32 Fast Food Survey Questions: Types, Uses & Winning Examples

Explore 30 expert fast food survey questions across 7 types to boost customer feedback, satisfaction, and loyalty in quick-service dining.

The fast-food industry is about as fierce as a lunchtime rush at a city center drive-thru. Margins are thinner than a French fry, and only those with supercharged insights keep customers coming back for more. Fast-food surveys feed brands the real-time feedback needed to survive—and thrive. Whether you’re catching guests right after a meal or keeping the brand pulse with regular check-ins, smart surveys are the secret sauce from discovery to loyalty. So, let’s explore all seven survey types guaranteed to spice up your quick-service customer feedback arsenal.

Customer Satisfaction (CSAT) Surveys

The customer satisfaction survey is the workhorse of fast-food feedback. It’s all about capturing how guests feel about a specific visit or order, no more, no less. Unlike surveys that dive deep into psychology or brand strategy, CSAT surveys are refreshingly direct. If you’re keen to know whether today’s burger hit the mark or the fries were perfectly golden, this is your go-to tool.

Why & When to Use CSAT

Timing is everything with CSAT surveys. They shine brightest when sent within 24 hours of a visit, while the taste linger and impressions are fresh. Common touchpoints include: - Receipt invites with a QR code, so customers can respond before the ketchup dries. - Digital kiosks that ask a quick question as customers finish their order. - Email follow-up sent directly after online or app-based orders. - In-app pop-ups triggered after order completion.

Deploying them in-the-moment lets managers track individual location performance, crush service issues before they snowball, and keep a close eye on trends. It’s also the easiest way for staff to get almost instant feedback, so they know when they’re doing a great job—or when they need to step up.

CSAT is crucial: - When launching new service protocols. - For rapid seasonal menu changes. - To isolate site-specific hiccups.

5 Sample CSAT Questions

How satisfied were you with your visit to [Brand] today? (1–5 scale)

How would you rate the freshness of your meal?

Was your order prepared accurately? (Yes/No)

How satisfied were you with the speed of service?

How likely are you to return to this location in the next month?

With bite-sized questions and real-time delivery, CSAT surveys give you a fast snapshot of what’s working and what’s not—no mystery, just results.

A study in the Australian fast food industry identified four key factors influencing customer satisfaction: personal service, communication, service setting, and assurance. (journals.sagepub.com)

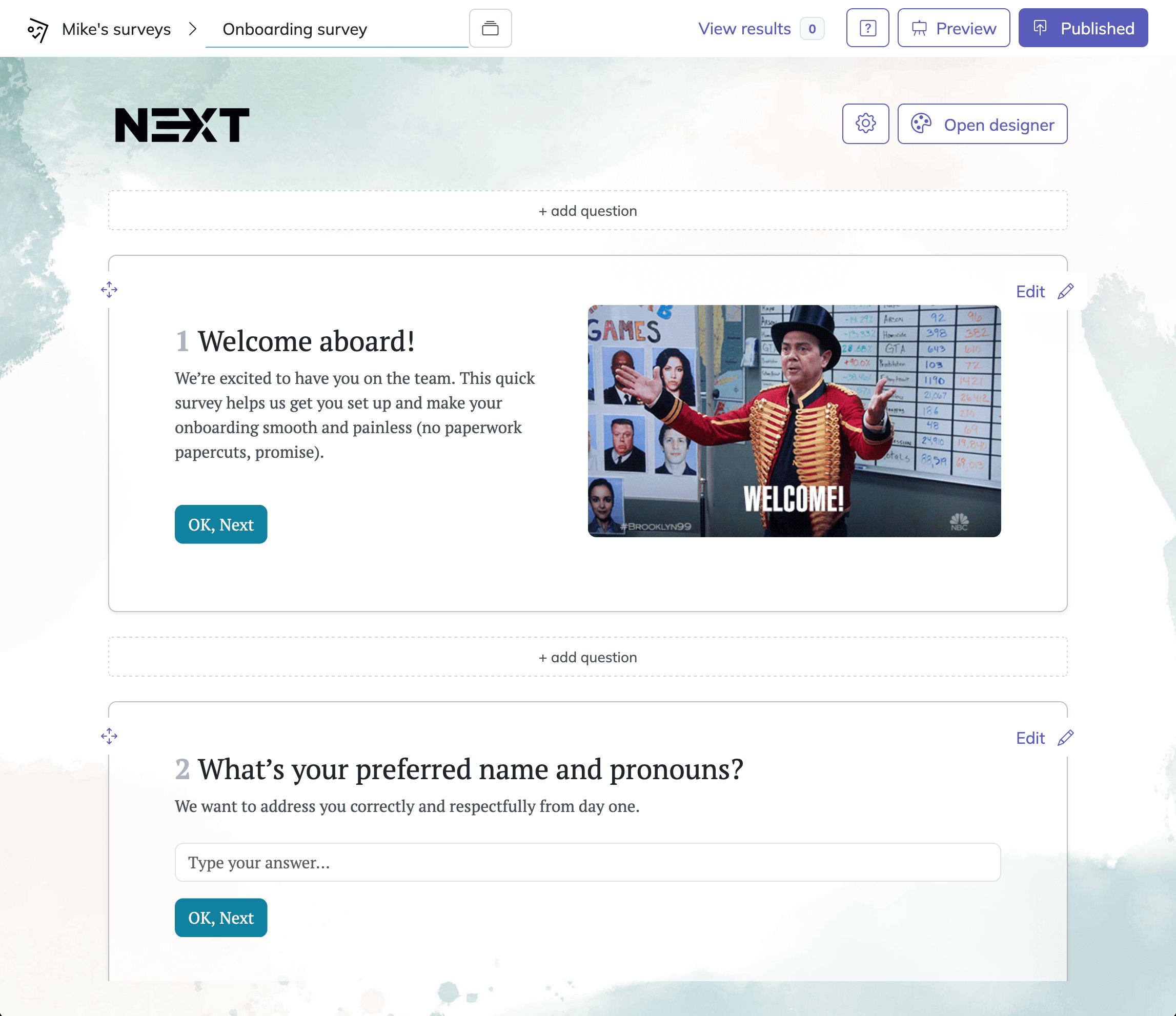

Creating your fast-food survey with HeySurvey is as easy as a triple-decker burger! Here’s your quick start guide to get that feedback sizzling in no time:

Step 1: Create a New Survey

- Head over to HeySurvey and click “Create Survey”.

- Choose a template or start from an empty sheet if you prefer full customization.

- Give your survey a name—something like “Fast-Food Customer Satisfaction” to keep things organized.

Step 2: Add Questions

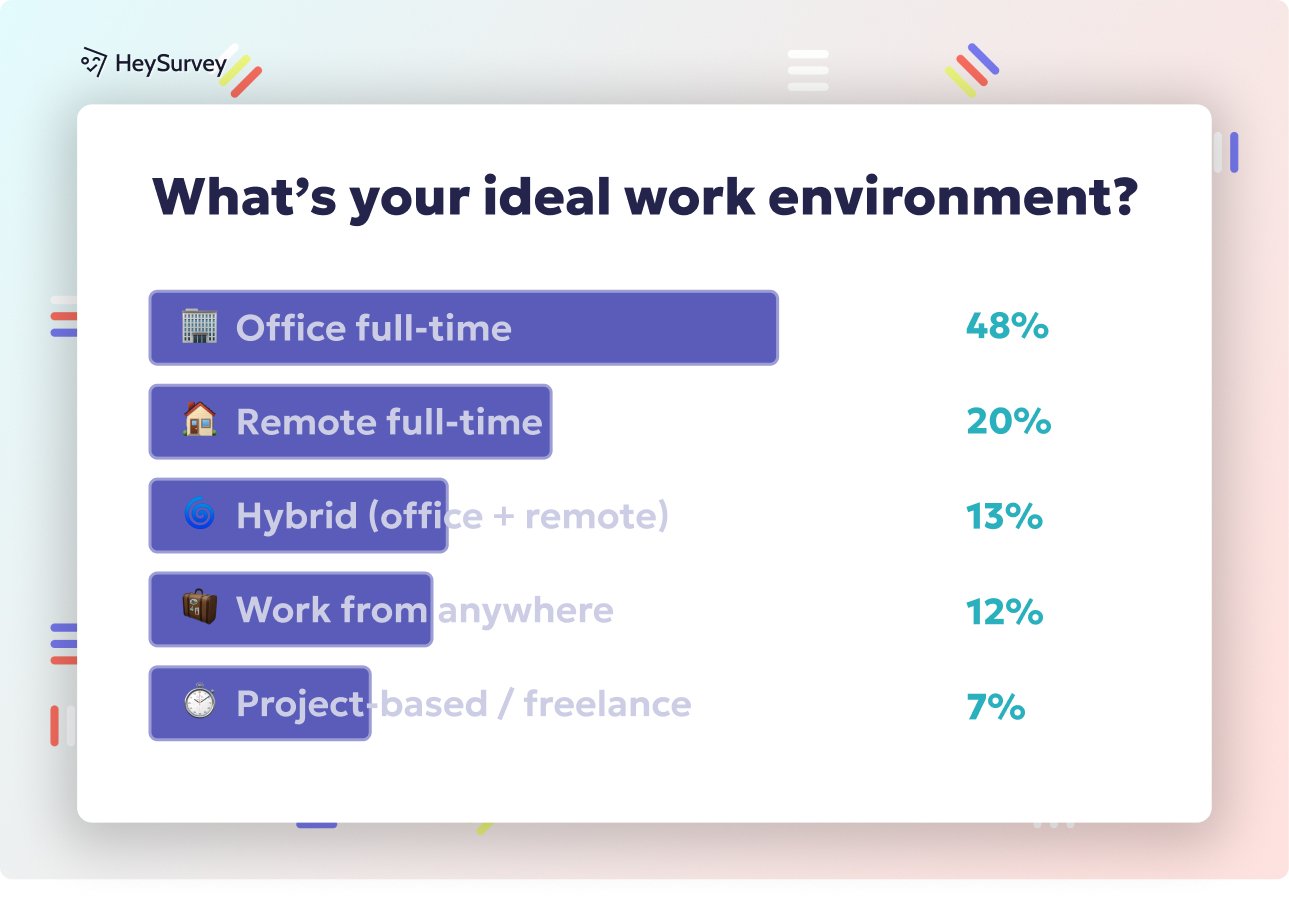

- Click the “Add Question” button at the top or between existing questions.

- Pick the question type that fits your needs, such as Choice, Scale, or Text.

- Enter your question text, for example: “How satisfied were you with your visit today?”

- Mark any important questions as required so you don’t miss critical feedback.

- Feel free to add images or descriptions to spice up the survey experience!

Step 3: Publish Your Survey

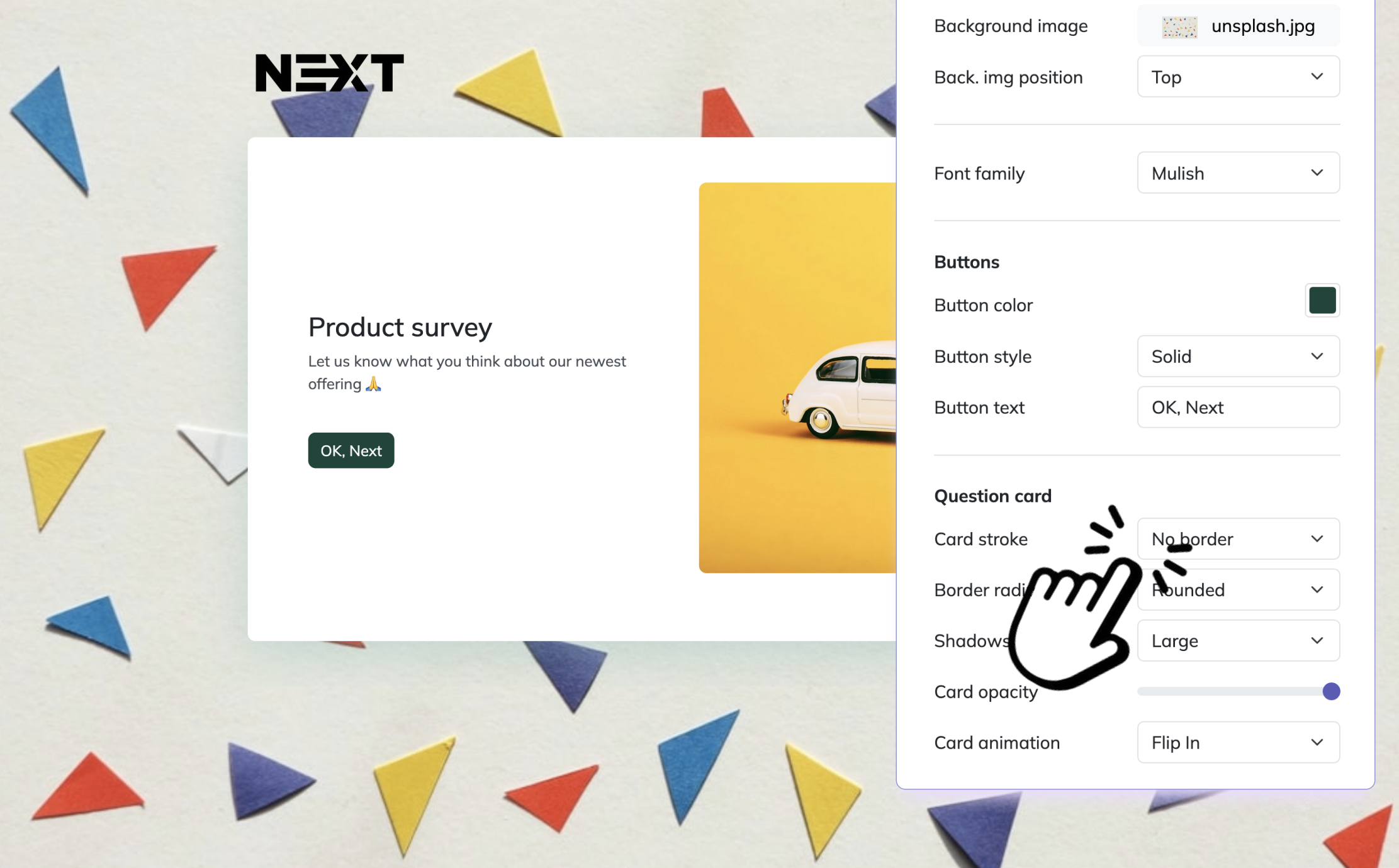

- When you’re happy with your questions, hit the “Preview” button to see how it looks.

- Tweak colors and fonts in the Designer Sidebar if you want your survey to match your brand.

- Click “Publish” to get a shareable link. (You’ll need an account for publishing.)

- Share the survey link via email, SMS, receipts, or on kiosks to start collecting responses.

Bonus Steps: Customize and Optimize

- Apply Branding: Upload your logo in the Branding panel to make the survey unmistakably yours.

- Define Settings: Set start and end dates, response limits, or redirect users after completion in the Settings panel.

- Use Branching: Create custom paths by defining which question appears next based on answers—perfect for tailoring the experience.

Ready to dive in? Click the button below to open a fast-food survey template and start gathering that delicious feedback today!

Net Promoter Score (NPS) Surveys

When it comes to customer loyalty, the Net Promoter Score survey reigns supreme. It’s part crystal ball, part popularity contest. The NPS survey doesn’t just measure satisfaction; it gets customers to declare their allegiance. Will they rave about you or send friends to a rival? With a single number, you’ll know if you’re building a fan army—or losing out to the burger joint next door.

Why & When to Use NPS

NPS surveys are best served at intervals, not after every meal. They work wonders when sent quarterly to loyal guests—think: - App users already munching their way through reward tiers. - Email subscribers who opted in for more than just coupons. - Printed on tray liners or on the back of napkin dispensers for dine-in guests.

Benchmarking is where NPS truly dazzles. You can measure brand advocacy and compare yourself against the best (and worst) in your quick-service league. This recurring pulse check guides long-term strategy and fosters genuine brand evangelists.

Key moments for NPS: - After major marketing campaigns. - During brand-wide reboots or product launches. - Before annual planning sessions.

5 Sample NPS Questions

On a scale of 0-10, how likely are you to recommend [Brand] to a friend?

What’s the main reason for your score?

Which competing fast-food brand do you recommend more often?

How long have you been a customer of [Brand]?

What one thing could we do to earn a 10 from you next time?

By quantifying your loyalty leaders versus detractors, NPS empowers you to celebrate the champions—and convert the critics. Plus, it’s a global standard, so your score travels just as well as your fries.

In the fast-food industry, Chick-fil-A leads with a Net Promoter Score (NPS) of 60, significantly surpassing the sector's average of 21. (fortune.com)

Product Feedback Surveys

Innovation never sleeps in fast food. New menu items, limited-time offers (LTOs), and bold flavor experiments are the heartbeat of staying relevant. The product feedback survey lets you cut through the kitchen chatter and find out exactly how that new Spicy Chicken Wrap lands with your customers—before you invest in balloons and confetti.

Why & When to Use Product Feedback

Timing and targeting are key for product feedback surveys. They come in hot right after someone tries a new item, typically when taste buds and curiosity collide. Smart chains use them: - Directly after an LTO purchase, via SMS or email. - Inside loyalty apps, nudging customers after they’ve chomped into that seasonal special. - Post-receipt invitations, prompting guests to share their thoughts for a chance at a prize.

For R&D teams, the intel is pure gold. It identifies: - Winning flavor combos. - Packaging snafus. - Price point sensitivities.

Transparency is also a bonus—customers love knowing you value their taste buds and opinions.

5 Sample Product Feedback Questions

How would you rate the taste of our new Spicy Chicken Wrap?

Is the portion size appropriate for the price?

Which flavor profile best describes the item? (Mild, Medium, Spicy)

Would you purchase this item again if it became permanent?

What would you change about the product, if anything?

The power of product feedback surveys is all about sharp, actionable insights. Menu innovation never sounded so tasty.

Service Quality Surveys

The magic of fast food isn’t always about the food—it’s the whole experience. Nothing says “we’ve got your back” like a dining room that sparkles or a staff member who knows just how to make you smile. Enter the service quality survey: the secret weapon for nailing everything from courtesy to cleanliness.

Why & When to Use Service Quality Surveys

Service quality surveys shine post-experience. Spot them after dine-in or drive-thru visits, sneaking QR codes onto table tents or receipts for immediate impressions. Brands love them for drilling down into operational details such as: - How clean is that lemonade dispenser? - Did anyone greet customers or just keep flipping burgers? - Is the restroom really “guest-ready”?

If you notice dips in reviews or sudden spikes in complaints, pull this survey faster than you’d restock the ketchup.

They’re perfect for: - Uncovering staff training needs. - Flagging location-specific pitfalls. - Celebrating superstars in the crew.

5 Sample Service Quality Questions

Was the dining area clean and well-maintained?

Did our staff greet you promptly?

Did you receive your order within the promised time?

How friendly was the staff during your visit?

Were restrooms clean and stocked?

With the fast-food service quality questionnaire, you keep every visit sparkling—and nip problems in the bud before they go viral.

Service quality and food quality are primary determinants of customer satisfaction in fast-food restaurants. (emerald.com)

Drive-Thru Experience Surveys

The drive-thru lane is often where the real action happens. With more than half of sales zipping through car windows, the drive-thru is the heartbeat of many chains. But it also comes with its own set of bottlenecks and glitches. Drive-thru experience surveys are custom-built to capture these high-speed moments.

Why & When to Use Drive-Thru Surveys

Drive-thru surveys tackle unique challenges head-on. No fiddly table service here—just fast cars, faster food, and zero patience for errors. The best brands trigger these surveys using: - SMS invitations based on license plate recognition systems. - Codes printed right on order bags and cups. - Instant digital pop-ups for app-based drive-thru orders.

When wait times tick up or you roll out a new communication system, the drive-thru survey is your best friend. Each car holds a story, and this tool makes sure you hear it.

Deploy after: - Major drive-thru remodels. - Menu board redesigns. - Changes to packaging or fulfillment flow.

5 Sample Drive-Thru Questions

How long did you wait in the drive-thru lane today?

Was your order read back for accuracy?

Rate the clarity of the menu board.

Did you receive napkins, condiments, and utensils as requested?

How friendly was the drive-thru crew member?

A sharp drive-thru survey keeps things moving—literally. It brings hidden hang-ups to light and lets you outpace the competition in the carpool lane.

Market Research & Menu Innovation Surveys

There’s more to fast-food than burgers and buzzers. With a world of tastes and new trends, smart chains rely on market research surveys to spot flavors before they’re trending on TikTok. When you want to tap into dietary shifts, price sensitivity, and wild cuisine wishes, nothing beats a deep-dive research poll.

Why & When to Use Market Research Surveys

Annual research surveys dig beneath the surface, gathering data that drives strategic decisions for quarters to come. The ideal targets are: - Large, demographically representative panels. - Super-users in your loyalty app who crave the next big thing. - Rarely, randomly sampled crowds to avoid echo chambers.

If corporate wants to pivot toward plant-based, target Gen Z, or set the bar on daypart deals, these surveys reveal what’s cooking in customer heads. They’re also a must for ad agencies determining where to spend those precious marketing dollars.

Use them: - When you sense a diet trend on the horizon. - To validate brand image and menu refreshes. - For pricing and promotional experiment design.

5 Sample Market Research Questions

Which diet trends influence your fast-food choices? (e.g., Keto, Vegan)

How much extra would you pay for organic ingredients?

Which daypart do you purchase fast-food most often?

Rank the following cuisines you’d like to see on our menu.

What is the biggest reason you skip fast food?

With the right market research survey, you get the inside scoop before competitors even know what’s up.

Post-Launch Follow-Up Surveys

Every new store or remodel is a party in fast food. But the confetti settles fast, and only the freshest insights keep the buzz alive. The post-launch follow-up survey checks in with those who visited first, helping you see if your new digs really deliver.

Why & When to Use Post-Launch Surveys

Post-launch surveys happen 2-4 weeks after opening day—the moment the crowds thin but the novelty is still bright. Forward-thinking brands push these surveys to: - Early loyalty-program check-ins. - Email invitations to nearby guests. - Friendly greeters handing out cards or flyers on-site.

You’ll measure not just curiosity, but true conversion. These surveys track: - If the layout is navigable (or a maze for lost lunch-goers). - Whether grand-opening deals actually moved the needle. - How fast new staff rise to peak proficiency.

Ideal after: - Opening in untapped neighborhoods. - Major redesigns or brand refreshes. - Piloting completely new service models.

5 Sample Post-Launch Questions

How satisfied are you with our new location’s layout?

Did the grand-opening promotions influence your visit?

How likely are you to become a regular customer at this location?

What improvements would make your next visit better?

How did you hear about our opening?

A post-launch survey is the victory lap that also fine-tunes your next big play.

Best Practices: Dos and Don’ts for Crafting Fast-Food Survey Questions

Survey design is an art, but there are no mysteries here—just best practices that guarantee rich responses and happy guests. Dodge the traps and speed toward meaningful feedback with these time-tested rules.

Essential Dos

- Do keep surveys under 3 minutes. Attention spans are shorter than ever.

- Use plain, friendly language; save the culinary jargon for the kitchen.

- Offer surveys that work just as well on mobile as they do at home.

- Mix up incentives: free fries one week, loyalty points the next.

- Segment your audience; not every guest needs the same questions.

Important Don’ts

- Don’t ask leading questions (“Was our famous burger amazing?”).

- Don’t cram two questions together (“Was the burger hot and delicious?”).

- Don’t overload with open-ended items; stick to one or two per survey.

- Skip personal questions unless absolutely relevant.

When you build surveys around these simple strategies, you set your brand up for actionable insights—without annoying your guests.

Get started now—start testing your own survey combos and turn that fast-food feedback into the recipe for faster growth. Every response brings you a step closer to becoming your market’s favorite spot, fries and all!

Related Customer Survey Surveys

28 Restaurant Survey Questions to Boost Customer Feedback

Discover 25 essential restaurant survey questions to boost customer feedback and improve your din...

31 Interior Design Survey Questions: Types, Use & Examples

Discover 28 expert interior design survey questions covering preferences, style, budget, and more...

31 Essential Help Desk Survey Questions to Boost Support Success

Discover 30+ effective help desk survey questions with detailed examples to boost IT support feed...