31 Consumer Behavior Survey Questions: Types & Best Practices

Explore 40+ consumer behavior survey questions with expert tips on types, timing, and crafting effective market research questions for success.

Unlocking the inner workings of your customers’ minds sounds like magic, but consumer behavior surveys bring you pretty close. From shaping product development to laser-targeting marketing segments, understanding customer motivations turns wild guesses into data-powered decisions. Want higher ROI and a sharper edge over competitors? Market research questions are your not-so-secret weapon. Let’s dig in—here are the action-packed survey question sets and best-practice moves you need to master the art (and fun) of reading your market.

Purchase Intention Surveys

Why & When to Use This Type

Beneath every click and curious glance lies a hidden thought: “Will I actually buy this?” A purchase intention survey helps answer that exact question. These surveys are your crystal ball for predicting demand before you even launch a product. Use them when you’re weighing the potential of a shiny new idea, fine-tuning your pricing, or A/B testing essential features.

Forecasting intent is essential when your sales funnel springs a leak or you need to sort the next big hit from the flop. Brands cherish these insights for new product feasibility studies, and marketers love optimizing conversion when budgets and patience are tight. The bottom line? When you want to know if your offering is “hot or not,” it’s time to crank out those intent to buy questionnaire forms.

- Reduce wasted ad spend on duds

- Spot hidden objections before they tank sales

- Prioritize features or bundles that move the dial

- Set realistic inventory or supply targets

- Monitor shifts in intent during promotions or seasonal waves

5 Sample Questions

How likely are you to purchase [product] within the next 30 days?

Which of the following factors would most influence your decision to buy?

At what price point would you consider [product] too expensive to purchase?

What alternative brands or solutions are you currently considering?

What would make you buy sooner than planned?

Purchase intention survey questions aren’t just about future sales—they’re about pointing your resources where they matter most.

Purchase intention surveys can effectively predict consumer behavior, especially when conducted among relevant target markets and with comprehensive product information. (cambri.io)

Creating a purchase intention survey with HeySurvey is easy—even if you’re brand new to the platform. Just follow these 3 simple steps to get your survey up and running fast:

Step 1: Create a New Survey

- Head over to HeySurvey and start a new survey by clicking Create Survey.

- You can begin with a blank slate or save time by opening a purchase intention survey template using the button below this guide.

- Give your survey a clear, internal name so you’ll spot it easily later (think: “2024 New Product Purchase Intent”).

Step 2: Add Your Questions

- Use the Add Question button to insert your purchase intention questions.

- Select question types that fit your needs, like multiple choice for “How likely are you…” or rating scales for price sensitivity.

- Customize each question with your product name and options, and mark mandatory questions to ensure key data isn’t missed.

- Don’t forget to sprinkle in some open-ended questions if you want richer insights beyond just numbers.

Step 3: Publish Your Survey

- Once your questions are ready and you’ve given your survey a once-over, click Preview to see it in action.

- Make sure it flows smoothly on desktop and mobile devices—the fewer hurdles, the better your response rate!

- Hit Publish to generate your survey link. Sharing this link lets your audience start answering right away.

- Note: You’ll need to create a HeySurvey account to publish and track responses, which is quick and free.

Bonus Step 1: Apply Your Branding

- Upload your logo and choose colors in the Designer Sidebar to make the survey feel like a natural extension of your brand.

- This helps build recognition and trust with respondents, boosting participation and honest feedback.

Bonus Step 2: Define Settings

- Use the Settings Panel to set start/end dates, cap the number of responses, or add a redirect URL after completion.

- You can also allow respondents to view summary results when it makes sense.

Bonus Step 3: Skip Into Branches

- Create custom paths by setting branching logic so respondents see questions tailored to their previous answers.

- For instance, if someone isn’t likely to purchase soon, you might skip pricing questions but ask about competitors instead.

With HeySurvey’s intuitive interface, your purchase intention survey will be live and insightful in no time! Ready to get started? Just click the template button below and watch the insights roll in.

Product Usage Surveys

Why & When to Use This Type

After the hoopla of acquisition, the real test begins: do customers actually use your product, and how? A product usage survey delivers tangible answers, revealing how customers fit your solution into their routines, what features become favorites, and what makes them roll their eyes. Rolling these out two to four weeks after purchase—or post-freemium upgrade—gives enough time for honest feedback, not just buyer’s glow.

By peeking into daily usage, teams uncover which bits of their product shine and which sink. This info is gold for developers and success teams, as it helps reduce churn, optimize onboarding, and prioritize features in your next sprint. The result? How customers use products—not just if they like them—becomes your growth compass.

- Detect bottlenecks in first-use or setup flows

- Spot overlooked or misunderstood features

- Learn hacks and work-arounds dreamed up by your most clever users

- Catch churn signals early—before they become a crisis

- Tune rollout timing of feature updates or support emails

5 Sample Questions

How often do you use [product] in a typical week?

Which feature do you use most frequently?

In what setting do you primarily use the product (home, office, on-the-go)?

What work-around have you created to make the product fit your needs?

What, if anything, prevents you from using [product] more often?

Product usage surveys transform educated guesses into roadmap-ready truths.

Customers who complete satisfaction surveys are more likely to repurchase the same product or service in the medium and long term. (business.rice.edu)

Brand Perception Surveys

Why & When to Use This Type

Your brand is a living, breathing thing built on every story and impression shared about it. A brand perception survey tracks how people actually feel about you—emotionally and logically—against the competition. These should be fielded quarterly, or right after big campaigns, to spot surges in loyalty or jitters from bad press.

Why wait for sales reports to tell you something’s off when a quick pulse check can highlight brand-health swings? Whether your brand’s vibe is bold and edgy or nurturing and reliable, knowing your reputation in real-time is a massive strategic edge when refining positioning or messaging.

- Measure associations (trust, innovation, fun, reliability, etc.)

- Detect mismatches between intended persona and how you’re seen

- Benchmark against hungry upstarts or legacy competitors

- Track effectiveness of rebrands, slogan changes, or new mascots

- Prioritize customer experience investments in areas that matter

5 Sample Questions

Which three words come to mind when you think of [brand]?

On a scale of 1–10, how trustworthy do you find [brand]?

How does [brand] compare to competitors in terms of innovation?

What brand personality traits do you associate with [brand]?

Would you recommend [brand] to a friend? Why or why not?

Brand perception survey questions give you the vocabulary—and scores—you need for lasting loyalty.

Price Sensitivity Surveys

Why & When to Use This Type

Setting prices isn’t a game of blindfolded darts. A price sensitivity survey helps you identify exactly where the sweet spot lives between “bargain” and “break the bank.” Tools like the Van Westendorp Price Sensitivity Meter or Gabor-Granger techniques make these surveys a must before changing prices, launching new tiers, or entering fresh markets.

Map out what customers call “cheap,” “fair,” “expensive,” or “ridiculous.” See what perks or bundles actually justify higher ticket tags. Time these surveys right before price shifts or as you weigh discount triggers, and you’ll sidestep costly pricing blunders.

- Reduce risk of pricing yourself out of your own market

- Uncover unexpected value markers or upgrade triggers

- Compare perceived price-value between segments or locations

- Dial in discounts or seasonal sales for max effect

- Spot the risk of churn following a price hike

5 Sample Questions

At what price would you consider [product] to be a bargain?

At what price would the product start to seem expensive, but still worth buying?

At what price would the product be too expensive to consider?

How would a 10% price increase affect your purchase intent?

Rank the following benefits in order of importance when justifying price.

Price sensitivity survey results keep your margins—and your customers—happy.

The Van Westendorp Price Sensitivity Meter effectively identifies consumer price perceptions but may lack accuracy due to its assumption of linear price perception and absence of competitive context. (symson.com)

Decision-Making Process Surveys

Why & When to Use This Type

Before credit cards fly, a mysterious journey unfolds: the consumer decision-making dance. A well-crafted consumer decision-making survey uncovers the trail your buyers blaze on the way to “yes.” Want to know who’s writing pros and cons, which YouTube influencer tilts the scales, or how long it takes to move from interest to action? These surveys are your guide.

Ideal for persona development or mapping the buyer’s journey, these surveys clarify which info sources are king and how evaluation priorities shift across segments. Use them when building out sales playbooks, tailoring email cadences, or aligning teams around the real-world buying adventure.

- Profile typical decision timelines for B2B and B2C

- Uncover influence of family, friends, and online reviews

- Rank the most persuasive decision drivers

- Spot drop-off points and hesitation moments

- Zero in on factors that prompt shortcutting or abandonment

5 Sample Questions

Who is involved in the decision to purchase [product]?

Which sources do you consult before buying?

How long do you typically research before making a purchase?

Rank these factors (price, quality, brand, reviews) in order of importance.

What was the tipping point that convinced you to buy?

Buyer journey survey questions make invisible pathways visible.

Post-Purchase Evaluation Surveys

Why & When to Use This Type

The sale is just the opening act. A post-purchase survey checks how your performance stacks up against towering expectations and hopeful promises. These are best sent within a week or two of delivery—close enough for fresh impressions, but not so soon that delight hasn’t had time to simmer.

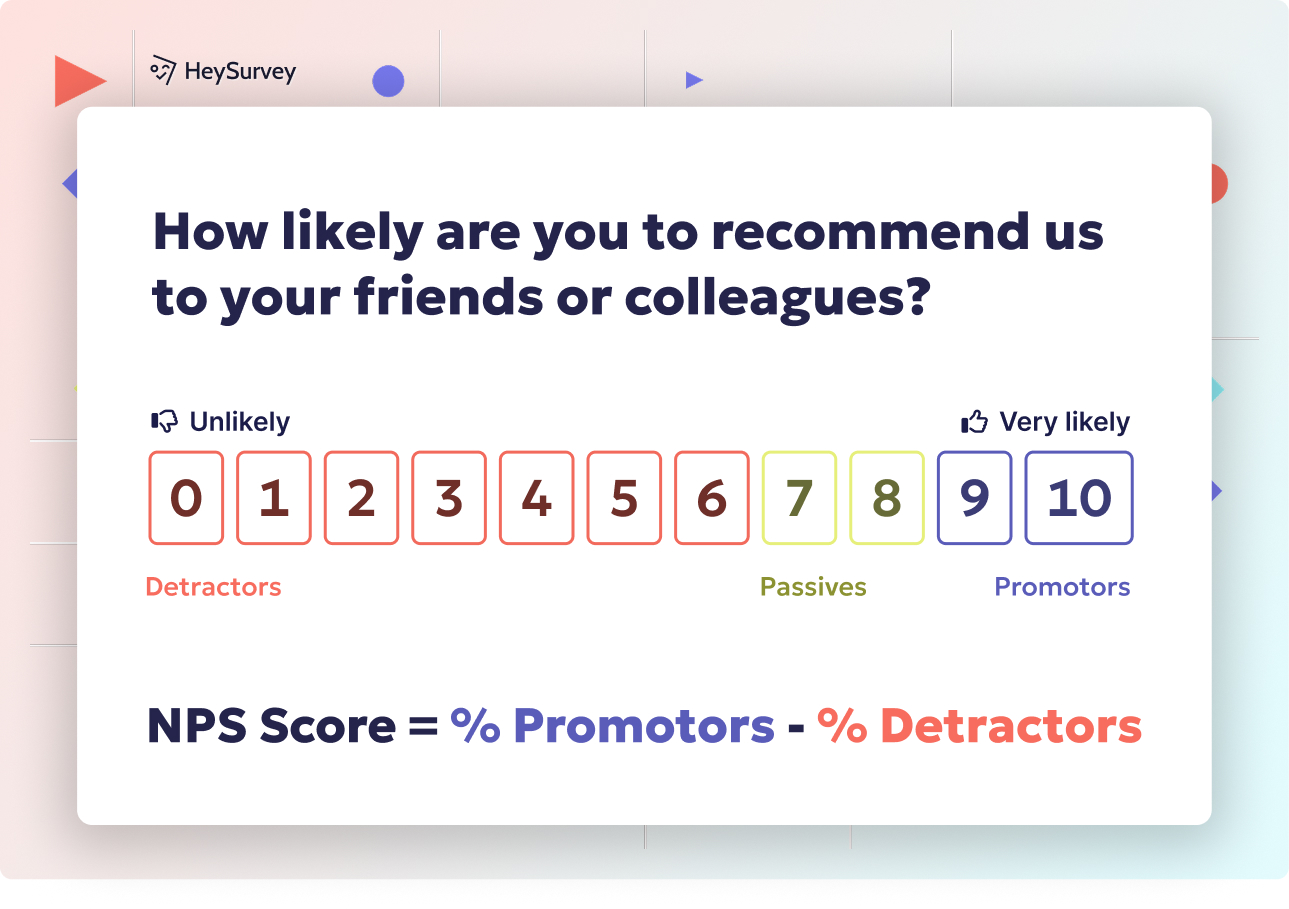

With these questions, you’ll spot friction points, exceeders, and the must-fix moments you need to win customer loyalty loops. Monitor Net Promoter Scores, gather glowing testimonials, and catch nagging issues early before they grow legs and post on social media.

- Identify unmet needs or winning features

- Diagram expectation gaps between marketing and reality

- Fuel case studies and reviews with genuine social proof

- Flag service or shipping issues while solutions can still dazzle

- Map intent to repurchase, renew, or explore premium options

5 Sample Questions

How satisfied are you with your recent purchase of [product]?

Did the product meet, exceed, or fall short of your expectations?

What was the most pleasant surprise after using [product]?

What could we improve for a better experience?

How likely are you to repurchase or upgrade in the future?

Customer satisfaction starts here—one honest answer at a time.

Lifestyle & Psychographic Surveys

Why & When to Use This Type

Numbers alone don’t tell you why people buy yoga mats or minivans. Enter the psychographic survey, your lens into mindsets, values, and secret aspirations driving reality-bending brand loyalty. Use these when building early market maps or revamping brand positioning so your messaging vibes with your target.

These surveys go beyond classic demographics, tapping into attitudes, hobbies, social concerns, and self-identity. Segment customers by what matters—not just who they are or where they live—and you’ll market with heart, not just algorithms.

- Cluster by interests and lifestyle for campaigns that click

- Map values (eco-consciousness, status, family, adventure)

- Personalize communication around relevant causes or passions

- Discover hidden tribes within your broader audience

- Test sponsorships or influencer partnerships for authenticity

5 Sample Questions

Which of the following hobbies do you participate in weekly?

How strongly do you agree: ‘I prefer experiences over possessions.’

When choosing a brand, how important is environmental impact?

Which social causes resonate most with you?

Describe your ideal weekend in one sentence.

Lifestyle segmentation means you’re not just selling—they’re relating.

Channel & Touchpoint Preference Surveys

Why & When to Use This Type

Modern shoppers bounce between channels—and their thumbs know the way. A sharp omnichannel survey helps you chart where discovery, trust, and shopping actually happen. Optimize your mix before launching a new chat, beefing up phone support, or deciding how to divvy up ad spend.

Unlock which platforms make the best store windows, which review sites customers believe, and how folks feel about buying via app vs. browser vs. brick-and-mortar. Get the pulse, then streamline every step to fit those preferences.

- Prevent wasted investment in underused channels

- Personalize support and communication to delight

- Craft seamless transitions between discovery, purchase, and help

- Uncover pain points in current omnichannel journey

- Plan inventory or ads where they truly pay off

5 Sample Questions

Where do you usually discover new products (social media, search, in-store)?

Which channel do you trust most for product reviews?

What is your preferred method for customer support?

How comfortable are you purchasing via mobile apps?

Rank these touchpoints (website chat, phone, email, SMS) for convenience.

Customer touchpoint preferences determine which channels get you the “big yes.”

Dos and Don’ts: Best Practices for Crafting Consumer Behavior Survey Questions

Dos for Next-Level Surveys

Let’s get real: Not all surveys are created equal. To unlock honest, actionable intel, keep these dos in play:

- Keep wording neutral so you don’t nudge answers

- Segment with smart logic branching for tailored question flows

- Mix closed-ended and open-ended questions for depth and scalability

- Test your survey on mobile devices to ensure it’s mobile optimized

- Limit survey length—10 questions or fewer keeps completion rates up

- Clearly state incentives and honor ethical guidelines

- Build in data privacy compliance (think GDPR/CCPA), no exceptions

For analysis, remember to:

- Cross-tab data by demographics or motivators for deeper trends

- Apply predictive modeling to forecast future behavior

- Use sentiment analysis on open-ends to unlock nuanced insights

Don’ts to Dodge

Skirting these pitfalls ensures your insights are actually usable:

- Don’t use double-barreled questions (e.g., “easy and affordable—yes or no?”)

- Don’t write with leading language that sways answers

- Never cram in jargon or assume knowledge—keep it plain and breezy

- Don’t forget to test for device compatibility (hello, mobile shoppers)

- Don’t ask too many required questions—you’re measuring intent, not patience

A winning survey experience is all about respect (for time, privacy, and voice), smart design, and asking questions you’ll know what to do with.

Following these best-practice approaches, how to write consumer survey questions won’t just be skillful—it’ll be strategic and even fun. The right mix of curiosity, psychology, and clarity turns your next survey into a rocket for real business growth. Unlock patterns, tweak your offerings, and watch your market insights soar.

Related Market Survey Surveys

32 Market Research Survey Questions: Types, Samples & Tips

Explore 30+ market research survey questions with examples across types like CSAT, concept testin...

30 Coffee Survey Questions: The Complete Guide for Cafés & Brands

Discover 25+ expert coffee survey questions to boost cafés, product development, and brand insigh...

31 Content Marketing Survey Questions for Actionable Insights

Discover 25+ content marketing survey questions to gather actionable insights—boost audience alig...