31 Bank Survey Questions: Boost Customer Feedback & Loyalty

Explore 30+ effective bank survey questions across 6 key types to boost customer feedback in banking and enhance satisfaction and loyalty.

In today’s banking world, every customer touchpoint is a battlefield for loyalty. To stay ahead, banks need sharp, data-driven insights—not just guesses. The right questions at the right moment make all the difference, transforming feedback into action. Whether it’s digital experiences, a branch visit, or onboarding, the right “bank survey questions” drive response rates sky-high. From classic CSATs to onboarding check-ins, let’s break down the six essential survey types you need for actionable, customer-centric banking.

Customer Satisfaction (CSAT) Survey

Understanding CSAT Surveys in Banking

Customer Satisfaction (CSAT) is the bread and butter of banking surveys. It helps gauge if customers are genuinely happy or just smiling through gritted teeth. A strong “bank CSAT survey” highlights where your services shine and where things get sticky. This type of feedback is like instant coffee—quick, direct, and energizing for your strategy meetings.

When to Use CSAT Questions

Deploy these gems post-transaction, after successfully resolving a customer’s issue, or as a regular, quarterly “pulse check.” You want to catch your customers while their memory is fresh. CSAT measures favorability right at the source: was their experience a breeze, a slog, or somewhere in between?

- Post-branch transaction: Catch real-time impressions.

- Following an online session: Quick insights on ease of use.

- After support resolution: Was the problem solved the first time?

- Quarterly surveys: Monitor consistency.

Five Sample CSAT Questions

How satisfied are you with the overall service you received during your most recent branch visit?

How well did our staff address your financial needs today?

How satisfied are you with the clarity of the information provided about fees and charges?

How satisfied are you with the speed of service for your last online banking transaction?

How likely are you to continue using our bank based on today’s experience?

Making CSAT Actionable

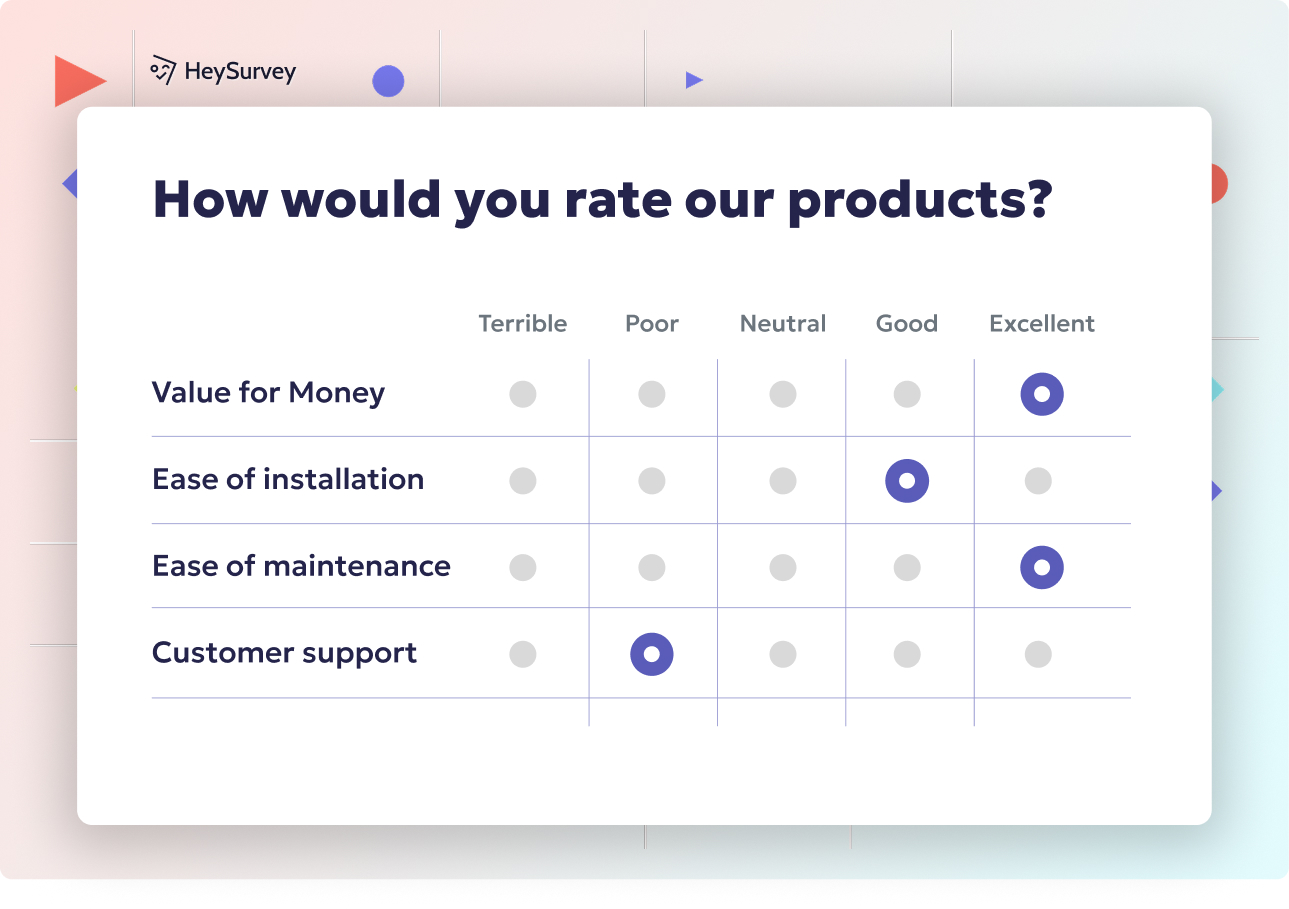

Use a 5-point or 7-point scale, with 1 meaning “very dissatisfied” and the highest score being “very satisfied.” Always leave room for open comments. Verbatim feedback is banking gold—real spur-of-the-moment honesty that no scale can capture. Follow up personally where relevant, making customers feel heard, not just counted.

Crafting clear, concise, and unbiased survey questions is essential for accurately assessing customer satisfaction in banking. (insightfulbanking.com)

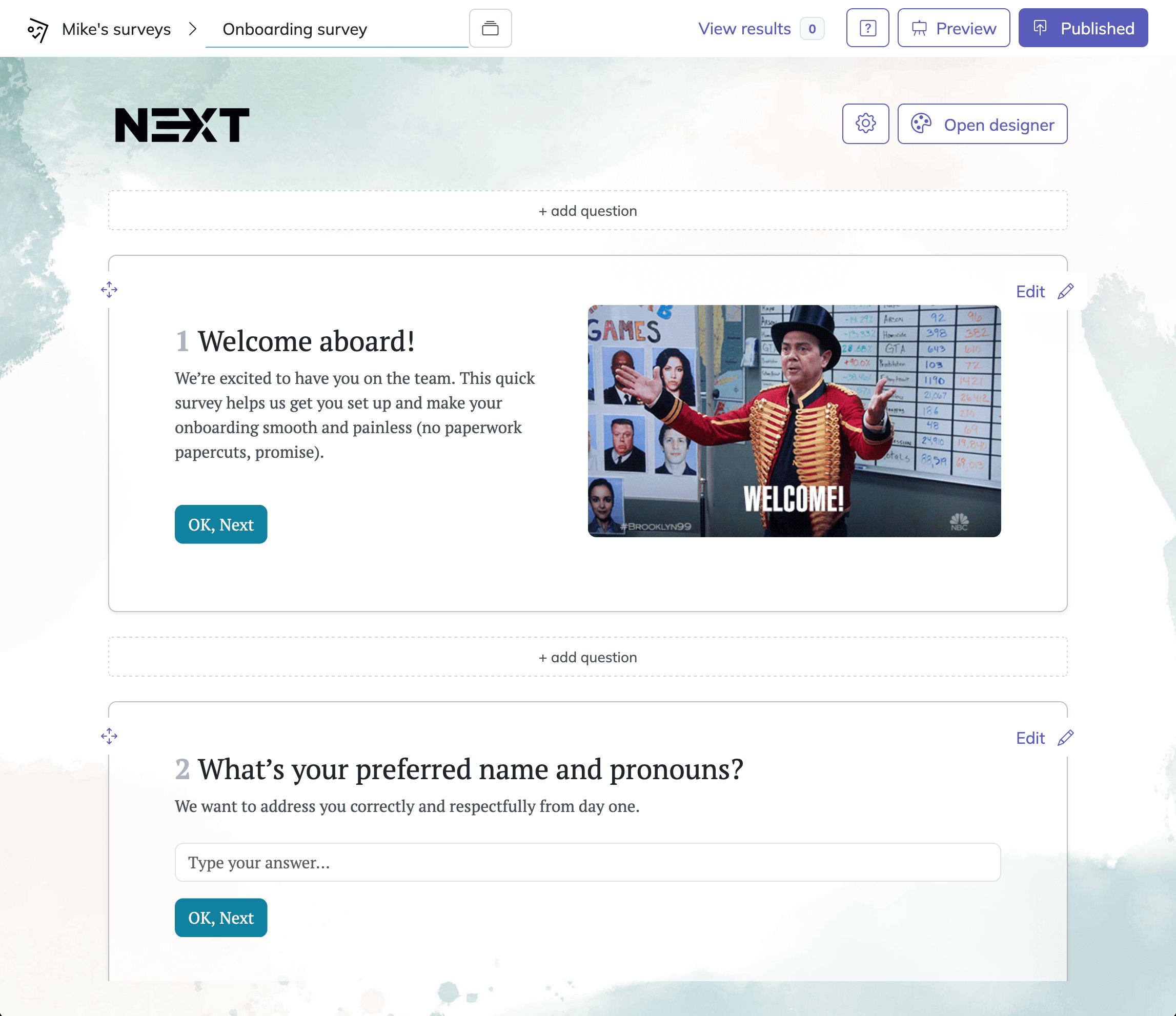

How to Create Your Bank Survey with HeySurvey in 3 Easy Steps

If you’re new to HeySurvey, don’t worry! Setting up your bank survey questions is simple and fast. Follow these three straightforward steps, and you’ll have your survey ready to collect valuable customer feedback in banking in no time. When you’re ready, just click the button below to start from a tailored template!

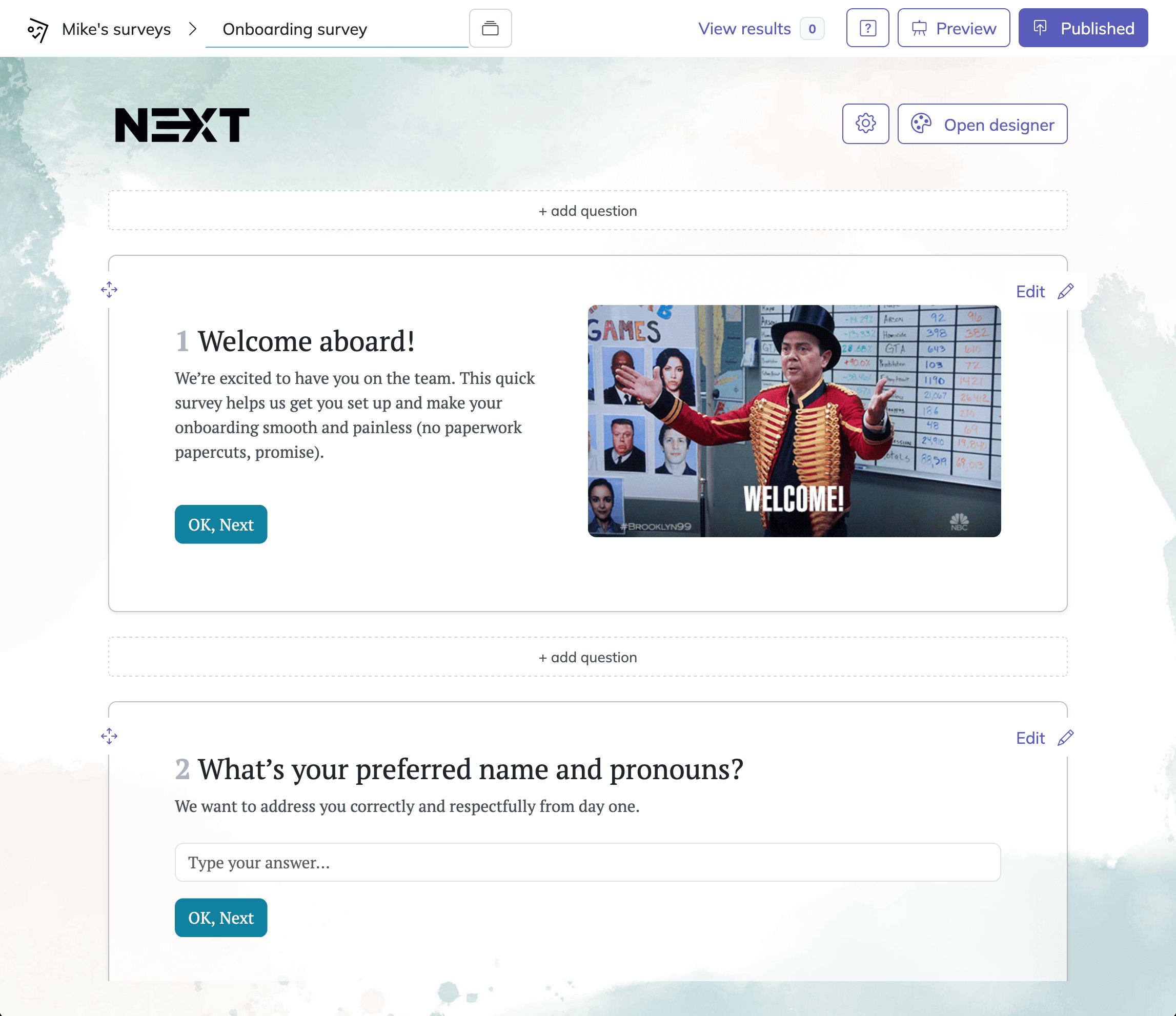

Step 1: Create a New Survey

- Go to HeySurvey and choose Create New Survey.

- Select either an Empty Sheet if you want to build your survey from scratch, or pick a Pre-built Template designed specifically for banking surveys.

- Give your survey a clear internal name like “Bank CSAT Survey” so it's easy to manage.

Step 2: Add Your Questions

- Click Add Question to start populating the survey with your carefully selected questions.

- Choose the right question type for each item: use Scale for satisfaction ratings, Choice for multiple selections, or Text for open-ended feedback.

- Customize each question's wording to match your banking context, then mark them as required if you want to ensure answers.

- Don’t forget to include space for customers’ verbatim comments—those nuggets of insight are pure gold.

Step 3: Publish Your Survey

- Hit the Preview button to see how your survey looks and test it on different devices.

- Once satisfied, click Publish. You’ll need to create a free account or log in to enable publishing and start collecting responses.

- Share the generated link via email, SMS, or embed it on your website for maximum reach.

Bonus Step: Apply Branding and Advanced Settings

- Open the Branding Panel to upload your bank’s logo and adjust survey colors and fonts, making your survey fully on-brand and professional.

- Go to Settings to:

- Set your survey’s start and end dates.

- Limit the number of responses if needed.

- Add a redirect URL to thank customers or direct them elsewhere after submitting.

- Enable or disable allowing respondents to view aggregate results if appropriate.

- Set your survey’s start and end dates.

- Use Branching to create smarter survey flows — for example, direct dissatisfied respondents to additional questions to dig deeper.

With these easy steps, you’ll be set to collect meaningful customer feedback in banking with HeySurvey—no tech wizardry required! Just open a template below to get your survey rolling.

Net Promoter Score (NPS) Survey

What Is NPS and Why Does It Matter?

If CSAT is your thermometer, Net Promoter Score (NPS) is your weather forecast. NPS zeros in on the customer’s emotional connection with your brand—will they shout your name from the rooftops, or whisper it in dread? The classic “bank NPS question” gives you a loyalty snapshot so clear, even the C-suite can’t ignore it.

When to Use NPS in Banking

Think of NPS as your quarterly or semi-annual heartbeat. It’s also a must after launching new products or services—will your newest wiz-bang app endear you, or trigger mass exodus? NPS helps benchmark “promoter score in finance”, making it ideal for long-term planning.

- Quarterly check-ins: Benchmark changes and shift strategies.

- After product rollouts: Assess customer advocacy.

- Relationship reviews: Pinpoint loyalists and at-risk customers.

Five Sample NPS Questions

On a scale of 0–10, how likely are you to recommend [Bank Name] to a friend or colleague?

What is the primary reason for the score you just gave?

Which of our banking services most influenced your rating?

What could we do to improve your likelihood to recommend us?

Compared with other banks you use, how does [Bank Name] perform?

Making NPS Work

Categorize responses: promoters (9-10), passives (7-8), detractors (0-6). Subtract detractors from promoters for your NPS. Textboxes for reasons capture crucial details—the emotional “why” behind the numbers. Segment further by product, location, or customer tenure for maximum impact.

In Q2 2022, digital Net Promoter Scores (NPS) in consumer banking increased for the first time in two years, likely due to a shift towards mobile banking, especially among customers aged 55 and older. (npsprism.com)

Customer Effort Score (CES) Survey

What Is CES and Its Benefits in Banking?

Customer Effort Score (CES) is all about making banking frictionless. It spotlights those moments where your processes either grease the wheels or throw in the wrench. If you want to “reduce effort in banking,” tracking effort is a must.

When to Use CES Questions

Perfect after self-service tasks, contacting your call center, or resolving disputes. If your customer had to scale Everest just to reset their password, you’ll know. CES question examples suss out hidden frustration points—it’s the GPS system for customer pain.

- After chat support: Was the resolution easy?

- Post-app tasks: Effort required for transfers, payments.

- New account setups: Were sign-ups smooth?

Five Sample CES Questions

How easy was it to resolve your issue with our customer support today?

The online instructions made it simple for me to complete my transaction. (Agree–Disagree)

How much effort did you personally have to exert to open your new account?

How easy was it to find the information you needed on our mobile app?

Rate the ease of transferring funds between accounts using our online platform.

Optimizing CES Surveys

Use a 5- or 7-point scale anchored at “very easy” and “very difficult.” Keep the tone helpful, not accusatory. Review scores regularly to spot and bust friction points. Customers will notice the smoother path—the reward is higher retention, fewer complaints, and higher self-service adoption.

Digital Banking User Experience (UX) Survey

The Importance of Digital UX in Banking

With websites and apps now a battleground for “digital banking survey questions,” a clunky interface can lose customers fast. The era of waiting in line is over; now, users want to bank while waiting in line for coffee. Mobile banking UX feedback guides you to surfaces that need a facelift…or a total overhaul.

When and Where to Use UX Surveys

Deploy surveys after customers complete high-stakes tasks like bill pay or money transfers. Send them out after major app updates or tap into your beta tester crowd. A snappy survey at the right moment beats a clunky quarterly review.

- Right after key tasks: Was sign-in smooth?

- Following updates: Did the changes confuse or delight?

- During beta tests: Pre-release feedback catches snags.

Five Sample Digital UX Questions

How intuitive was the navigation in our mobile banking app today?

Did all pages load within an acceptable time for you?

Which feature, if any, did you find difficult to locate?

How visually appealing is the design of our online banking dashboard?

What additional digital features would improve your banking experience?

Making Digital UX Feedback Action-Oriented

Report trends back to your product team. Use a mix of scales and open-ended prompts for richer data. Continuous improvement is your game plan—constantly tweak, track, and test. Customers will feel your investments in every click and swipe.

Reliability, efficiency, and ease of use in e-banking services significantly enhance customer satisfaction, with reliability having the strongest impact. (journals.sagepub.com)

Branch & ATM Experience Survey

Why Branch & ATM Experience Still Matters

Sure, digital is king, but branches and ATMs aren’t relics yet! These touchpoints define trust, safety, and the human side of banking. “Branch banking survey” questions dig into staffing, wait times, and clean facilities. ATM feedback questionnaire items tell you if customers trust your machines.

Strategic Moments to Use These Surveys

Send a quick SMS or email post-visit or after ATM use. Quarterly audits help ensure consistency—no one wants mystery grime at the ATM. In-person surveys also capture the “intangibles” that tech sometimes can’t—smiles, eye contact, empathy.

- Instant post-transaction: Get top-of-mind feedback.

- Facility audits: Test ongoing standards.

- Mystery shopping: Secret tests for quality checks.

Five Sample Branch & ATM Questions

How long did you wait before being attended to at the branch?

How courteous and professional was our branch staff?

Was the ATM area clean and well-lit?

Did you find the cash-withdrawal process smooth and error-free?

How satisfied are you with the availability of in-branch advisory services?

Delivering Top Branch & ATM Experiences

Categorize by branch, time of day, or transaction type. Visualize data for branch managers to inspire quick action. In-person touchpoint insights keep your physical spaces as sharp as your apps, ensuring no weak link in your customer experience chain.

New Account Onboarding Survey

The Critical Role of Onboarding Feedback

First impressions are powerful—ask any nervous new customer. A bank onboarding survey identifies speedbumps in paperwork, card delivery, and digital setup. Early feedback catches brewing issues before they explode into churn.

When and Why to Use Onboarding Surveys

Send surveys 7–14 days after account opening, when excitement is still fresh but reality has set in. Early check-ins can reveal confusion over fees or account access troubles. “New customer banking feedback” is a goldmine if you listen closely.

- 7–14 days post-account opening: Catch customers before they churn.

- Following card delivery: Was activation easy?

- After digital setup: Did they log in without hiccups?

Five Sample Onboarding Questions

How clear were the instructions for setting up your new account?

How satisfied are you with the time it took to receive your debit card or checkbook?

Did you understand all applicable fees associated with your new account?

How confident do you feel using our online or mobile banking tools?

What could we have done to make opening an account easier for you?

Turning Onboarding Feedback Into Action

Map onboarding satisfaction by branch, product, or demographic. Respond fast to negative feedback. Proactive outreach makes new customers feel welcome and valued—most often, a single call can turn frustration into delight.

Best Practices – Dos and Don’ts for Crafting High-Performing Bank Survey Questions

Dos: The Art of Survey Excellence

- Keep questions concise: Brevity makes it easy for customers to engage and avoids confusion.

- Align scale types: Stick to 5- or 7-point scales to keep interpretation simple.

- Personalize questions: Reference relevant account data for relatable, meaningful questions.

- Comply with privacy: Always ensure your surveys are aligned with banking regulations and respect data privacy.

- Close the feedback loop: Respond quickly, showing customers their input sparks real action.

Don’ts: Survey Traps to Dodge

- Avoid leading questions: Sneaky prompts skew honesty and destroy actionable insight.

- Don’t overdo it: Excessive questions trigger survey fatigue faster than you can say “unsubscribed.”

- Don’t ignore open-ended responses: These are customer gold—dig deep.

- Don’t treat all customers the same: Segment questions by product, branch, or customer type for richer insight.

Powerful Habits for Success

Adopt a continuous improvement mindset. Test your surveys with insiders, tweak fragrances, and aim for conversation over interrogation. Best bank survey practices turn feedback into your sharpest competitive weapon. If you want to master “how to write banking questionnaires,” think empathetically—what would you enjoy answering after a long day?

Even the flashiest questions fall flat if customers don’t feel heard. Align your approach, communicate outcomes, and thank your respondents—not just with rewards, but with genuine gratitude and tangible improvements.

Bank survey questions are more than data points—they are opportunities to connect, correct, and create loyalty that lasts. With the right type, timing, and tone, your surveys will build the foundation for stellar, future-ready banking experiences.

Related Customer Survey Surveys

28 Restaurant Survey Questions to Improve Customer Experience

Discover 25 sample restaurant survey questions to boost customer feedback, improve your service, ...

31 Interior Design Survey Questions: Types, Use & Examples

Discover 28 expert interior design survey questions covering preferences, style, budget, and more...

31 Essential Help Desk Survey Questions to Boost Support Success

Discover 30+ effective help desk survey questions with detailed examples to boost IT support feed...