32 Financial Survey Questions: Types, Use-Cases & Templates

Explore 28 expert financial survey questions across 7 types to unlock spending habits, investment goals, literacy, and more insights.

Financial insights are central to smarter decisions—for individuals planning monthly budgets, employees contemplating retirement, or organizations launching the next FinTech revolution. Only the right data can reveal hidden spending patterns, knowledge gaps, or shifting investment attitudes. When you need anonymous feedback, nationwide reach, or scalable rapid research, financial surveys shine brighter than interviews or focus groups. Explore seven top survey types, each unlocking actionable insights and loaded with sample question templates you can use today.

Personal Budgeting & Spending Habits Survey

Why and When to Use This Type of Survey

Personal budgeting and spending habits surveys are designed to illuminate the everyday choices people make with their money. This survey zeroes in on spending leaks, budget confidence, and the quirks of real-life money management. Whether you’re a budgeting app developer, a credit-counseling agency, or a researcher peering into household economics, this survey fits.

- Launch a new budgeting product? Deploy this survey first for market clarity.

- Want to understand the effectiveness of financial-education programs? Start here.

- Looking for pain points in consumer spending? This survey is your go-to.

A major plus is timing: Use it ahead of product launches, before educational workshops, or as part of ongoing user feedback. You’ll glean honest insights into how people actually allocate their funds—often a mystery, even to themselves. Crucially, the anonymous format helps respondents be candid about financial struggles and wins alike.

Sample Questions

How often do you track your monthly expenses?

Which expense category surprises you most at month-end?

What percentage of your income goes to discretionary spending?

Rank the tools you use for budgeting (spreadsheets, apps, manual notes, none).

On a scale of 1-10, how confident are you in sticking to your budget?

What single change would most improve your budgeting success?

These questions dig beneath the surface to reveal both weaknesses and strengths in personal finance routines. Survey results can inform new features, tutorials, or community support strategies—making your next step more than just a shot in the dark.

Approximately 74% of Americans maintain a monthly budget, yet 84% of those admit to exceeding it at times. (nerdwallet.com)

Creating your financial survey with HeySurvey is a breeze—even if you’re brand new! Follow these three easy steps to get your survey up and running in no time.

Step 1: Create a New Survey

Start by logging in or opening HeySurvey. Click on “Create New Survey” and choose whether to build your survey from scratch or pick a ready-made template relevant to your financial topic. Templates help you get going fast with professionally structured questions already in place.

- Give your survey a clear internal name for easy management.

- Decide on your survey language and any initial settings.

- Hit “Create” to open the main Survey Editor.

Step 2: Add Your Questions

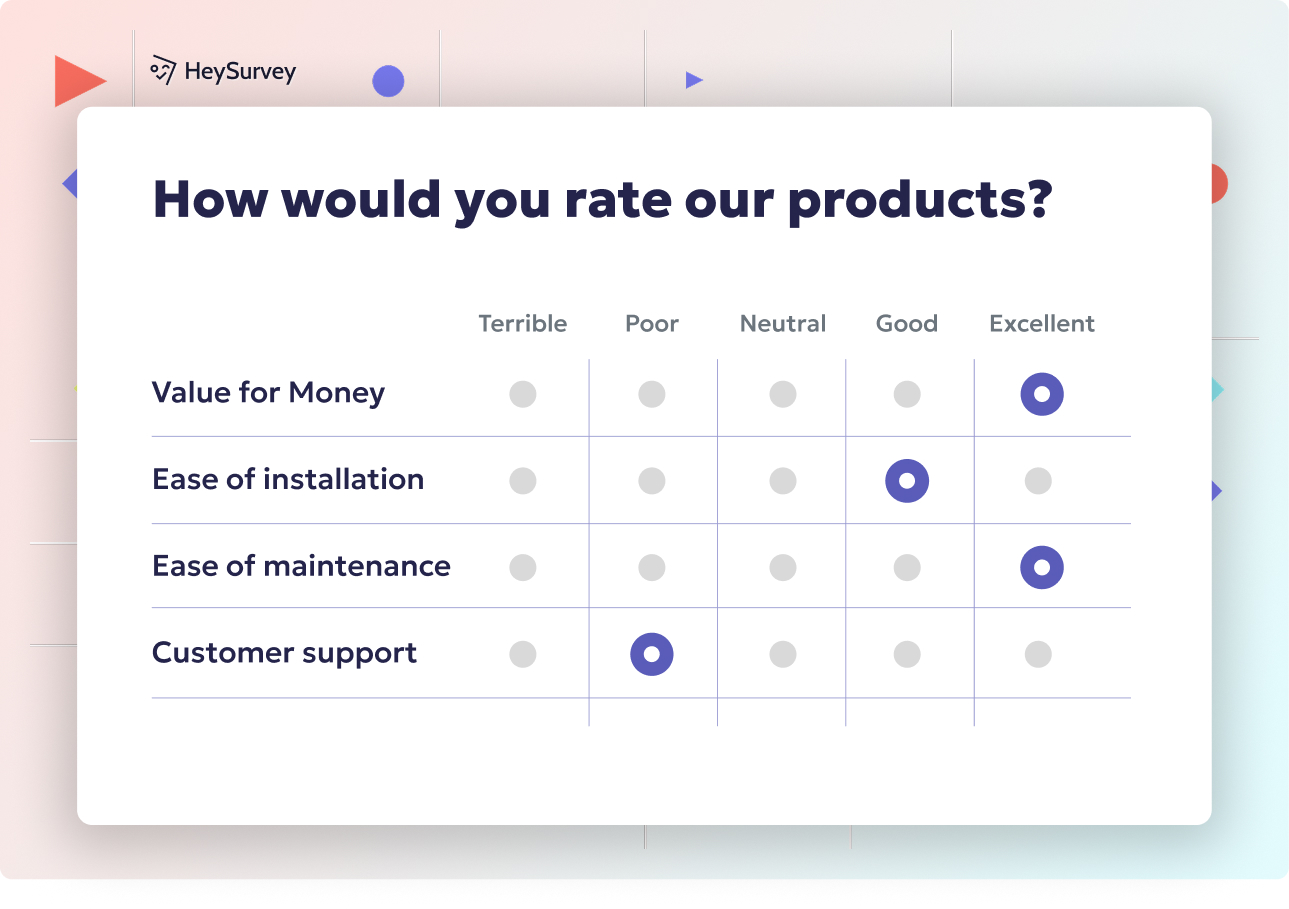

Next, add the questions you want to ask your respondents. Click on the “Add Question” button, then pick the question type—multiple choice, scale, text entry, or others—that suits each question best.

- Customize question text and descriptions.

- Set questions as required if you need a mandatory answer.

- Rearrange question order by dragging and dropping to create a smooth flow.

- Use branching to send respondents down different paths based on their answers, if you want a tailored experience.

Step 3: Publish Your Survey

Once your questions are set and your design polished, preview your survey to see how it looks on desktop and mobile screens. When you’re happy, click “Publish.”

- Generate a shareable link for email distribution, website embedding, or social media.

- Remember: Publishing requires an account so you can collect and analyze responses.

Bonus Step: Apply Your Branding

Hop into the Designer Sidebar to add your company logo or adjust colors and fonts. This makes your survey look the part and builds trust among respondents.

Bonus Step: Define Your Settings

Visit the Settings Panel to configure start/end dates, response limits, thank-you page redirects, and data privacy options. You can even allow respondents to view collective results if it suits your goals.

Bonus Step: Create Branches

Want the survey to adapt to each respondent’s input? Use HeySurvey’s branching logic. Choose which question comes next based on prior answers—perfect for diving deeper or skipping irrelevant sections.

When you’re ready, just tap the button below to open a template tailored to the financial survey type you want to create—and start collecting those golden insights today!

Investment Goals & Risk Tolerance Survey

Why and When to Use This Type of Survey

Understanding the unique investment profile of each individual is vital for successful portfolio management. This survey focuses on uncovering goals, time horizons, and risk comfort, giving advisors a clear route to tailored recommendations. It’s priceless for robo-advisors, financial planners, and brokerages customizing portfolios.

- Perfect for onboarding new clients—get to the heart of their investment style fast.

- Useful before updating KYC (Know Your Customer) files, so all advice stays relevant.

- Great as part of annual portfolio check-ins, making sure risk and goals stay aligned.

Serving up these questions flushes out cold feet, speculative urges, and appetite for the unknown—so your next allocation isn’t just based on gut instinct. Honest risk-tolerance answers are gold for compliance and suitability standards.

Sample Questions

What is your primary investment objective (growth, income, preservation, speculation)?

How would you react if your portfolio lost 15 % in a single quarter?

What is your planned investment time horizon?

Which asset classes do you currently hold?

Rate your knowledge of investment products (1-novice to 5-expert).

How frequently do you review your investment performance?

Whether you’re an advisor tailoring advice or a platform improving default recommendations, these questions steer you clear of mismatched allocations. They set the stage for trust, transparency, and smarter investment choices.

Risk tolerance questionnaires often fail to predict actual investor behavior during market volatility due to subjective interpretations of risk and emotional responses. (kitces.com)

Financial Literacy & Knowledge Survey

Why and When to Use This Type of Survey

Financial literacy surveys shine a spotlight on what people really know about money. This survey uncovers gaps in concepts like interest, credit scores, and diversification—areas where myths and misunderstandings run rampant. Educators, nonprofits, and banks are frequent users, especially when planning or evaluating program impact.

- Kick off any workshop, classroom course, or online module with this baseline.

- Assess change over time by repeating the survey after program delivery.

- Use aggregated data to justify new content funding or pinpoint curriculum priorities.

People often overestimate their own financial savvy. A clear snapshot from this survey lets organizations meet learners at their true starting point. And for regulatory compliance or grant reporting, nothing beats hard data on what participants actually comprehend.

Sample Questions

What does APR stand for?

True or false: A diversified portfolio lowers risk.

How long would it take $1,000 to double at 7 % annual return (rule of 72)?

Which factor affects your credit score the most?

Which statement about inflation is correct?

Rate your confidence in reading a credit-card statement.

A well-designed literacy survey pulls double duty—unveiling strengths to celebrate and weaknesses to tackle. You’ll build more engaging, effective content with concrete feedback on knowledge gaps.

Retirement Planning & Preparedness Survey

Why and When to Use This Type of Survey

Retirement readiness remains one of the most pressing—and stress-inducing—aspects of personal finance. This survey examines savings rates, planning status, expected retirement age, and likely income sources for your golden years. It’s an essential tool for HR teams, pension providers, and financial advisors.

- Use it during annual benefits enrollment or when reviewing existing retirement programs.

- Roll it out as part of a broader workplace financial wellness audit.

- Identify readiness gaps early—before employees face a shortfall too late to fix.

Providing a safe space for honest reflection, this survey helps organizations spot who’s on track and who’s in trouble. Participation also nudges individuals to think about the future—often a first step toward action.

Sample Questions

At what age do you aim to retire?

What percentage of your salary do you contribute to retirement accounts?

Do you have a written retirement income plan?

Rate your confidence in maintaining lifestyle post-retirement.

Which retirement income sources do you expect to rely on?

What is your biggest obstacle to saving more for retirement?

These questions tease out both obstacles and motivations, pointing the way for targeted guidance. Survey insights justify plan enhancements or targeted communications—before stress turns into crisis.

A 2024 Bankrate survey found that 57% of American workers feel behind on their retirement savings, with 35% significantly behind. (bankrate.com)

Employee Financial Wellness Survey

Why and When to Use This Type of Survey

An employee’s financial stress doesn’t punch out at 5 p.m.—it follows them onto the job. This survey takes the pulse of employee well-being by diving into debt, savings cushions, education needs, and benefits satisfaction. HR leaders, office managers, and wellness pros rely on it.

- Run baseline surveys after onboarding, then update annually for trend data.

- Use after changes to retirement or health benefits for real-time feedback.

- Segment data by location, tenure, or department to fine-tune wellness offerings.

Employers committed to productivity and retention know that financial stress affects everything from absenteeism to engagement. Confidential surveys gather the frank truth—without the discomfort of face-to-face disclosures.

Sample Questions

How would you rate your current level of financial stress?

Do you have at least three months of living expenses saved?

Which financial topics would you like more workplace education on?

How valuable do you find our current financial-wellness benefits?

How often do financial concerns distract you at work?

Which new benefit would most improve your financial health?

The answers light a path for employers, helping them build better benefits and more targeted education. Win-win: reduced stress, happier teams, and fewer costly productivity dips.

Banking & FinTech Preferences Survey

Why and When to Use This Type of Survey

Banking and FinTech moves fast, and customer loyalty can be as fleeting as a trend on social media. This survey dives into preferred channels, digital trust, feature wishlists, and the likelihood of switching. It’s ideal for product managers at traditional banks, neobanks, and hot new app startups.

- Roll it out after a major new feature goes live, gauging customer demand and satisfaction.

- Use for competitive intelligence—what customers like elsewhere but your app lacks.

- Test product-market fit ahead of a new launch or marketing push.

Understanding which banking tools get used (or ignored) provides your roadmap for smarter investment. Hear straight from the source what builds trust—or sends users running back to bricks-and-mortar.

Sample Questions

Which banking channels do you use weekly (mobile app, branch, ATM, web)?

Rank the following features by importance: instant transfers, budgeting tools, crypto trading, etc.

What is your primary concern about digital-only banks?

How likely are you to switch banks in the next 12 months?

Which FinTech apps have replaced traditional banking services for you?

What would make you trust a new financial app immediately?

Data here doesn’t just influence features—it can sway marketing, customer support, and even risk management decisions. Stay ahead of evolving expectations before the competition does.

Small Business Financial Health Survey

Why and When to Use This Type of Survey

Small businesses are the heartbeat of the economy, yet many operate without a safety net. This survey uncovers pain points in cash flow, access to financing, and the realities of bookkeeping. Lenders, SaaS accounting platforms, and local chambers of commerce find it indispensable.

- Before designing new lending products, check the pulse of capital needs.

- Roll out during tax season or budgeting cycles for sharp, fresh insights.

- Use survey data to segment businesses for events, webinars, or advisory support.

Armed with anonymous feedback, platforms and lenders can tailor tools and loans to real-world needs—not just assumptions. The survey also flags underserved segments for special outreach.

Sample Questions

How many months of operating expenses can your cash reserves cover?

What is your biggest finance-related challenge today?

Which funding sources have you used in the past 12 months?

How frequently do you update your financial statements?

Rate your satisfaction with current accounting software.

Are you planning to seek external financing within the next year?

You’ll spot patterns that suggest new service opportunities, warnings signs, or education gaps—before business failure rates creep up. Brighter, more resilient Main Street starts with smarter, targeted listening.

Best Practices: Dos & Don’ts for Crafting High-Impact Financial Surveys

Dos

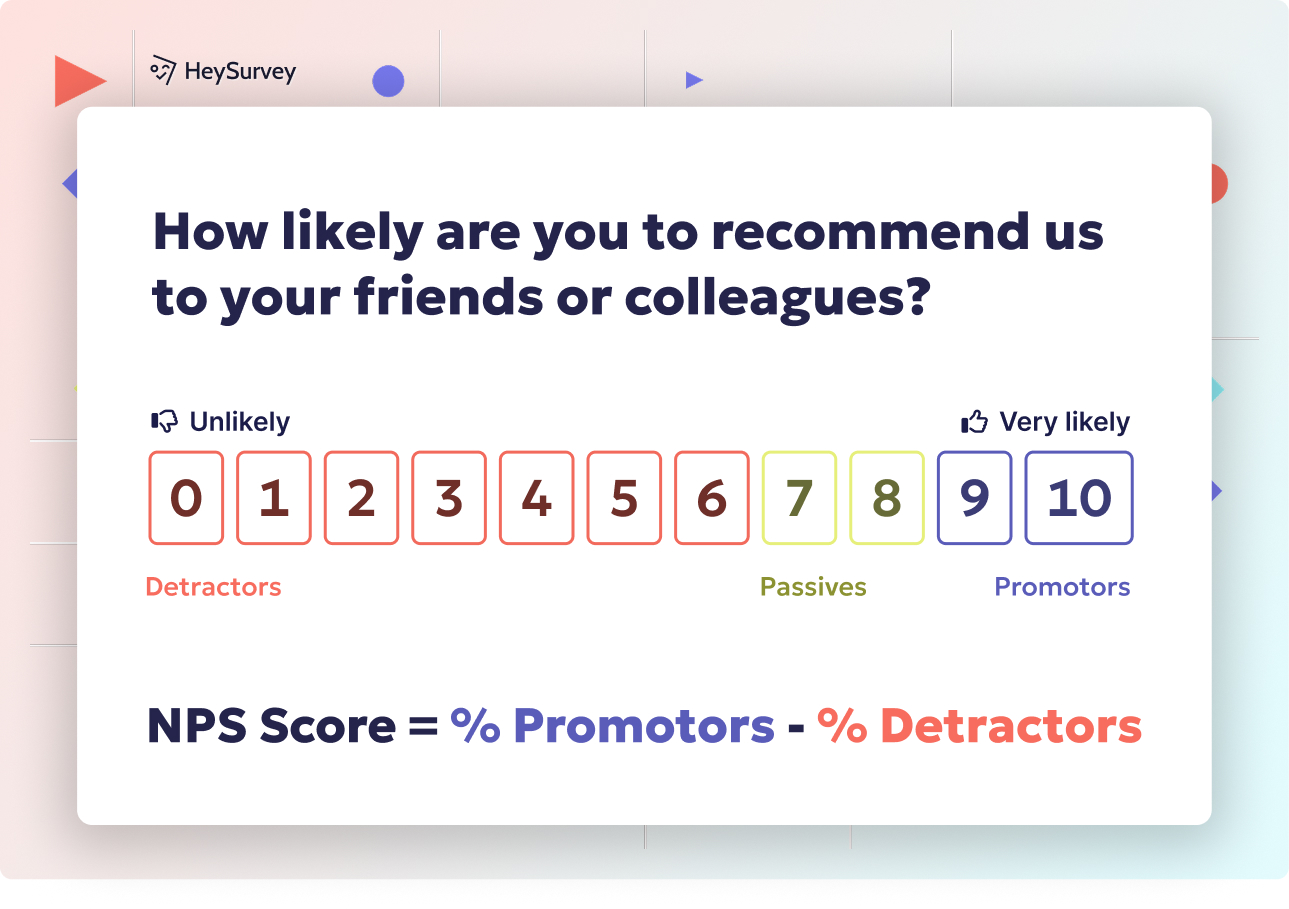

- Use clear rating scales so respondents know exactly what each number means.

- Keep survey language simple and minimize jargon that can confuse or intimidate.

- Ensure absolute anonymity to encourage candid responses and higher participation.

- Pilot test your survey to spot confusing questions or technical glitches before a broad launch.

- Mobile-optimize every question for the tap-tap convenience of small screens.

- Create a logical flow—group similar topics and make the path intuitive.

- Offer incentives or gentle reminders for encouraging more completions.

- Comply with modern data laws—GDPR or CCPA are non-negotiable.

- Segment respondents for richer, more actionable analysis.

- Carefully time and stagger reminders for maximum response rates without burning goodwill.

Don’ts

- Don’t combine multiple metrics in one question (“Rate your savings and debt” = confusion).

- Avoid leading or biased wording that nudges answers in your preferred direction.

- Never ask for sensitive data unless absolutely necessary—and explain why.

- Resist the urge to overload surveys; keep it concise, respecting people’s time.

- Don’t skimp on accessibility—test surveys for screen readers and assistive devices.

- Avoid abrupt survey endings—always thank respondents at the finish line.

A sprinkle of respect, a dash of seamless tech, and a big dose of clarity mean your survey data is always crisp, actionable, and reliable. The best survey is one that’s easy to take and even easier to act on.

A winning financial survey delivers more than spreadsheets or market forecasts. It captures real voices, uncovers truths, and inspires better tools, programs, and portfolios. Use these proven question templates and best practices to craft your next survey—and watch your financial insights soar. Nothing replaces the power of a well-asked question. Now, go ask yours.

Related Financial Survey Surveys

29 Income Survey Questions: Types, Uses & Best Practices Guide

Explore 35 sample income survey questions across 7 types to capture accurate data for market rese...

32 Salary Survey Questions Examples – The Complete 2025 Guide

Discover 28 salary survey questions example across 8 survey types to collect accurate, actionable...

29 Income Range Survey Questions: Types, Uses & Examples

Explore 25+ income ranges survey questions with practical examples, types, and best practices to ...