31 Pricing Survey Questions: Frameworks, Samples & Best Practices

Explore proven frameworks and 30 sample pricing survey questions to optimize revenue and product-market fit with expert best practices.

In today’s wild world of product launches, competitive battles, and skyrocketing customer expectations, pricing surveys are your secret weapon. Getting the right price isn’t just about boosting revenue—it’s how you ensure customers see value, stay loyal, and keep your business humming. Whether you’re entering a new market, facing stubborn churn, or plotting your next price jump, you need the right survey framework to make sense of what customers really want to pay. Below, you’ll find the best methods, sample questions, and insider tips to help you nail your pricing strategy—every time.

Van Westendorp Price Sensitivity Meter (PSM)

Why & When to Use

The Van Westendorp Price Sensitivity Meter (PSM) is a classic tool in the world of pricing research for a reason—it’s quick, effective, and incredibly revealing for early-stage products or when you need a fast, high-level read on customer price tolerance. When you’re rolling out a brand-new offering, scoping a revamp, or debating price tiers, this survey shines a light on what people truly think is “too cheap,” “cheap,” “expensive,” or “too expensive.” It helps you explore a “Goldilocks zone” where your price isn’t scaring buyers off—or leaving too much money on the table.

You should reach for the PSM when you want a visually compelling output to map the acceptable price range for your audience. It comes in clutch when time is short and you need to triangulate price brackets for different customer segments—especially if you’re prepping for board meetings, investor pitches, or just need internal clarity on positioning or tiering.

Some key scenarios where Van Westendorp is your go-to:

- Launching an MVP or beta: Early adopters can give you an honest sense of perceived value.

- Trying a price increase: Test the waters before making any bold moves.

- Entering a new market: Local norms and economic tolerance can be wildly different.

- Adjusting feature sets: Understand what “standard” or “premium” tiers should cost.

The beauty of this method is that the data feels intuitive to stakeholders. Its approach fits best if you want to anchor the conversation in real customer psychology, before marching off to more granular or experimental pricing games.

Five Sample Questions

At what price would you consider this product a bargain—so cheap you’d doubt its quality?

At what price would you consider the product inexpensive but still acceptable?

At what price would you start to think the product is getting expensive?

At what price would the product become too expensive to consider?

Which of these price points best represents the value this product delivers? (Open field or slider)

The Van Westendorp Price Sensitivity Meter effectively identifies consumer-perceived acceptable price ranges for new products but may underestimate optimal pricing by approximately 35%. (pricingsolutions.com)

Creating your pricing survey in HeySurvey is a breeze—even if you’re new to the platform. Follow these three easy steps, and you’ll have your survey up and running in no time:

Step 1: Create a New Survey

- Head to HeySurvey and select “Create New Survey.”

- You can start from an empty sheet if you want full control or pick a pre-built template that fits your pricing study to save time.

- Give your survey a clear internal name so you can easily find it later in your dashboard.

Step 2: Add Your Pricing Questions

- Click the “Add Question” button at the top or between existing questions.

- Choose the question type that fits your pricing method, such as Choice, Scale, or Text.

- Enter your pricing questions exactly how you want them, using markdown to highlight key points if you’d like.

- Mark essential questions as required to make sure you get all the answers you need.

- Don’t forget to add images or descriptions to clarify your product or pricing options, making it easier for respondents to understand.

Step 3: Preview and Publish Your Survey

- Hit the “Preview” button to see how your survey looks on desktop and mobile devices.

- Make any final tweaks using the easy-to-access Designer Sidebar to adjust colors, fonts, or layouts.

- When you’re happy, click “Publish”—you’ll need to create an account if you haven’t already, to activate sharing and start collecting responses.

- Copy the shareable link or embed the survey on your website with an iframe.

Bonus Tips: Customize Like a Pro

- Apply Your Branding: Upload your logo and adjust colors so the survey matches your company’s style perfectly.

- Define Settings: Set survey start/end dates, response limits, or add a redirect URL to guide users when they finish your survey.

- Use Branching: Tailor the survey path by directing respondents to different questions based on their previous answers, for a more personalized and insightful experience.

Ready to get started? Click the button below to open a pricing survey template and watch your pricing insights come to life with HeySurvey!

Gabor-Granger Pricing Method

Why & When to Use

If you need crystal-clear demand curves for specific prices, the Gabor-Granger method is your new best friend. Unlike broader frameworks, this one goes straight to the numbers: you show customers defined price points and ask how likely they are to buy at each. No fluffy hypotheticals—just crisp, real-world options.

This method comes alive when your concept is locked, features are fixed, and you need to know how price tinkering impacts demand. It’s awesome for validating next quarter’s pricing or seeing what a $10 delta really does to conversion rates. If you want to see where revenue maxes out and how elastic your product is, don’t skip Gabor-Granger.

Situations where the Gabor-Granger works its magic:

- Testing reaction to a planned price increase: Don’t anger your best customers—know before you go.

- Narrowing launch price for a finished product: Turn gut feel into something mathematically defensible.

- Measuring elasticity by segment: See who’s price-sensitive and who’ll shrug at a premium.

- Discounting experiments: Quantify where a price cut actually moves the needle.

This method is practical, actionable, and gives you a clear path for plotting revenue forecasts and segmentation strategies.

Five Sample Questions

Would you purchase Product X at $49? (Yes/No)

If not, would you purchase at $39? (Yes/No)

At $59, how likely are you to purchase? (5-point likelihood scale)

What is the maximum price you’d still find reasonable for Product X? (Numeric)

Which of these prices—$39, $49, $59—best matches what you would expect to pay?

The Gabor-Granger method effectively estimates demand curves and revenue-maximizing price points but may yield biased results due to lack of competitive context. (quirks.com)

Conjoint Analysis for Pricing Optimization

Why & When to Use

Sometimes price isn’t the whole story—features, bundles, and trade-offs rule the day. That’s where conjoint analysis struts in with a swagger. It dives deep into customer psychology to untangle which features push people to open their wallets, and which just pad out the spec sheet. This framework reveals ideal packaging and pricing for complex offerings, bundling dreams, and crowded markets.

Turn to conjoint analysis when you’ve got:

- Multiple product options: Think SaaS tiers, product lines, or service bundles.

- Feature-rich environments: Where “what’s included?” is almost as important as “how much?”

- Competitive markets: Your rival is adding AI, but does anyone really care?

- Prioritizing roadmap investments: Which features will boost willingness to pay most?

This approach turns decision-making into a science. It’s perfect for big launches, competitive repositioning, or just understanding where to squeeze more margin without losing too many fans. Conjoint analysis lights up the dark corners of bundling and positioning, so you stop guessing and start winning.

Five Sample Questions

Choose your preferred option among Package A ($29, basic) vs. Package B ($39, pro analytics).

Select the bundle you would most likely purchase: Option 1, 2, 3 (varying price/feature combos).

How important is 24/7 support when paying $10 extra per month?

Which version would you choose if Package C ($49) adds AI insights?

Rate your likelihood to purchase Package D at $59 with premium onboarding.

Monadic Price Testing Surveys

Why & When to Use

If you want to avoid the nasty anchoring effect that can warp price perception, monadic surveys offer a pure, distraction-free path. Here, each respondent sees only one price—no side-by-side comparisons, no sneaky clues about what you “really want.” The result? Clean, honest readouts on willingness to buy that slice through the noise.

Monadic testing is your best friend when you:

- Want to run genuine A/B price tests: No polling bias from seeing all possibilities.

- Need discrete, actionable purchase metrics: Each price point gets its own, untainted verdict.

- Are prepping in-market experiments: Go from survey to real-world test seamlessly.

- Operationalize quick learning loops: Launch, survey, learn, repeat.

This approach is incredibly sharp for learning what percentage of your target group will actually buy at a given price, not just what they think they “could” or “might” tolerate. Use it before big launches or for pricing updates where a single number will make or break your rollout. Monadic surveys keep your price tests honest, so you can trust the results (even if they sting a little!).

Five Sample Questions

Product X is available for $45. How likely are you to buy it today? (7-point scale)

Does this price feel too high, too low, or about right?

What concerns, if any, would stop you from purchasing at $45?

How much value do you feel you receive at this price? (1–10 scale)

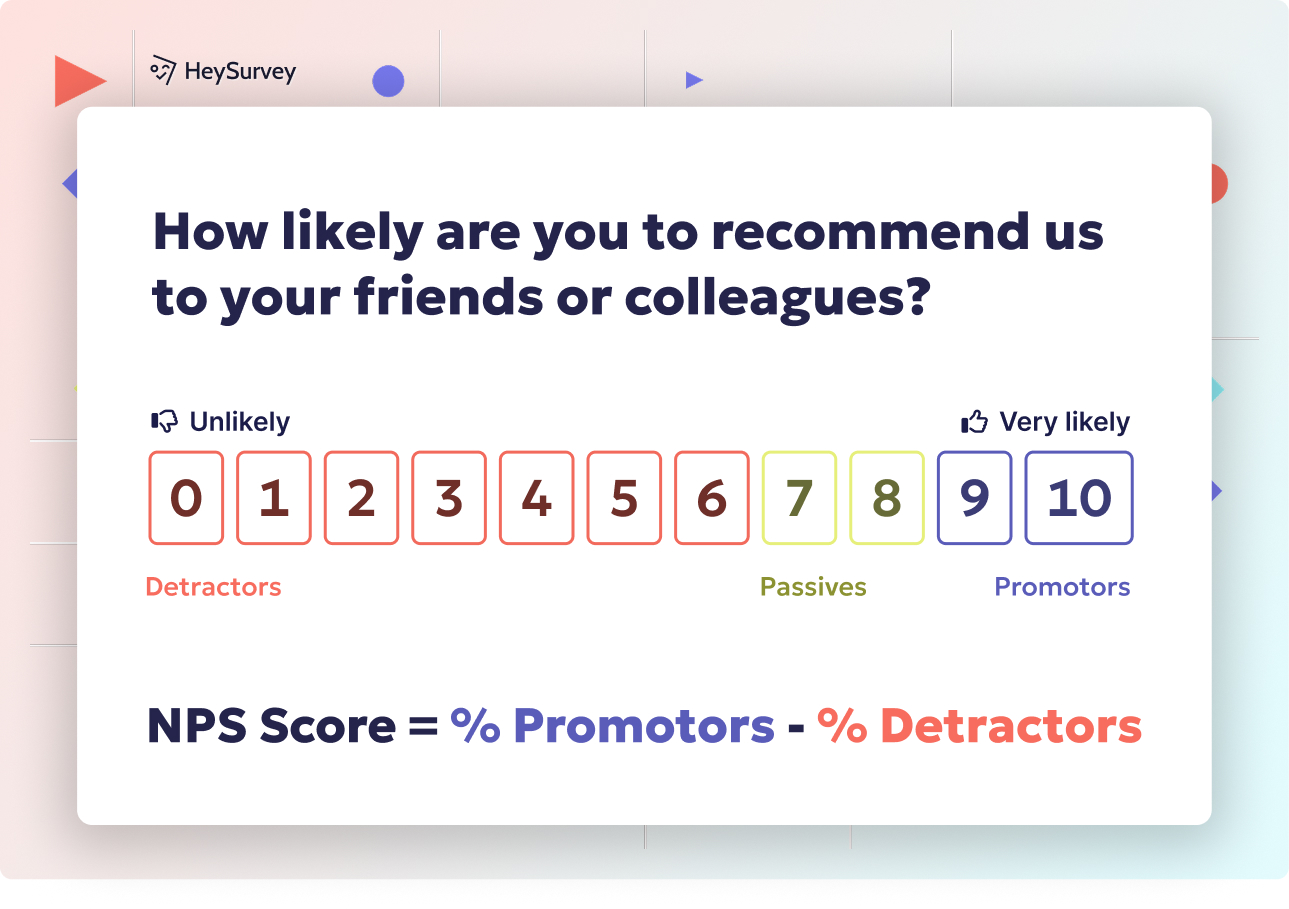

Would you recommend Product X to a friend at $45? (NPS format)

Monadic price testing, by exposing respondents to only one price point, effectively eliminates bias and provides clear insights into price sensitivity. (pricingsolutions.com)

Brand–Price Trade-Off (BPTO) Surveys

Why & When to Use

When the competitive heat is on, you need to know if your brand can hold its ground at higher prices or if customers jump ship for a rival deal. That’s what brand–price trade-off surveys are built for. They put actual purchase choice in front of customers, comparing brands across real (sometimes hypothetical) prices and feature mixes.

Reach for BPTO surveys when:

- Testing price changes in a competitive market: Will your loyal base pay more if you increase prices?

- Evaluating market share risks: How much could you lose to a cheaper new entrant?

- Planning for perks, bundles, or promos: See if free shipping or a new feature sways the decision.

BPTO is unbeatable for modeling share shift scenarios—if Brand A goes up, who wins the defectors? If Brand B adds a feature, does it make a dent? It brings razor-sharp clarity to launch strategies, repositioning, and defending your turf.

Five Sample Questions

Choose one: Brand A at $29, Brand B at $25, or Brand C at $27.

If Brand A increased to $35, which would you buy?

At what price would Brand B become your preferred choice over Brand A?

Assume Brand C adds free shipping. Which option do you choose now?

How much more are you willing to pay for your current brand versus alternatives?

B2B Willingness-to-Pay (WTP) Surveys

Why & When to Use

Selling to businesses is a whole different ballgame—budgets, ROI hurdles, and buying committees galore. B2B willingness-to-pay surveys meet buyers where they live, by speaking their language: investment, returns, risk trade-offs, and procurement red tape.

This survey type shines brightest when:

- Dealing with enterprise deals: Buyers care deeply about proven ROI.

- Navigating multi-stakeholder sales: Different budget holders, sign-off thresholds, and procurement quirks.

- Testing various pricing models: Per-seat, usage-based, or annual flat rates.

- Sizing upsell or cross-sell potential: See what extra value is worth to your biggest accounts.

B2B WTP questions help you set credible list prices and negotiate confidently by revealing real-world budget ceilings, procurement pain points, and cost/benefit calculus of target accounts.

Five Sample Questions

What annual budget could you allocate for a solution that saves 10% in operating costs?

At $15,000 per year, how compelling is the ROI for your organization?

What pricing model aligns with your procurement policies? (Per-seat, usage, flat rate)

What price ceiling would require executive sign-off?

How much would you expect to invest to achieve a 3x ROI within 12 months?

Best Practices & Common Pitfalls (Dos and Don’ts)

Getting your pricing survey right is part art, part science. The secrets to great results are hiding in the details, so follow these dos and avoid these classic stumbling blocks to keep your survey data squeaky clean.

Do:

Segment your audience so you spot differences in price perception by customer type or region.

Pretest your questions to make sure people actually interpret them as intended.

Randomize price points or presentation order to minimize bias.

Contextualize the value proposition—don’t make respondents guess what your product does.

Pair quantitative questions with open-ended follow-ups for richer insights.

Don’t:

Lead with the price you hope to hear—keep things unbiased.

Mix different pricing frameworks in a single survey—that breaks data comparability.

Ignore localization or currency differences—context matters for clarity.

Overload with too many price/feature combinations—decision fatigue is real.

Forget to backtest survey data with real market experiments—paper promises don’t always turn into real dollars!

Each of these steps keeps your pricing survey sharp, relevant, and actionable. Remember: the smallest details can make or break the insights you get!

Conclusion & Next Steps for Running High-Impact Pricing Surveys

Every stage in your product life cycle calls for a different pricing survey strategy—from rough concepts with Van Westendorp to razor-sharp BPTO for mature products. The right tool plugs you into real customer perceptions and gives you confidence to set, shift, or defend your prices. Use a simple rule: if you want elasticity, choose Gabor-Granger or Monadic; for feature trade-offs, go with Conjoint; for competitive battles, BPTO wins. Always run surveys, test your results in the wild, and iterate your way to a price people love—and pay. The market never stands still, and neither should your pricing insights!

Related Market Survey Surveys

32 Market Research Survey Questions: Types, Samples & Tips

Explore 30+ market research survey questions with examples across types like CSAT, concept testin...

30 Coffee Survey Questions: The Complete Guide for Cafés & Brands

Discover 25+ expert coffee survey questions to boost cafés, product development, and brand insigh...

31 Content Marketing Survey Questions for Actionable Insights

Discover 25+ content marketing survey questions to gather actionable insights—boost audience alig...