31 Insurance Survey Questions: Ultimate Guide for Customer Feedback

Discover 28 expert insurance survey questions with sample sets to enhance customer insights, reduce churn, and boost profitable growth.

Insurance professionals know that understanding your customers is the ultimate policy benefit. Slick insurance surveys are like x-ray glasses: they reveal what your policyholders feel, want, and worry about from the moment they sign up, to renewing, and all the way through those (sometimes bumpy) claims experiences. The right survey questions—centered around insurance customer feedback and razor-sharp policyholder surveys—let you keep an ear to the ground, spot problems early, and build stronger, more profitable relationships with every single insured. Whether you need quick insights or robust insurance questionnaire templates, here’s your playbook to make every survey drive measurable business impact.

Customer Satisfaction Insurance Survey

Why and When to Use This Survey Type

Nothing says happy customer like a smile—and insurance surveys can catch even the faintest grin (or frown). The customer satisfaction insurance survey is your go-to tool whenever a customer interacts meaningfully with your company. Deploy it right after milestones such as a policy purchase, payment, renewal, claim, or after a helpful chat with your contact center.

By measuring experience at critical touchpoints, you can quickly seize on what’s working and address what isn’t. This survey lets you:

- Benchmark Net Promoter Score (NPS) so you know if your policyholders would sing your praises

- Identify potential detractors before they call it quits

- Measure and report on service KPIs that tie directly to customer loyalty

- Reveal digital pain points or delights through quick feedback on your app or portal

- Prioritize customer experience (CX) improvements for the biggest impact

Periodic check-ins—not just one-and-done—mean you’ll always know if customers are coasting or considering a switch.

Sample Questions

On a scale of 0–10, how likely are you to recommend our insurance to family or friends?

Which aspect of your experience could we improve the most?

How satisfied are you with the clarity of your policy documents?

Rate the speed at which your inquiries are resolved.

How fairly do you feel you were treated during your last interaction?

These questions dig deep into the heart of customer satisfaction in insurance. Quick, candid answers become your roadmap for making customers happier, stickier, and louder advocates for your brand.

A study analyzing nearly 25,000 customer satisfaction surveys identified that a positive or empathetic adjuster attitude was the primary driver of five-star insurance claims experiences. (prnewswire.com)

Creating your insurance survey with HeySurvey is a breeze—even if you’re new to the platform. Follow these three simple steps and get your insights flowing in no time!

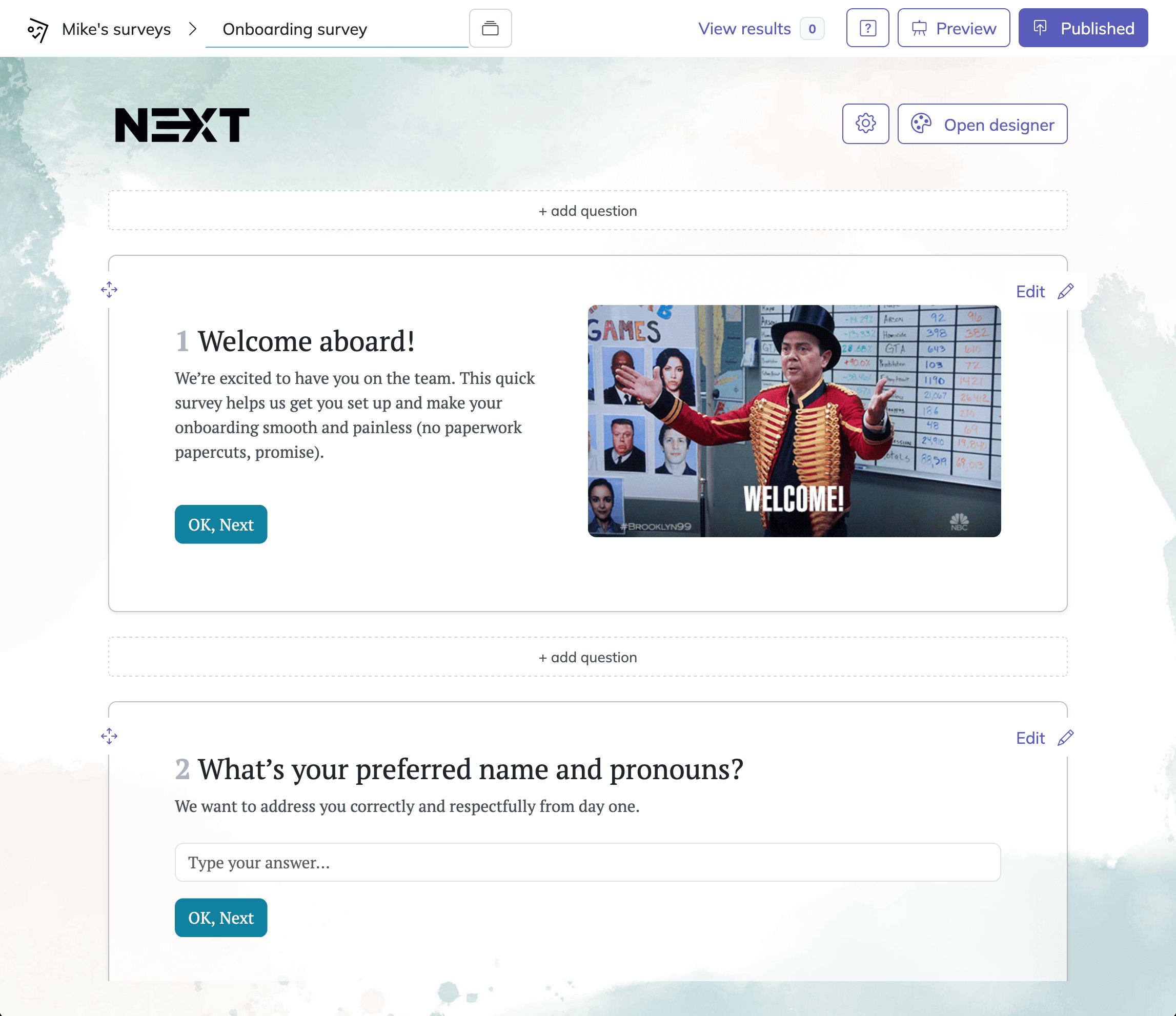

Step 1: Create a New Survey

Start by logging into HeySurvey or begin without an account if you want to explore first. Click “Create Survey” and choose whether to:

- Pick a pre-built template that matches your insurance survey needs (like Customer Satisfaction or Claims Experience), or

- Start from an empty sheet for full customization.

Give your survey a clear name so you can find it easily later (e.g., “Customer Satisfaction Insurance Survey”). Now you’re ready to build!

Step 2: Add Your Questions

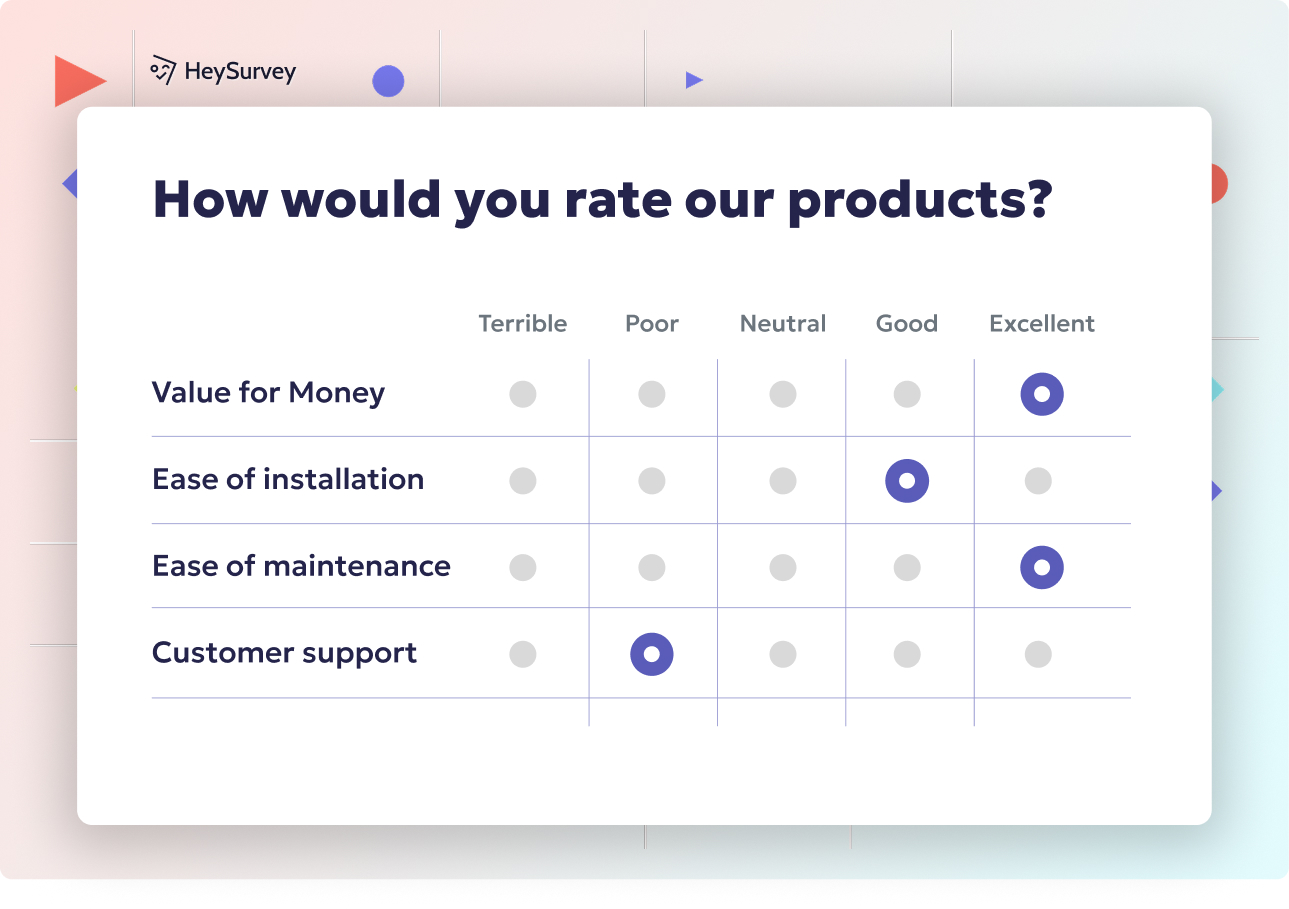

Once inside the Survey Editor, click “Add Question” to insert your first question. Choose the question type that suits your needs:

- Use Scale for ratings or NPS questions (“On a scale 0–10...”)

- Select Choice for single or multiple choice questions

- Pick Text to allow open-ended feedback answers

Type in your questions and customize option labels or add descriptions where needed. Don’t forget to mark must-answer questions as required for complete feedback. If you want to personalize paths in your survey, use logic branching to direct respondents to relevant questions based on their previous answers.

Step 3: Publish Your Survey

Before sharing, hit “Preview” to see how your survey looks for respondents on different devices. When it’s looking sharp, click “Publish.” You’ll then get a shareable link for your survey that you can email, embed on your website, or post on social media. Note you will need an account to publish and view responses.

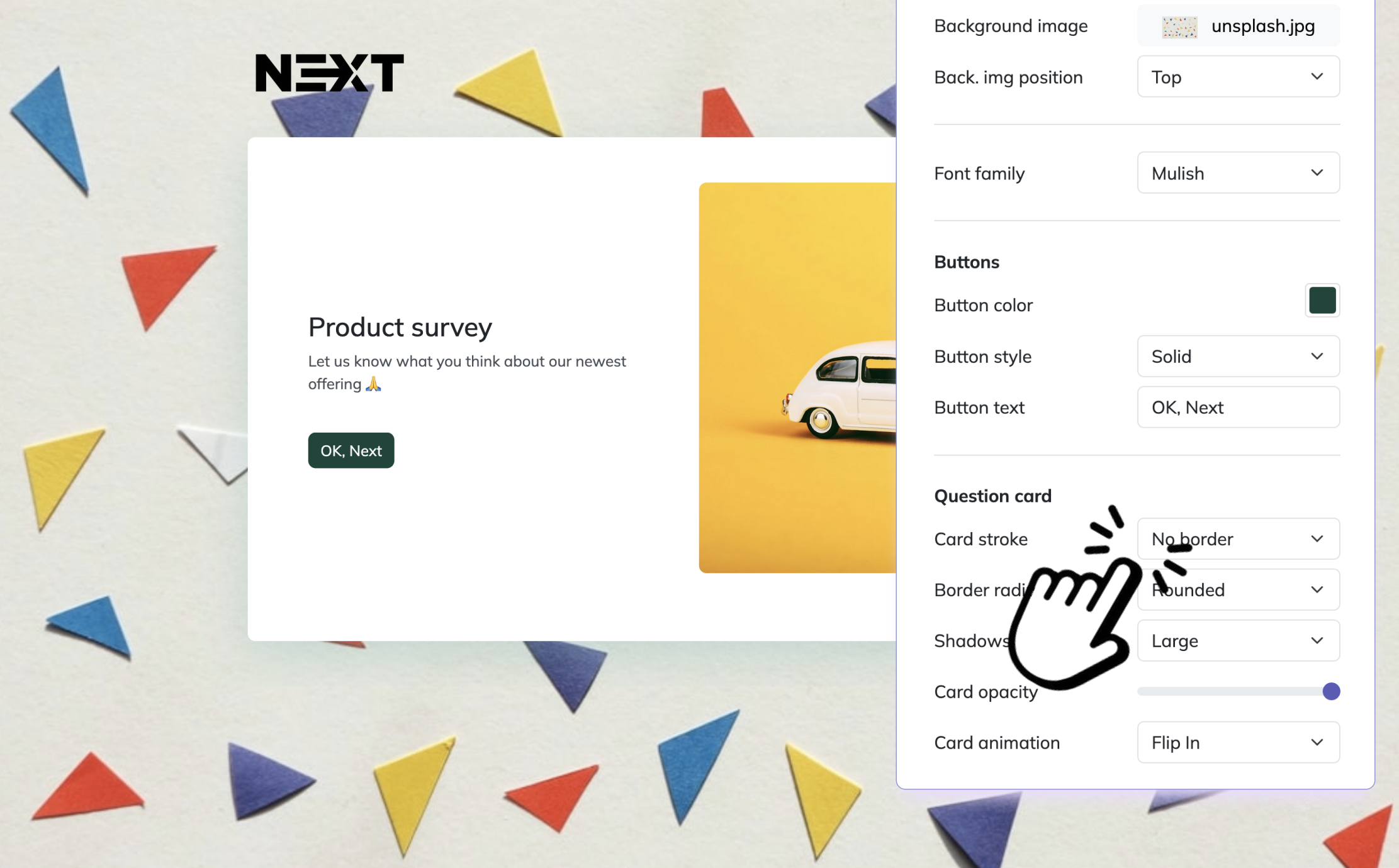

Bonus Step A: Apply Branding

Make your survey look uniquely yours by adding your company logo via the Branding option. Also use the Designer Sidebar to tweak colors, fonts, backgrounds, and animations. This helps build trust and recognition with respondents.

Bonus Step B: Define Survey Settings

In the Settings Panel, set your survey’s:

- Start and end dates (run it on your schedule)

- Response limits to cap how many fill it out

- Redirect URL to send respondents to a thank-you page or special offer after completion

- Whether respondents can view aggregated results

Bonus Step C: Skip Logic and Branching

Use HeySurvey’s branching feature to create dynamic question flows. For example, if a customer says they’re unlikely to renew, you can direct them to a customized set of retention questions. Branching keeps the survey relevant, reduces fatigue, and gets sharper data.

Now that you have the essentials, just hit the button below to open a ready-made template and customize it to your exact insurance survey goals. Easy, powerful, and designed to get real insights!

Claims Experience Survey

Why and When to Use This Survey Type

Claims are where loyalty is won or lost—fast. When that fender bender or leaky roof sends your customer your way, the claims experience survey helps ensure they're not left frustrated or confused. Send this survey immediately after claim closure or when a settlement offer goes out. Catch insights while the experience is still top of mind.

By collecting feedback right away, you:

- Measure the professionalism and empathy of your loss-adjusters

- Gauge communication clarity and timeliness at every claims stage

- Uncover fairness (or lack thereof) in settlement discussions

- Catch lingering questions or complaints before they snowball

- Detect and address root causes of reopened claims or costly disputes

With structured feedback, you’ll reduce complaints, litigation risk, and even regulatory headaches. It’s a win-win for your team and your customers.

Sample Questions

How clear were the instructions for submitting your claim?

Did you feel informed about the status of your claim at all times?

Rate the speed of claim processing.

How satisfied are you with the settlement amount?

What could we have done to improve your claims experience?

Every question targets a different gear in your insurance claims process machine. The resulting data is pure gold for continuous improvement—and can save you from costly aftershocks down the road.

A study analyzing nearly 25,000 customer satisfaction surveys found that almost 50% of five-star ratings cited a positive or empathetic adjuster attitude as the primary reason for satisfaction. (prnewswire.com)

Policy Renewal Intent Survey

Why and When to Use This Survey Type

A renewal isn’t just another transaction—it’s a vote of confidence. The policy renewal intent survey lets you get ahead of churn by understanding what keeps each customer loyal (or nudges them toward a competitor’s open arms). This one is best sent 60–90 days before a policy expires—when there’s still time to act.

Use these surveys to:

- Gauge the precise appetite for renewal in advance

- Spot price sensitivity, gaps in coverage, or competitive threats

- Get cues on what might tempt someone to switch providers

- Tailor retention and win-back campaigns for maximum effect

- Find cross-sell and upsell openings when life circumstances change

This kind of proactive approach can turn a maybe into a yes—and help you keep more business on the books.

Sample Questions

How likely are you to renew your policy with us?

What factors will influence your renewal decision most?

Do you feel your current coverage still meets your needs?

Have you received competing quotes from other insurers?

What improvements would encourage you to stay with us?

By using these policyholder retention survey questions, you can ensure fewer surprises come renewal season—and possibly even spark upgrades before your rivals get a chance.

Insurance Needs Assessment Survey

Why and When to Use This Survey Type

The wrong coverage can be downright awkward—like showing up to a surf lesson in a tuxedo. Insurance needs assessment surveys are your chance to get it right from the start, matching prospects and current customers with the perfect bundle of products and protection. Typically, these surveys shine early in the sales cycle or during yearly reviews.

This approach allows you to:

- Build detailed profiles using lifestyle, family, and asset-related questions

- Curate recommendations that fit every stage of life

- Catch new or shifting risks before they cause pain

- Reduce underinsurance gaps that can lead to unhappy surprises

- Feed insights to advisors for smarter conversations

The end result? Personalized solutions for every customer—plus cross-sell and upsell opportunities galore.

Sample Questions

Which of the following life events have occurred in the past year (marriage, home purchase, new child)?

What is your primary financial goal for the next 5 years?

How would you rate your risk tolerance?

Do you currently have any gaps in health or disability coverage?

Which assets (home, vehicles, valuables) would you like protected?

This selection brings clarity to your insurance prospecting process and helps build trust from the first call or click.

A study found that consumers often overestimate their understanding of health insurance, with many unable to define basic terms or identify their coverage type. (archives.joe.org)

Product Awareness & Brand Perception Survey

Why and When to Use This Survey Type

If nobody knows your brand, you risk being the world’s best-kept secret. Product awareness and brand perception surveys keep you in tune with how prospects and customers see you (and your rivals). Run these quarterly or after major marketing blitzes to see where you stand.

This kind of holistic feedback measures:

- Top-of-mind brand recall within key segments

- Awareness and perception of specific product lines

- Level of trust compared to other carriers

- How and where customers discover your marketing

- Keywords and themes associated with your reputation

Armed with this data, marketing teams can fine-tune messages, optimize ad budgets, and strengthen insurance brand positioning.

Sample Questions

Which insurance brands come to mind first when you think of [product line]?

How familiar are you with our customizable policy options?

What three words best describe our brand in your opinion?

Where did you first hear about our company?

How trustworthy do you find our advertising messages?

Vivid insights from these questions help you get noticed, boost recall, and build a reputation customers actually remember.

Post-Purchase Onboarding Feedback Survey

Why and When to Use This Survey Type

First impressions are lasting ones—especially in insurance! The post-purchase onboarding feedback survey is your secret weapon for creating instant reassurance and clarity. Use this survey 7–14 days after policy activation, when new policyholders are taking their first (sometimes nervous) steps in your ecosystem.

With data from this survey, you can:

- Ensure customers were able to log in, find documents, and access tools

- Find points of confusion in digital and human welcome touchpoints

- Reduce early policy cancellations and costly errors from misunderstanding

- Spot helpful tweaks for emails, portal instructions, or welcome calls

- Encourage new users to reach out before frustration leads to churn

Done right, it turns nervous newcomers into loyal fans.

Sample Questions

How easy was it to set up your online insurance portal?

Did you receive your policy documents in a timely manner?

How clear was the explanation of your coverage limits and deductibles?

Rate the usefulness of our welcome emails or calls.

What additional information would have made onboarding smoother?

This set of onboarding feedback questions smooths out bumps and cements your trustworthiness—and shows customers you’re invested in their comfort from day one.

Best Practices for Crafting Insurance Survey Questions

A good insurance survey is like a friendly handshake—it’s welcoming, clear, and leaves a positive impression. Master the craft with these tips:

- Keep language plain, consumer-friendly, and in line with compliance standards

- Use a mix of closed-ended questions (for stats) and open-ended ones (for personal stories)

- Apply logic branching to skip irrelevant questions and prevent survey fatigue

- Time your surveys “in the moment,” post-claims for emotion, and pre-renewal for retention

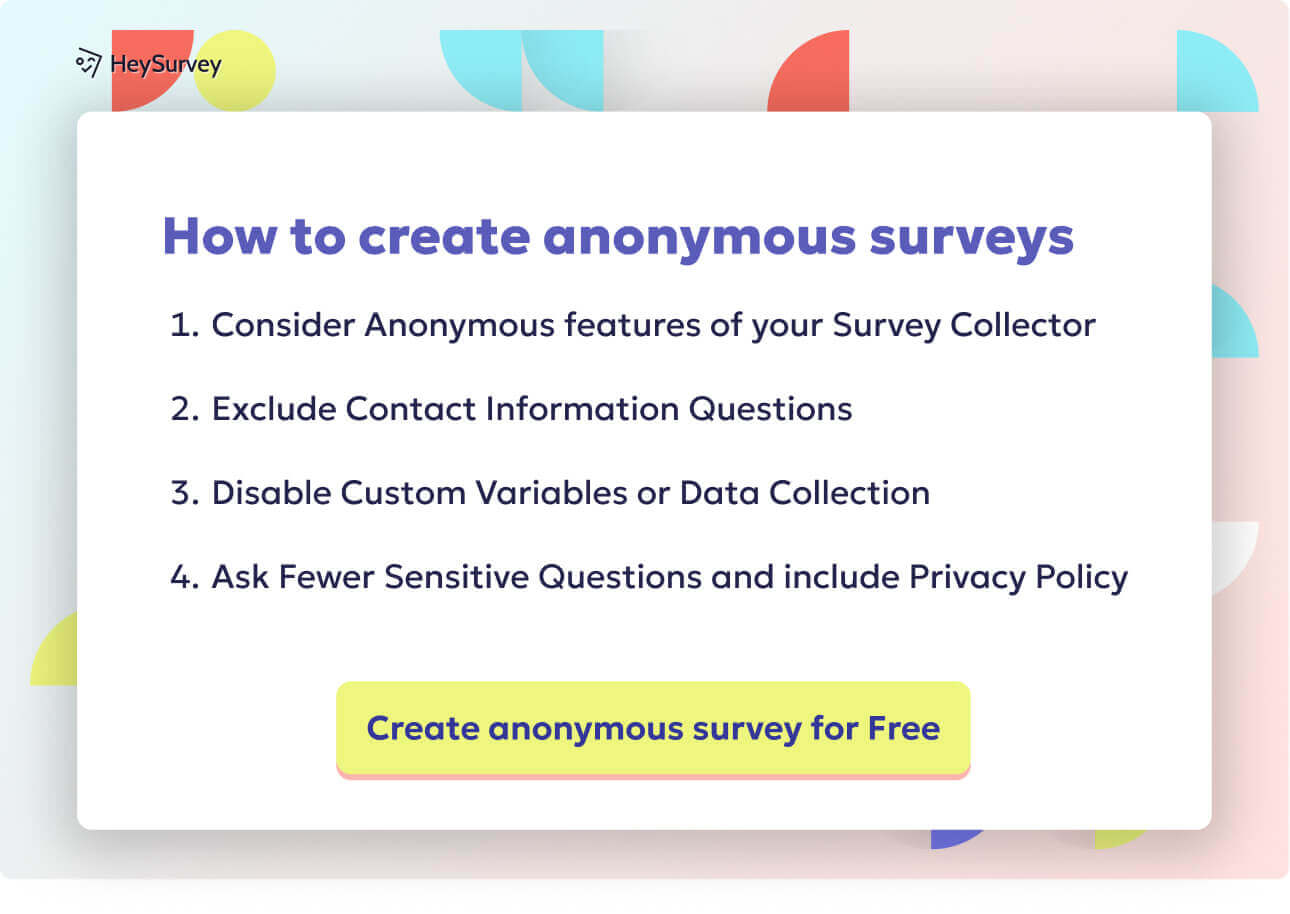

- Offer ironclad confidentiality to encourage honest and complete responses

- A/B test different subject lines and incentives to lift your response rates

- Personalize questions wherever possible for greater engagement

- Benchmark results to industry standards for meaningful action

- Let the dos guide you: Do keep it short, sharp, and focused

- Avoid the don’ts: Don’t ask double-barreled or leading questions, and don’t overload their inbox or patience

Each of these practices ensures your insurance survey questions are more insightful, actionable, and well received by your audience.

Conclusion & Next Steps

Insurance surveys are more than just a checkbox—they are the engine behind smarter acquisition, better retention, and brand loyalty that stands the test of time. Each survey type helps you target key goals, from onboarding to renewal, and everywhere in between. Make survey cadence part of your rhythm, align every answer with your KPIs, and update your questions as your business—and customer expectations—evolve. Ready for next-level insights? Download our Insurance Survey Template or reach out for custom survey design to fit your unique business needs.

Related Customer Survey Surveys

28 Restaurant Survey Questions to Boost Customer Feedback

Discover 25 essential restaurant survey questions to boost customer feedback and improve your din...

31 Interior Design Survey Questions: Types, Use & Examples

Discover 28 expert interior design survey questions covering preferences, style, budget, and more...

31 Essential Help Desk Survey Questions to Boost Support Success

Discover 30+ effective help desk survey questions with detailed examples to boost IT support feed...