31 Perception Survey Questions: Ultimate Guide to Measuring Opinions

Explore 25+ perception survey questions across customer, employee, brand, product, and service surveys to measure opinions accurately.

Perception surveys are the secret sauce for understanding what people really think about you, your organization, or your brand—beyond what they actually do or say. Unlike satisfaction scores or engagement metrics, perception data reveals feelings, beliefs, and hidden expectations that shape market position, employee loyalty, and even public policy support. Whether you’re prepping for a new product launch, rebooting your brand, or responding to sweeping change, mastering the art of perception surveys is vital. This guide explores the best survey types for any situation, their purposes, and the perfect perception survey questions to ask for honest insights that drive genuine improvement.

Introduction: Why Perception Surveys Matter

What Is a Perception Survey?

A perception survey uncovers how people feel, believe, or interpret something about your organization or offering. Unlike traditional surveys that focus on satisfaction, engagement, or behaviors, these surveys are keenly tuned to subjective impressions.

How Is Perception Data Unique?

While satisfaction data tells you if someone enjoyed a product or event, and engagement data measures participation, perception data asks why—why someone feels loyal, distrustful, excited, or hesitant. It’s less about measurable actions and more about intangible impressions.

When Are Perception Surveys Essential?

Organizations rely on them during high-stakes moments, including: - Market repositioning to discover how audiences see the new direction. - Pre-launch and post-launch periods to gauge first reactions. - After big policy or staff changes to check sentiment shifts. - During employer branding to test appeal.

Common Goals Powered by Perception Surveys

Teams use perception insights to boost: - Market positioning by shaping messaging. - Customer experience (CX) with empathy-driven improvements. - Employer branding through culture and reputation checks. - Policy support by reading community mood.

Types of Perception Surveys Explored Here

Ready to dig in? We’ll look at how to smartly measure perceptions from customers, employees, broader markets, product users, and communities—plus all the best practices for the sharpest results.

Acquiescence bias, where respondents tend to agree with statements regardless of content, can significantly distort perception survey results. (en.wikipedia.org)

How to Create a Perception Survey with HeySurvey in 3 Easy Steps

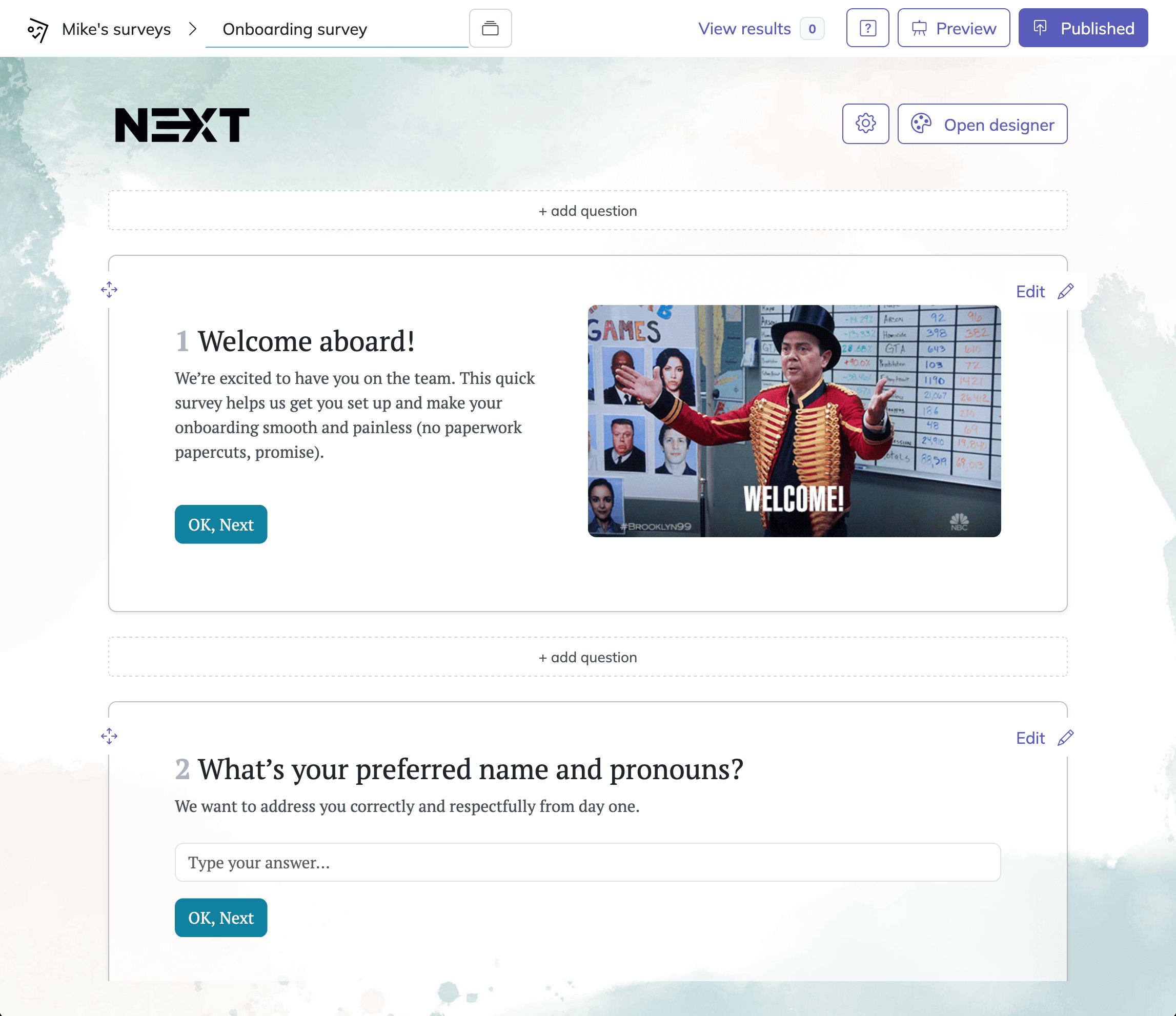

Step 1: Create a New Survey

Begin by logging into HeySurvey or simply visiting the site if you want to start without an account. Hit the “Create Survey” button and choose your starting point:

- Pick a pre-built template tailored to perception surveys to save time, or

- Start with an empty sheet if you want full control.

You can also try the text input creation for quick question formatting. Give your survey a clear internal name to keep things organized.

Step 2: Add Questions

Next, click “Add Question” in the Survey Editor. Select from question types like:

- Choice (single or multiple answers) for rating perceptions,

- Scale (such as Likert or numeric scales) to measure attitudes,

- Text for open-ended responses that reveal feelings and explanations.

Make sure to add your key perception questions—whether about brand trust, product usability, or service quality. Label required questions so no important info slips through. For extra polish, sprinkle images or emoji from the built-in libraries to keep respondents engaged.

Step 3: Publish Your Survey

When your survey looks good, click “Preview” to see it from your respondent’s view. Tweak colors or fonts using the Designer Sidebar if you want. Once ready, hit “Publish” to generate a shareable link. (Note: Publishing requires a HeySurvey account.) Share this link with your audience via email, social, or embed it on your website to start gathering perceptions in real time.

Bonus Steps to Boost Your Survey

Apply Branding

Upload your logo and customize colors and fonts using the Designer Sidebar to give your perception survey a professional, on-brand look. This builds trust and makes your survey stand out.

Define Settings

Head over to the Settings Panel to:

- Set start and end dates for survey availability,

- Limit the number of responses if needed,

- Add a redirect URL to guide respondents after completion,

- Enable the option for respondents to view results if appropriate.

Skip Into Branches

Use branching logic to customize the path respondents take through your survey. For example, if someone rates your product poorly, you can direct them to questions probing why. This keeps the experience relevant and insightful, capturing nuanced perceptions without annoying detours.

Click the button below to jump into a ready-made perception survey template and start customizing your own with HeySurvey!

Customer Perception Surveys

The Focus of Customer Perception Surveys

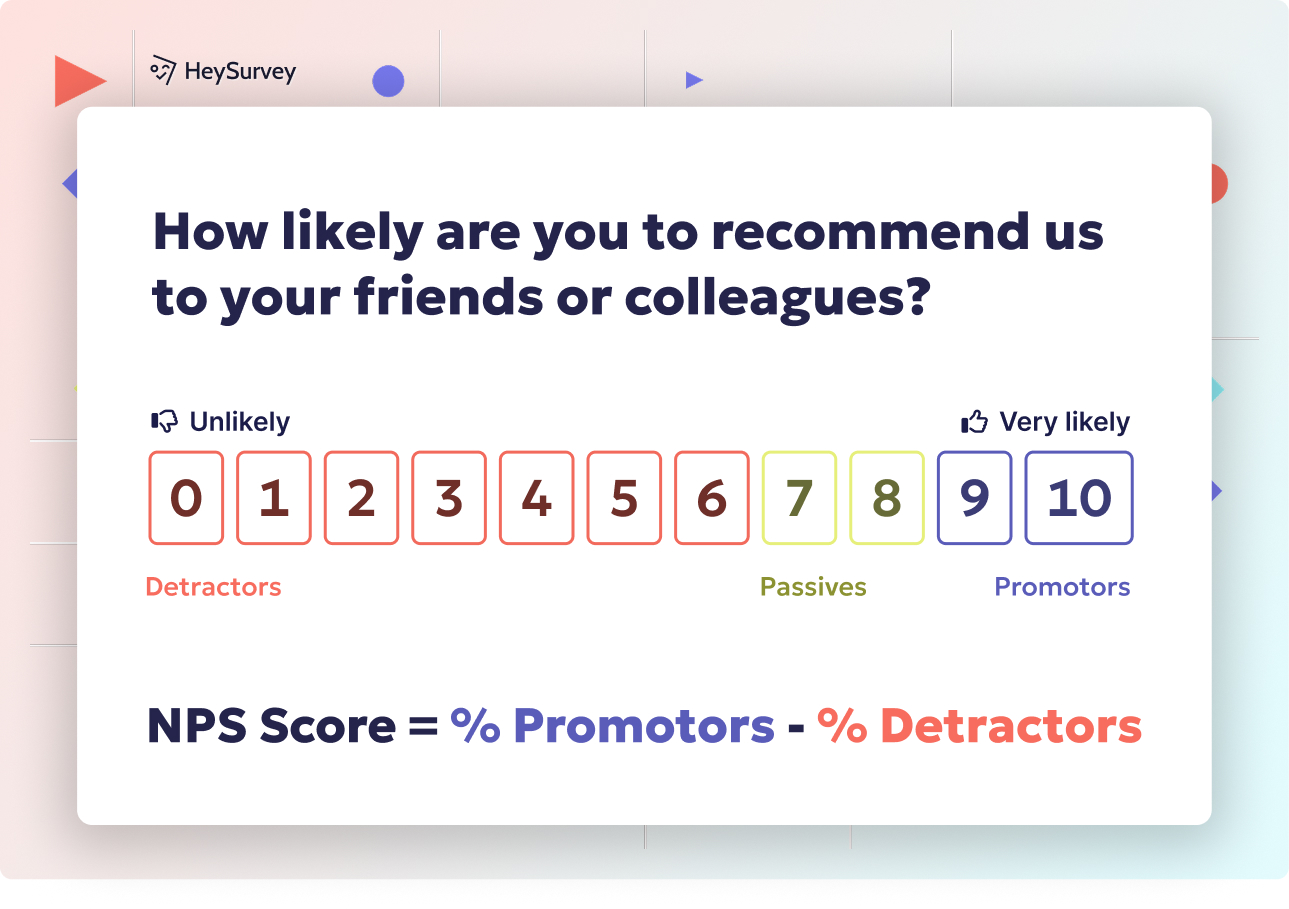

Customer perception surveys aim to unwrap what buyers truly think of your company, not just if they’re happy. Unlike Net Promoter Score (NPS) or Customer Satisfaction (CSAT) surveys, which chase basic loyalty or happiness, these questions explore value, the why behind choices, and even competitor comparisons.

Why and When to Use Customer Perception Surveys

These surveys are magic for occasions like: - Gauging what drives first-time or repeat purchases. - Testing risk of customers moving to a competitor. - Sizing up how product or marketing changes shape opinion. - After a campaign, to see if the narrative stuck.

Customer Perception Survey Examples

Use these questions to measure customer perception in meaningful ways:

How would you describe our brand in one sentence?

On a scale of 1–10, how well does our product meet your expectations?

Which competitors, if any, do you believe offer better value?

How trustworthy do you find our advertising messages?

What emotions come to mind when you think about our company?

Beyond Ratings: Digging for Deeper Insights

To get the clearest picture, ask a mix of open-ended and scaled questions. This combo reveals both quantifiable trends and surprising stories.

- Let customers explain in their own words (don’t just box them into scales).

- Measure not only satisfaction, but the emotion and reasoning behind it.

- Revisit the survey after each major launch or initiative for comparison.

Direct questions like these help spot trust gaps, emotional loyalty, or perception risks well before sales or satisfaction slip. That way, fine-tuning messaging or service becomes a proactive adventure—not a scramble for lost trust regained.

Incorporating a mix of open-ended and scaled questions in customer perception surveys provides both quantifiable trends and qualitative insights, enhancing the understanding of customer sentiments. (checkmarket.com)

Employee Perception Surveys

The Real Difference from Engagement Surveys

Employee perception surveys dive into what people believe about company culture, leadership, or adaptability—which is way more nuanced than just asking if they’re engaged or happy at work. Think of these as the “vibe check” for your organization.

Why and When Should You Use Them?

Deploy these tools in high-impact HR moments, such as: - Before mergers and acquisitions, to scout acceptance or unease. - During efforts to reshape company culture. - Start of, or post, major policy changes. - Rolling out employer branding strategies that aim to attract new talent.

Employee Perception Survey Questions

Try these to surface honest feedback:

How transparent do you believe senior leadership is about company performance?

Which three words best describe our workplace culture?

How confident are you in our company’s future success?

To what extent do you feel valued for your contributions?

How effectively does internal communication keep you informed?

What Sets These Apart?

Perception questions go beyond “Are you happy here?” They illuminate trust gaps, optimism for the company’s future, or subtle divides in inclusion.

- Focus on beliefs about processes and leadership, rather than tasks or perks.

- Use anonymous responses to encourage candor—staff are more honest when safe.

- Include open-ended questions to elicit breakout ideas or concerns that numbers alone miss.

These surveys are the go-to toolkit when you know something needs changing, but can’t quite spot what’s brewing under the surface. They’ll help you build, adapt, and communicate a culture in ways “engagement” stats just can’t deliver.

Brand Perception Surveys

Measuring More Than Awareness

Brand perception surveys gauge how your brand is actually viewed in the wild—what stories, traits, and value people connect to your name. These are broader and subtler than brand awareness studies, which only check if you are known, not how you are known.

Key Moments for Brand Perception Surveys

Leverage these surveys when you need to: - Shift the brand’s market positioning. - Monitor how campaigns change brand credibility. - Benchmark yourself against rivals in your niche. - Track the fallout or success of big public moves.

Sample Brand Perception Survey Questions

Here’s a flavor of questions that reveal brand persona in real detail:

Which of the following brands do you associate with innovation?

How memorable is our logo on a scale of 1–7?

If our brand were a person, which traits would it have?

How likely are you to recommend our brand to a friend?

What makes our brand stand out from others in your mind?

Keys to Insightful Brand Perception Data

When crafting these, focus on emotional language, imagery, and direct competitor comparisons.

- Use lists or open-ended formats to surface unique brand attributes.

- Test against competitors to check differentiation.

- Rotate brand lists in survey versions to eliminate position bias.

Strong brand perception feedback uncovers unique strengths, quirky misconceptions, or “hidden” reasons why a brand wins attention. Use it to shape campaigns with soulful stories, not just empty impressions.

Effective brand perception surveys should encompass cognitive, emotional, language, and action-based questions to comprehensively understand consumer associations and experiences with the brand. (qualtrics.com)

Product Perception Surveys

Why Product Perception Deserves Its Own Spotlight

Getting feedback about specific products is more than just asking if people “like” your offering. Product perception surveys zero in on features, usability, and perceived value—critical when you’re testing, tweaking, or validating growth opportunities.

When Should You Run Product Perception Surveys?

Perfect for moments like: - Rolling out a new feature, MVP, or beta. - Validating changes after launch. - Investigating why trial usage lags behind competitor products.

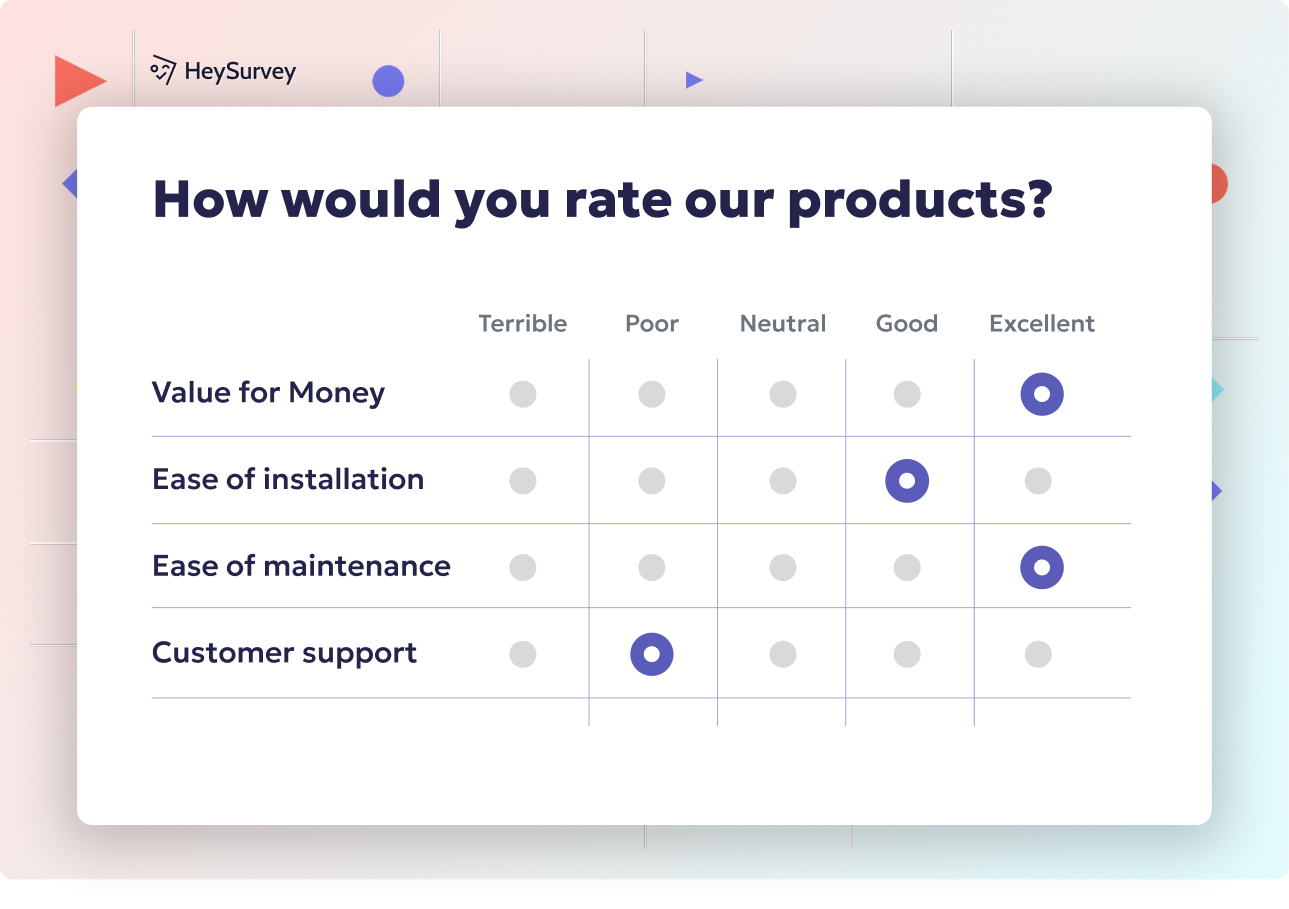

Product Perception Survey Sample Questions

Pick and choose from these to tailor your own survey:

How intuitive do you find the new dashboard layout?

Which feature adds the most perceived value?

How does this product compare to alternatives you’ve used?

What concerns, if any, do you have about durability?

How confident are you that this product will solve your problem?

Making the Most of Product Perception Data

Balance ratings scales with open feedback for a true view into product strengths and friction points.

- Include direct product comparisons to identify competitive gaps.

- Ask about both first impressions and lasting impact.

- Probe for confidence and emotional satisfaction, not just usage.

Savvy teams use product perception data to chart their improvement roadmap, choose top features for spotlight, or identify lurking dealbreakers—all before expensive changes are made.

Service Quality Perception Surveys

What Makes Service Perception Different?

Service quality perception is less about what happened, and more about how the experience felt, how trustworthy the team seemed, and if expectations were exceeded. These surveys dig far past ticket resolution, uncovering empathy, professionalism, and reliability.

When to Use Service Perception Surveys

Deploy for crisp insights after: - Any customer interaction with support or service reps. - Before renegotiating service level agreements (SLAs). - Identifying weak spots in the service journey.

Service Quality Perception Survey Questions

Capture the right moments with these proven questions:

How personable was the representative you spoke with?

Did our team resolve your issue faster than you expected?

On a scale of 1–5, how professional did the service feel?

How secure did you feel sharing information with us?

What could we do to improve future service experiences?

Getting Real About Service Perceptions

Make sure your questions cover courtesy, speed, security, and accountability.

- Use a mix of numeric and open-ended responses for a three-dimensional view.

- Compare reactions from different teams or channels for service consistency.

- Ask about future service improvements, not just recent experiences.

When tracked over time, these surveys paint a vivid portrait of service culture, trustworthiness, and where reputation-building starts (or stumbles).

Community / Public Perception Surveys

Understanding Community and Public Sentiment

When a decision affects the public, community perception surveys help uncover sentiment, trust, and involvement in proposed changes or ongoing projects. Unlike customer surveys, these tackle complex, multi-stakeholder opinions.

When and Why Do They Matter?

Crucial for organizations like NGOs, schools, and municipalities at times like: - Proposing changes (new developments, policies, or community plans). - Evaluating public events, safety initiatives, or crisis responses. - Measuring support for local governance.

Sample Community Perception Survey Questions

Tried-and-tested for real world community listening:

How informed do you feel about the upcoming redevelopment project?

To what extent do you believe the initiative will benefit the local economy?

How involved would you like to be in decision-making?

What are your primary concerns about environmental impact?

How well do you think officials listen to community feedback?

Building Stronger Community Dialogue

Ask about awareness, engagement desire, specific worries, and trust in authority.

- Let people signal both enthusiasm and concerns.

- Allow anonymous feedback for thorny issues.

- Mix fact-finding with questions about honesty or transparency.

Better public insight means smarter decisions, smoother deployments, and stronger, long-term community relationships.

Best Practices: Dos and Don’ts for Crafting Perception Survey Questions

The Crucial Dos for Top-Notch Perception Surveys

A strong perception survey starts with neutral, clear, bias-free question design. Don’t just wing it—make each question count!

- Keep questions short, focused, and unbiased.

- Use clearly defined rating scales so answers are meaningful.

- Randomize lists, especially for brands or features, to avoid order effects.

- Pre-test questions with diverse audiences for clarity and unintended bias.

- Segment your analysis (by demographics, experience, tenure) for deeper insights.

What NOT to Do: Avoid these Pitfalls

Some mistakes drain trust and muddy the data. Here are common traps to dodge:

- Don’t use leading language (avoid implying what answer you want).

- Steer clear of double-barreled items (no: “Was the service quick and satisfactory?”).

- Don’t neglect open-ended responses—magic often hides there!

- Don’t ignore mobile experience; people text on the go.

- Never assume every respondent is an expert—offer “I don’t know” as needed.

Survey Flow, Length, and Motivation

Order matters! Start broad, zoom in, and end on demographics.

- Begin with general perceptions (brand, company, or context).

- Drill down into specifics (experience, particular product or feature).

- End with optional demographic or role questions.

Keep surveys snappy—ten minutes max is the sweet spot. Offer a small thank you or relevant incentive when you need higher completion rates. And don’t forget: always follow up with a thank-you note and a “here’s what we learned” summary when possible.

Conclusion & Action Steps

Perception surveys aren’t just forms—they’re the spark that shows you how others interpret your brand, product, or policy efforts. Choose the right survey type by matching it with your goals and timing. Build a question library and pilot with a small group to smooth out kinks. Pair your questions with a pragmatic analytics plan for real results. For more advice, check out our guide to Likert scales and build your survey with confidence!

Related Market Survey Surveys

32 Market Research Survey Questions: Types, Samples & Tips

Explore 30+ market research survey questions with examples across types like CSAT, concept testin...

30 Coffee Survey Questions: The Complete Guide for Cafés & Brands

Discover 25+ expert coffee survey questions to boost cafés, product development, and brand insigh...

31 Content Marketing Survey Questions for Actionable Insights

Discover 25+ content marketing survey questions to gather actionable insights—boost audience alig...