31 Nominal Survey Questions: Definition, Types & Best Practices

Explore nominal survey questions with 25 sample questions, sub-types, best practices, and tips for clear, effective categorical survey design.

Nominal survey questions are the secret sauce behind so many of the surveys you’ve ever taken—those tidy little tick-boxes and clicky categories that make research faster, more fun, and foolproof. By slicing big audiences into simple chunks, these questions help us see patterns at a glance and keep everything tidy behind the scenes. In this article, you'll learn what makes nominal survey questions unique, how to choose the right sub-type, and how to write questions that give sharp, bias-proof results—all with practical examples you can steal and use today.

What Are Nominal Survey Questions?

Definition and Variations

Nominal survey questions, sometimes called categorical survey questions or nominal scale questions, are designed to sort information into groups without any natural order or ranking between them. Simply put, these questions put things in buckets with labels—no bucket is “greater” or “less” than the other. This is what makes them different from other types of survey questions, where order or numbers matter.

The beauty of nominal survey questions lies in their simplicity. Imagine asking, “What is your eye color?” The answer could be blue, green, brown, or hazel. There is no best or worst—just different types.

What Sets Them Apart

Nominal questions aren’t like ordinal, interval, or ratio questions. Let’s break this down:

- Ordinal questions ask respondents to rank things, like rating happiness from “not at all” to “very.”

- Interval questions measure distances on a scale, such as temperature in Celsius.

- Ratio questions deal with absolute values—think age, height, or income.

Nominal scale questions only care about category, not order, and the categories are always mutually exclusive. You cannot be in two categories at once, and there’s no logical way to rank or sort the options.

Core Characteristics

Let’s highlight the essential characteristics of nominal survey questions:

- Mutually exclusive categories: Every response fits only one category.

- No intrinsic order: Categories can’t be listed from best to worst.

- Simplified statistical analysis: Results are analyzed with tools like mode (the most common answer) and chi-square tests, never means or medians.

Nominal survey questions are foundational in quantitative research, giving numbers and clarity to messy sets of opinions or attributes—without ever suggesting one is better than another.

Nominal survey questions, which categorize data without inherent order, are effectively analyzed using non-parametric tests like the chi-square test to identify relationships between categorical variables. (dataheadhunters.com)

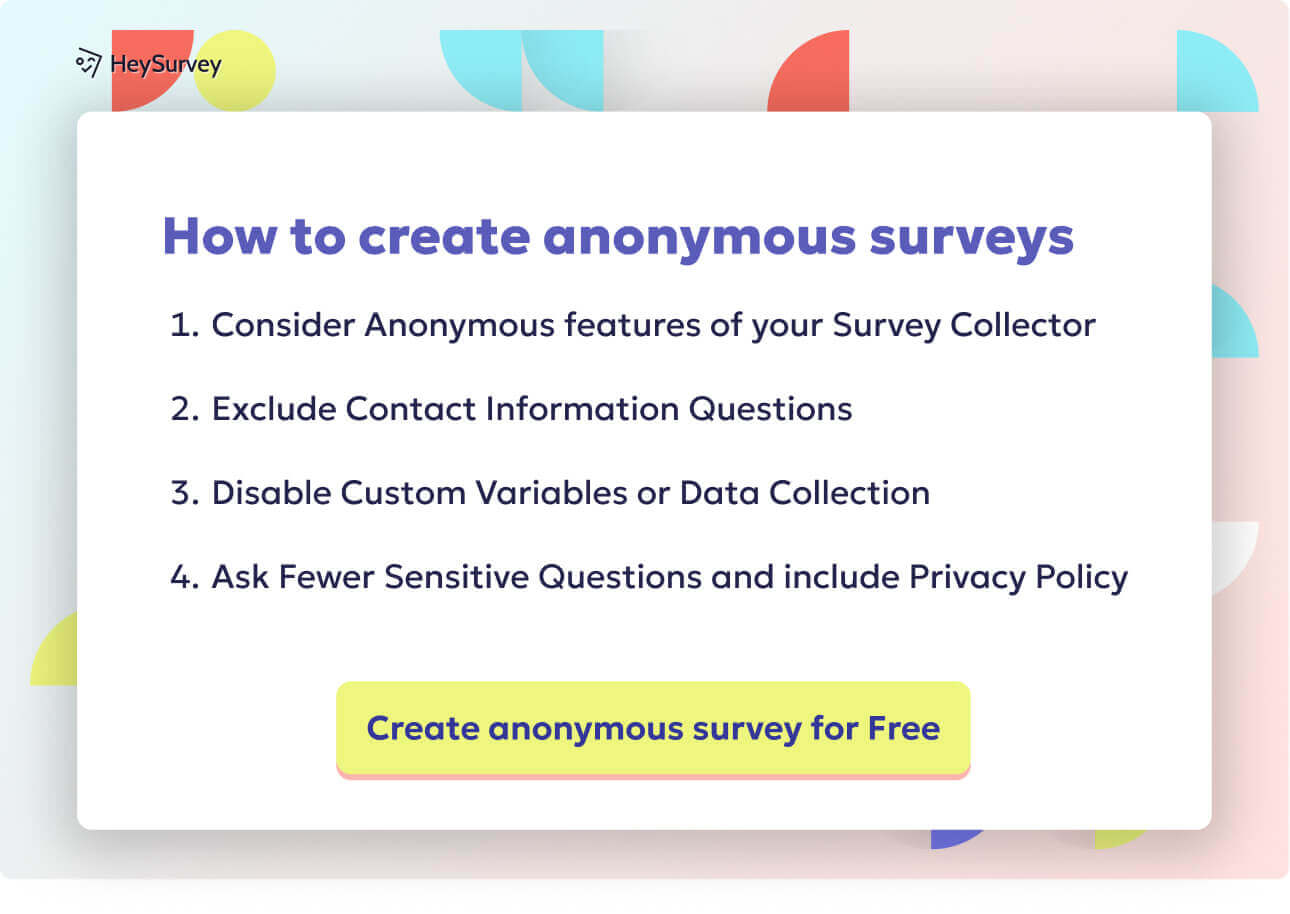

How to Create a Nominal Survey with HeySurvey in 3 Easy Steps

Ready to craft your own survey packed with nominal questions? HeySurvey makes it a breeze—even if you’ve never created a survey before. Follow these three simple steps to get your survey up and running fast.

Step 1: Create a New Survey

Head over to HeySurvey and click “Create New Survey”.

Choose to start from an empty sheet for full control, or pick a pre-built template that fits nominal questions to save time.

Give your survey a clear internal name to keep things organized.

Voilà! Your survey canvas is ready for your brilliant questions.

Step 2: Add Your Nominal Questions

Click “Add Question” wherever you want a new item.

Select the question type based on the nominal sub-type you’re using:

- For demographics or brand preferences, choose Single Choice (single-select multiple-choice).

- For quick yes/no or true/false checks, pick Choice with two options (binary question).

- To allow multiple answers at once (multi-select), pick Choice with the “allow multiple answers” option enabled.

Type your question text and enter your categories or options, making sure they are mutually exclusive and exhaustive.

If needed, add an “Other, please specify” option for answers that don’t fit your list.

Mark questions as required to prevent skipping, and add images or descriptions to clarify.

Step 3: Preview and Publish Your Survey

Click “Preview” to see how your survey looks and feels from a respondent’s perspective.

Tweak design elements using the Designer Sidebar if you want to add some personality with colors or fonts.

Once you’re happy, hit “Publish” to make your survey live.

Copy the link provided and share it with your audience to start collecting responses.

Bonus Steps for Next-Level Surveys

Want more power? Use these bonus features to polish your survey:

Apply Branding

- Upload your logo through the Designer Sidebar to give your survey that official company touch.

- Adjust colors and backgrounds so your survey matches your brand vibe perfectly.

Define Settings

- Set start and end dates for your survey availability.

- Limit response counts to control your sample size.

- Setup redirect URLs to send respondents somewhere cool after completing your survey.

Add Skip and Branching Logic

- Use branching rules to guide respondents down customized paths based on their answers.

- For instance, a “No” answer in a binary question can jump respondents past irrelevant sections.

- This keeps surveys lean, personalized, and more engaging.

Feel free to start right now with one of our nominal survey templates below and see how easily your questions come to life!

Key Advantages & Limitations of Nominal Data

Main Benefits

Nominal data shines for researchers and survey designers in several ways:

Rapid analysis: Answers snap instantly into clear reports—no math gymnastics required.

Easy visualization: Making pie charts or bar graphs is a breeze, since each category stands alone.

Branching logic: Responses can guide where a survey goes next with zero ambiguity.

Low cognitive load for respondents: Choosing categories is familiar and simple, reducing fatigue.

Efficient coding and storage: Categories can be numerically coded, making spreadsheet work neater.

Constraints and Pitfalls

But nominal survey questions also come with built-in limitations:

Cannot measure magnitude: You’ll never know “how much” or by “how many,” just “which type.”

Risk of category overlap: Clumsy list-making can let respondents slip between the cracks (like choosing multiple, similar answers).

Cannot capture intensity: You won’t know how strongly someone feels—just which side of the fence they’re on.

When NOT to use nominal questions:

- If you need to know how much or how many—choose interval, ratio, or ordinal formats.

- When detailed ranking or comparison is vital, look elsewhere.

Nominal data works best when labeling is all you need, and when clarity trumps complexity.

Nominal data is easy to collect and analyze, but it lacks depth and cannot measure the intensity or magnitude of preferences. (pastquestionsandanswers.com)

Demographic Nominal Questions

Quick Definition

Demographic nominal questions are a fantastic way to slice data by asking about personal attributes—usually things you can’t change, like age, gender, or employment status. Their whole purpose is to group people by who they are, not what they feel or how much they do.

Why & When to Use

Here’s where these questions shine:

Audience segmentation: Curious about how different age groups feel about your product? Start with demographics.

Quota sampling: Ensuring fairness or diversity in sampling by controlling who gets into your data.

Post-survey weighting: Adjust for imbalances in your respondents after the survey closes.

Kicking off a survey: Starting with personal information helps with screening and later correlation.

Demographic questions are best asked early—get the stats before diving into attitudes or behaviors.

5 Sample Questions

What is your gender? (Male, Female, Non-binary, Prefer not to say)

Which age bracket do you fall into? (18-24, 25-34, 35-44, 45-54, 55+)

What is the highest level of education you have completed? (High school, Some college, Bachelor’s degree, Graduate degree, Other)

What is your marital status? (Single, Married, Divorced, Widowed, Prefer not to say)

What is your current employment status? (Employed, Unemployed, Student, Retired, Prefer not to say)

Writing Tips

Keep categories exhaustive and mutually exclusive: Make sure every respondent fits somewhere, with zero overlap.

Always offer a “Prefer not to answer” option: Respect privacy and prevent forced disclosure.

Review for cultural appropriateness: Demographics can vary globally—never assume a one-size-fits-all set of categories.

Asking demographics thoughtfully sets the table for the rest of your research meal.

Binary / Yes-No Nominal Questions

Quick Definition

Binary (yes-no) nominal questions present just two possible answers, letting respondents quickly stake a claim: yes or no, true or false. These questions are the Swiss Army knife of surveys—neat, efficient, and perfect for fast decisions.

Why & When to Use

These straightforward questions are often used for:

- Screening respondents: Directing people down specific survey paths based on eligibility.

- Skip logic: Jump over irrelevant questions with clean “yes” or “no” answers.

- A/B funnels: Pinpoint which path a respondent takes early on.

- Churn prediction: A “no” can signal possible customer loss.

Binary questions are great for minimizing respondent effort, stripping deadweight from the survey and moving quickly.

5 Sample Questions

Have you purchased our product before? (Yes/No)

Are you currently a college student? (Yes/No)

Do you own a smartphone? (Yes/No)

Have you visited our website in the past month? (Yes/No)

Would you recommend our service to a friend? (Yes/No)

Writing Tips

Pair with follow-up probes if depth is needed: Use a “Why?” after a “No” to mine more insight.

Double-check clarity: Ambiguous wording can make a simple question confusing.

Use these questions for routing and eligibility: Get quick answers, shape the journey, and keep things brisk.

Binary questions are fast, friendly, and always clear—just don’t forget to dig deeper if yes or no isn’t enough.

Binary (yes-no) survey questions are efficient for quick data collection but may oversimplify complex opinions, potentially leading to biased or incomplete insights. (granicus.com.au)

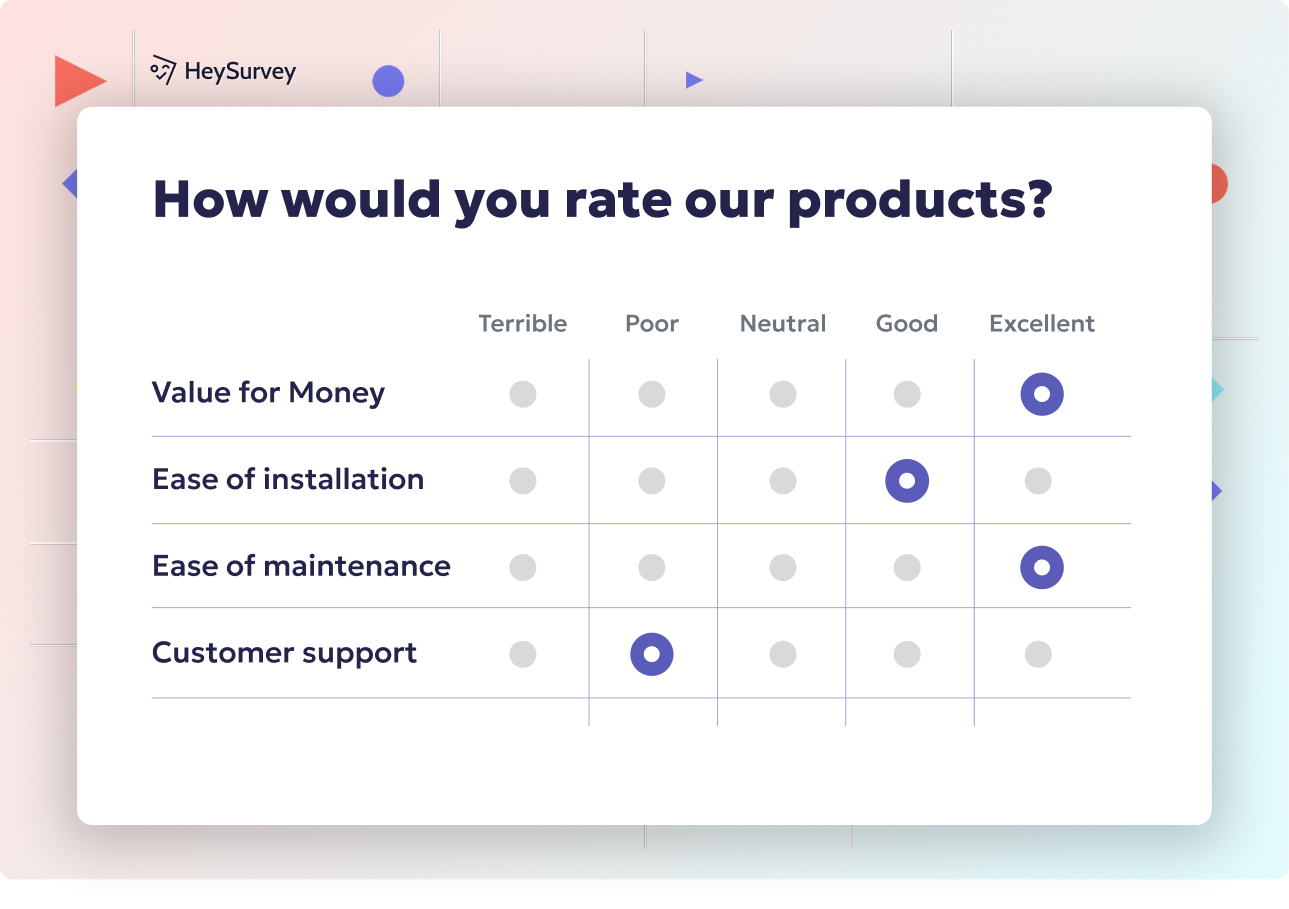

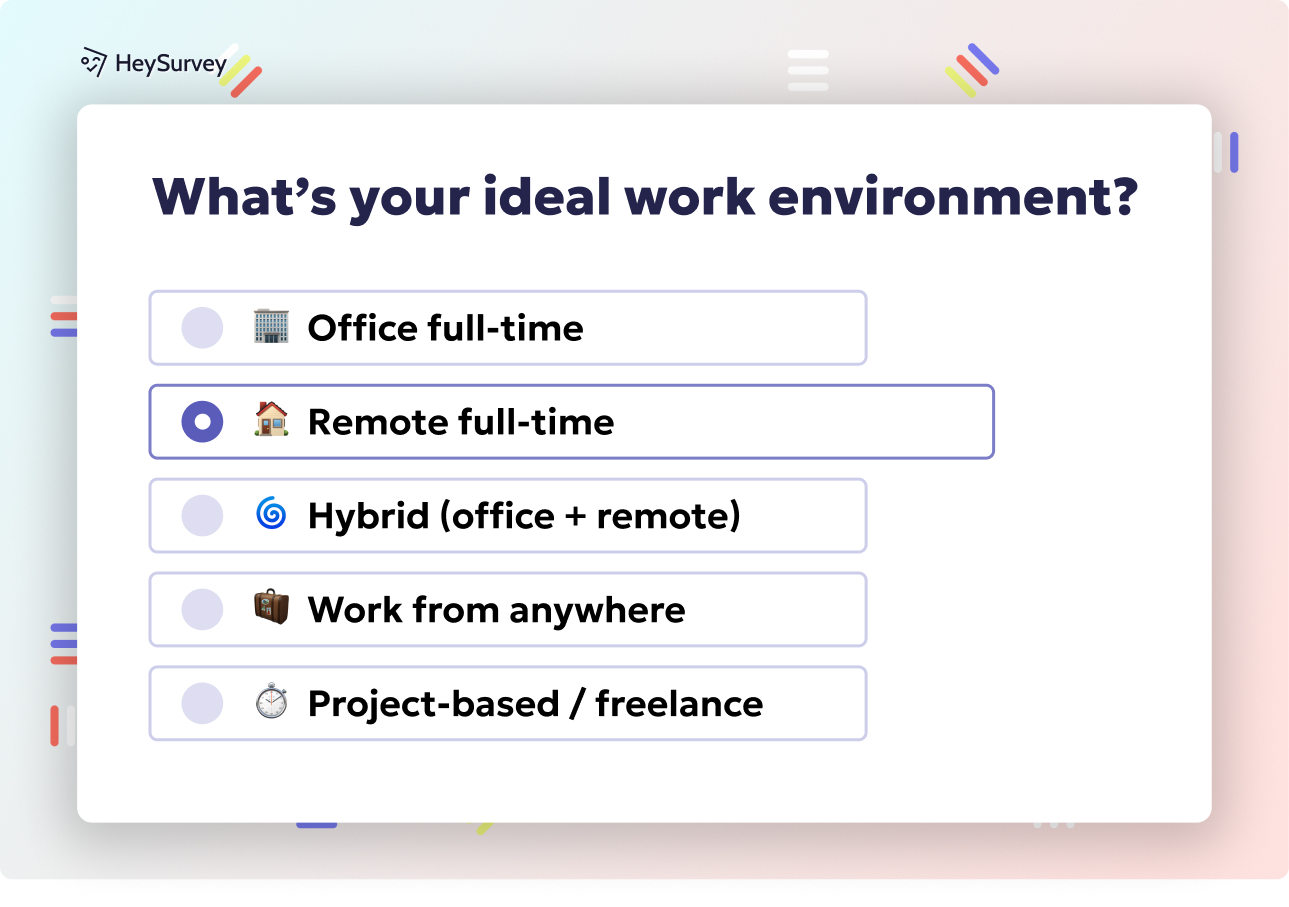

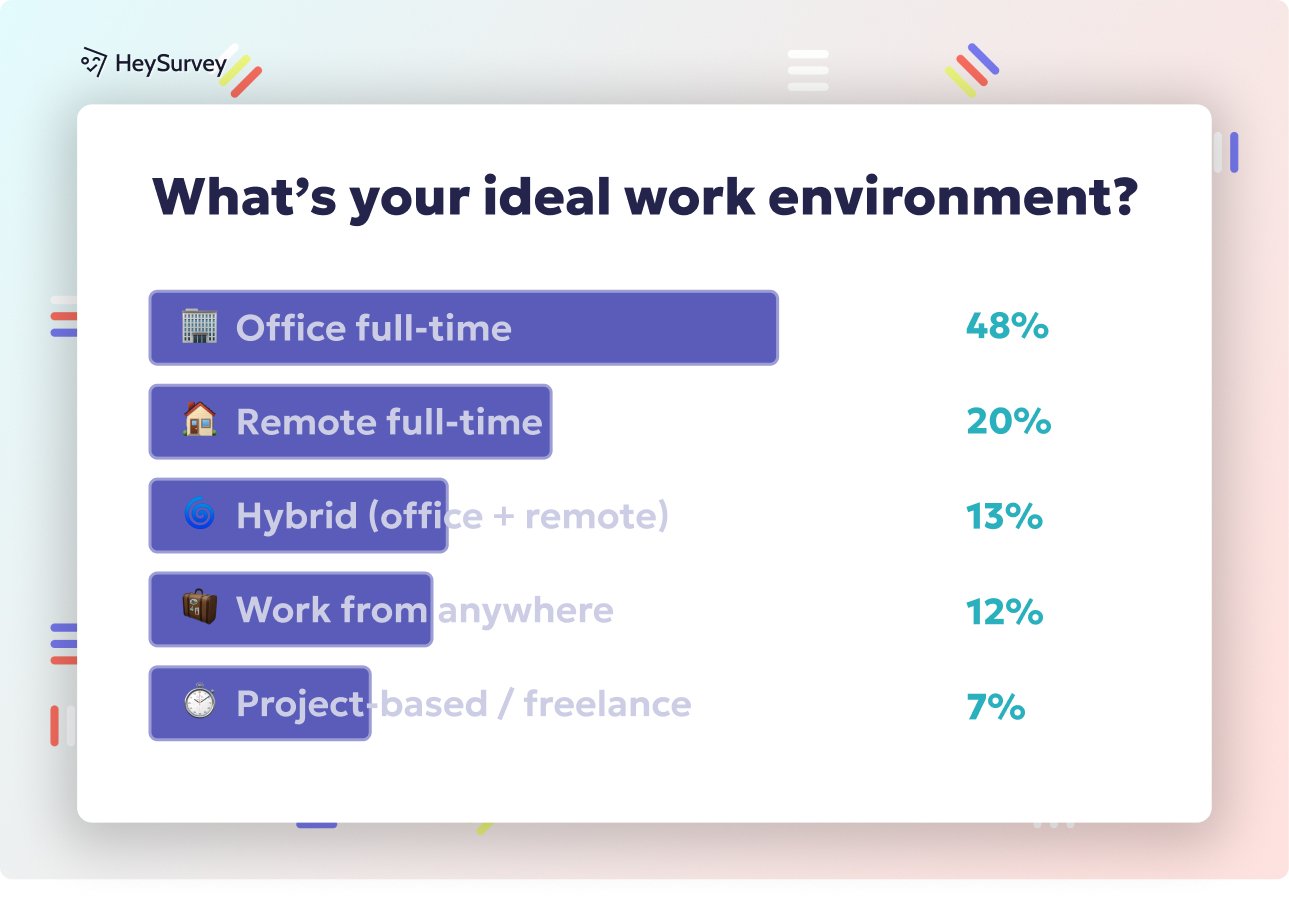

Single-Select Multiple-Choice Nominal Questions

Quick Definition

A single-select multiple-choice nominal question asks the respondent to pick one answer from a list of three or more options—no squishy middle ground allowed. Each possibility is a spot on the map, and you can only stand in one.

Why & When to Use

Here are the sweet spots for these questions:

Uncovering “primary” preferences or behaviors: Learn what people do or prefer most.

Pie chart magic: Perfect for splitting results into color-coded slices—think top streaming services or favorite pet types.

Simple frequency analysis: Count how many folks picked each answer—done!

Single-select questions shine when you want a primary answer—no fence-sitters or multi-taskers muddying the results.

5 Sample Questions

Which streaming service do you use most often? (Netflix, Hulu, Disney+, Amazon Prime, Other)

What type of pet do you own? (Dog, Cat, Fish, Bird, None)

Which social media platform do you use daily? (Facebook, Instagram, Twitter, TikTok, LinkedIn)

What is your primary mode of transportation to work? (Car, Bus, Train, Bike, Walk)

Which operating system does your main computer use? (Windows, macOS, Linux, ChromeOS, Other)

Writing Tips

Include an “Other, please specify” option: Future-proof your list and catch outliers or new trends.

Keep answers mutually exclusive: Respondents should fit in only one bucket.

Randomize answer order if possible: Prevent position bias.

These questions make comparing groups so easy—just count, sort, and draw the pie chart!

Multi-Select (Check-All-That-Apply) Nominal Questions

Quick Definition

Multi-select nominal questions (aka, “check-all-that-apply”) let respondents pick as many answers as they want, casting a wide net across categories. They’re the best way to capture the breadth of someone’s experiences or habits.

Why & When to Use

This format works brilliantly for:

Product feature usage: Understand which features people use—maybe all, maybe just one.

Channel overlap: See if the same user gets news from multiple sources.

Lifestyle profiling: Get richer portraits of respondents’ interests.

Best placed mid-survey, these questions catch the nuances without scaring anyone off right at the start.

5 Sample Questions

Which payment methods do you regularly use? (Credit Card, Debit Card, PayPal, Apple Pay, Google Pay, Cash)

Which of the following cuisines do you enjoy? (Italian, Mexican, Chinese, Indian, Mediterranean)

In which sports do you participate? (Soccer, Basketball, Running, Swimming, None)

What sources do you rely on for news? (TV, Newspapers, Online Websites, Social Media, Radio)

Which devices do you own? (Laptop, Desktop, Tablet, Smartphone, Smartwatch)

Writing Tips

Always include “Select all that apply” in your instructions: Make it obvious!

Keep options clear and non-overlapping: Avoid head-scratchers like “mouse” and “mice.”

Be aware of data complexity: You’ll need fancier analysis (like multiple response analysis) to make sense of results.

Multi-select questions are the best way to capture the full story, but they need crystal-clear answers for smooth analysis.

Brand & Preference Nominal Questions

Quick Definition

Brand and preference nominal questions are designed to tap into gut reactions about brands and choices. These ask respondents to pick the one brand or item that comes instantly to mind, turning raw awareness into readable data.

Why & When to Use

These questions are survey gold for:

Brand tracking research: Watch how top-of-mind awareness changes over time.

Competitive audits: Spot who’s winning the first-thought battle among competitors.

Positioning studies: See if your brand “owns” a certain attribute, like value or luxury.

Running post-campaign studies: Measure the impact of advertising on brand recall.

Use them mid-survey or alongside other nominal sub-types to pinpoint true rivals and brand leaders.

5 Sample Questions

Which brand do you associate most with premium coffee? (Starbucks, Dunkin’, Peet’s, Costa, Other)

When thinking of athletic footwear, which brand comes to mind first? (Nike, Adidas, Reebok, Puma, New Balance)

Which smartphone brand do you trust the most? (Apple, Samsung, Google, OnePlus, Other)

Which grocery store do you shop at most often? (Walmart, Kroger, Costco, Aldi, Other)

Which ride-share service do you prefer for airport trips? (Uber, Lyft, Local Taxi, Other, None)

Writing Tips

Rotate list order to reduce primacy bias: No favorites at the top!

Always allow an “Other” option with open text: Real-world opinions rarely fit neat lists.

Mind cultural and regional variations: Brands can mean different things in different places.

Brand and preference questions offer a fun window into how people really think, lightning-fast.

Best Practices, Dos & Don’ts for Nominal Survey Design

Dos

When thinking about how to write nominal survey questions, stay on the right track with these habits:

Ensure mutual exclusivity: Each category must be unique to avoid overlap.

Provide exhaustive answer lists: Make sure every respondent finds an answer that fits.

Pilot test categories: Run your options past a small group first to catch problems.

Apply logical skip patterns: Use answers for smart routing and smoother surveys.

Rotate answers, especially for brand lists: Blend fairness into every question.

Don’ts

Steer clear of these classic mistakes:

Never overlap categories: Don’t leave respondents wondering, “Which one am I?”

Don’t force ranking on nominal data: Categories are equal—no pecking order allowed.

Avoid overloading on jargon: Use simple, familiar labels.

Don’t forget “None,” “Other,” or “Prefer not to answer”: Keep your sample inclusive.

Ignore cultural context at your peril: What works in one country can flop in another.

How to write nominal survey questions well means always keeping the respondent’s perspective in sharp focus, and prepping your list for bulletproof clarity.

Conclusion & Key Takeaways

Nominal survey questions are big-time problem-solvers—whether you’re slicing respondents by demographics or tracking brands battle for mindshare. Each sub-type shines in specific survey tasks, from fast eligibility checks to deep-dive multi-selects. The secret to sharp insights lies in building clear, mutual-exclusive categories with every question you write. Use the sample questions and tips from this article to make your next survey punch above its weight, today! Now, go add some crystal-clear, bias-busting nominal questions to your next questionnaire.

Related Question Design Surveys

29 Quantitative Survey Research Questions Example for Success

Explore 25+ quantitative survey research questions example with clear explanations and tips for c...

32 Good Survey Question to Boost Your Data Quality

Discover how to craft good survey questions with 30 sample questions across 8 types for better da...

31 Survey Question Mistakes You Need to Avoid Today

Discover 25 common survey questions mistakes with real examples and expert tips to craft clear, u...