery. You’re looking squarely at your harshest critics and most passionate fans—exactly what you need to take your product all the way.

Achieving product-market fit is often indicated when at least 40% of surveyed users would be "very disappointed" if they could no longer use the product. (measuringu.com)

Churn & Win-Back Survey

Why and When to Use This Type of Survey

The dreaded cancellation email has landed. Ouch! But wait—your journey with these customers isn’t over yet. Deploy a churn and win-back survey right after cancellation to catch authentic, unfiltered reasons and to tempt users back.

Here’s what makes this survey a game-changer:

- You build predictive churn models, spotlighting at-risk segments.

- Every loss becomes a learning moment, guiding your retention strategy.

- Reactivation campaigns land better when you know what wasn’t working.

Strike while the iron’s hot and those reasons are still top of mind. Sometimes, all it takes is one fix or one sweet upgrade offer to bring a customer back.

Sample Questions

- What is the primary reason you decided to cancel?

- Which competitor did you switch to, if any?

- How well did our pricing match the value you received?

- What feature could have kept you as a customer?

- Would you consider returning if we made improvements? Which ones?

By capturing this feedback, you not only reduce churn for the future—you also show empathy and openness that can rebuild trust. Every win-back is a tiny victory for your product and your brand.

Continuous In-App Microsurvey (e.g., CES, CSAT, Thumbs-Up)

Why and When to Use This Type of Survey

Let’s talk about the smallest, most nimble survey of all—the continuous in-app microsurvey. These unobtrusive, single-question check-ins spot pain points in real time, during critical moments like onboarding or checkout.

With microsurveys you will:

- Fine-tune the tiniest details that drive conversion (hello, Core Web Vitals!).

- Spot UX hiccups before they snowball into support tickets.

- Enjoy high response rates thanks to the “just one question!” format.

Continual, gentle nudges for feedback help you keep your product sharp and user-centric—all without annoying your audience.

Sample Questions

- How easy was completing this task? (1–7)

- Did this page meet your expectations? (Yes/No)

- What almost stopped you from finishing?

- Rate the clarity of instructions you just read.

- Any quick suggestion to improve this step?

Easy to ignore, dangerous to skip—continuous in-app surveys are your best friends for rapid optimization and keeping your users smiling.

Best Practices: Dos and Don’ts for High-Converting Product Feedback Surveys

Crafting a killer survey isn’t just about picking the right questions. It’s the art—and a dash of science—behind how you ask that transforms voice of the customer into bankable insights.

Let’s start with the dos:

- Segment your audiences for smarter targeting—send tailored questions to power users, new signups, or lost customers.

- Use neutral wording to avoid biasing your results or pushing people in one direction.

- Incentivize feedback wisely—small rewards spark higher response rates, but don’t let the lure of gift cards tank your data quality.

- Always close the loop—follow up after receiving feedback, share what changed, and let customers know their input matters.

Just as vital are the don’ts:

- Avoid asking leading questions—watch for those sneaky words that tilt answers your way.

- Never combine double-barreled items like “How would you rate the speed and ease of use?” Pick one!

- Don’t over-survey—respect your users’ time. Sending too many surveys in a short span leads to survey fatigue (and grumpy participants).

- Ignore mobile UX at your peril. Test your surveys across devices to prevent rage taps and abandonment.

Other pro tips:

- Keep surveys short and sweet. Aim for five questions max (unless you fancy a revolt).

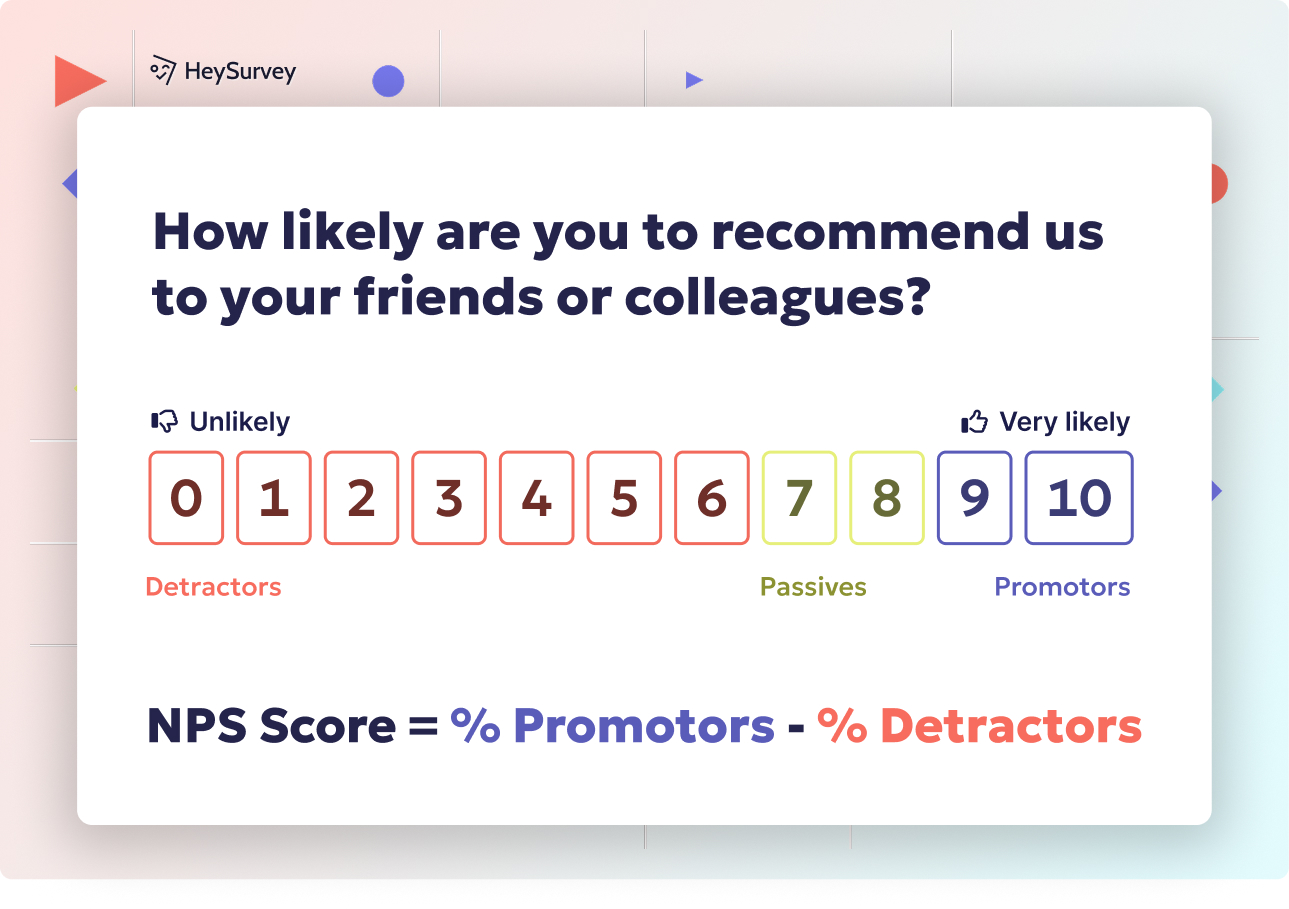

- Beware of misusing Net Promoter Score (NPS)—it’s powerful for benchmarking, but only if interpreted alongside feature-level feedback and analytics.

- Integrate survey results with product analytics whenever possible, so your gems of insights connect directly to usage data and retention trends.

By treating feedback surveys as dynamic conversations—not annoying chores—you transform raw opinions into the goldmine of rapid product growth.

Conclusion & Next Steps

Surveys are your product’s superpower at every stage—pre-launch ideas, betas, adoption, product-market fit, churn learning, or quick-fire in-app tweaks. Each survey type offers a tactical lens to capture the voice of the customer and inform smarter decisions. The next best step? Map your own survey calendar and embed feedback into your product roadmap. Embrace the data, make your users feel heard, and watch your product take flight.

What will you discover next?

Related Product Survey Surveys

31 Beta Testing Survey Feedback Questions Form Template Guide

Explore a comprehensive beta testing survey feedback questions form template with 35 sample quest...

29 Product Testing Survey Questions: Types, When to Use & Samples

Discover 27 proven product testing survey questions with 9 expert survey types to validate ideas,...

30 Proven Product Market Fit Survey Questions for Success

Discover 25+ proven product market fit survey questions with templates, best practices, and perfe...